Many large-cap pharmaceutical companies have backed out of the high risk, high reward area of central nervous system drug development, leaving smaller biotechs to step up with their own novel approaches to difficult-to-treat CNS disorders.

|

"More and more people are willing to jump into neuroscience even though it's been a more challenging place, because we realize the opportunity and potential," said Ellie McGuire, a partner at venture capital firm Polaris Partners' LS Polaris Innovation Fund. "We have a lot of ground to cover in neuro."

Big pharma has kept a foot in the door by partnering with innovative biotechs and academic institutions, especially as regulatory bodies look to address the void in effective CNS drugs.

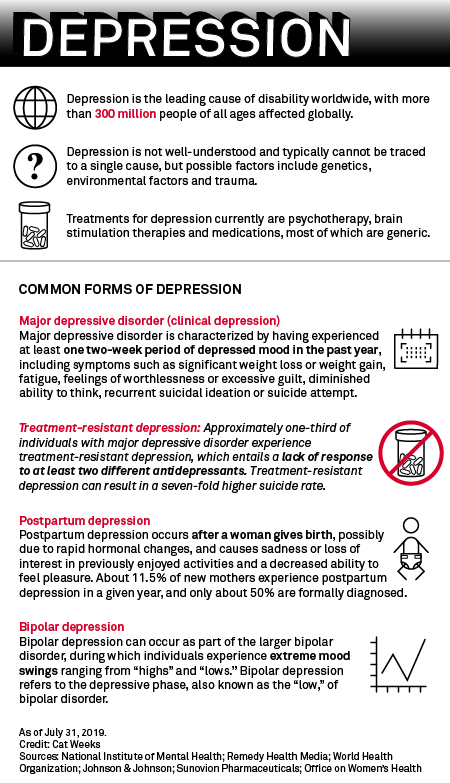

Several new therapies that take a different approach to treating neurological conditions will face their reckoning in 2019, and investors are becoming increasingly interested after the U.S. Food and Drug Administration approved Sage Therapeutics Inc.'s first-ever postpartum depression therapy Zulresso, and Johnson & Johnson's Spravato for treatment-resistant depression. GW Pharmaceuticals PLC also received U.S. approval for its cannabis-based epilepsy medication Epidiolex in June 2018.

"We have been witnessing an explosion of new scientific knowledge about the nervous system," the FDA said in April 2018.

Leerink analysts Marc Goodman and Mani Foroohar also commented, "There really is a renaissance in neuroscience."

New guidance for new approaches

But, as in other disorders, CNS drug development is no safe bet.

Clinical trials — which have a median cost of $19 million, according to data from the journal JAMA Internal Medicine — can cost even more for neurological or psychiatric disorders. According to Tufts University's Center for the Study of Drug Development, CNS drugs need longer and larger clinical phases, as well as lengthier regulatory review times. In all, bringing a CNS drug candidate from laboratory to market takes about 15 years, the center's director, Kenneth Kaitin, said.

|

Only about 6.2% of psychiatric drugs and 8.4% of neurological drugs gain approval, according to the Biotechnology Innovation Organization.

The FDA recognizes the challenges involved in drug development for CNS disorders as these conditions are not fully understood and often cannot be measured quantitatively. The regulator has become more flexible toward CNS drug development, an attitude reflected in the increased breakthrough therapy designations granted to CNS drugs, Goodman and Foroohar wrote in July.

Most of the currently available CNS drugs are generic and have very similar treatment paths, for example, the plethora of similarly functioning antidepressants.

"We need new mechanisms, new alternatives, not just the same old thing," CNS drug developer VistaGen Therapeutics Inc.'s CEO, Shawn Singh, told S&P Global Market Intelligence.

The FDA released five draft guidances in 2018 for neurological conditions, including Alzheimer's disease, epilepsy and amyotrophic lateral sclerosis, to clarify clinical trial strategies and expectations.

"There are definitely changes in companies' approaches for some of these disorders, and they're done almost always with the cooperation and agreement of regulatory authorities," said Kaitin, a professor at Tufts.

Polaris Innovation Fund's McGuire added that evaluating specific subpopulations of more similar patients within certain diseases, like Alzheimer's, could have a higher chance of success and elicit clearer results.

Analysts pointed to changes in psychiatric clinical trials, such as J&J's approach to Spravato, which included 10-plus phase 1 clinical trials before moving on to larger late-stage trials. McGuire said this can be especially beneficial for smaller early-stage biotech companies, as large phase 3 trials are costlier.

The FDA has also become more open to alternative clinical trial goals, called "surrogate endpoints"; for example, the presence of stress-related hormones or rapid eye movement sleep in affective disorders, or dopamine metabolism in Parkinson's disease.

Such measures, some of which have not yet been clinically validated, could supplement often subjective trial goals, like behavioral and cognitive scores that may see high placebo effects, in clinical trials.

"[Surrogate endpoints] may be a good alternative to use in cases where it may take a very long time to see an effect in treatment for a particular disease," the FDA said in November 2018.

|

Investors take note

Investors have noticed the FDA's shifting attitude toward tough-to-treat CNS disorders, a high-risk high-reward field, analysts said.

The second fiscal quarter of 2019 saw $321 million in funding toward mental health and wellness companies, a quarterly record for the therapeutic area, according to market intelligence firm CB Insights.

Overall money flow into the central nervous system field has seen an uptick in the past decade. In both venture capital investment and initial public offerings from 2009 to 2018, U.S. neurology companies have come second only to cancer companies.

|

In addition to biomarkers, promising surrogate endpoints and novel approaches, investors look for genetic links and hypotheses based in neurobiology of the disease, McGuire said.

She pointed to Polaris Partners portfolio company Blackthorn Therapeutics Inc., which uses digital tools to zero in on the neurobiology of psychiatric disorders and find neurobehavioral treatments.

Digital advancements have made their way into the CNS field, and Blackthorn Therapeutics is looking to pair treatment with speech and facial expression recognition software, as well as vocal samples for analysis of mood, Stifel analyst Paul Matteis said.

Takeda Pharmaceutical Company Ltd. and Mindstrong Inc. struck up a partnership in 2018 to determine digital biomarkers for mental health conditions, Matteis wrote in a March report.

Depression has historically been characterized by the drugs that appeared effective, professor Kaitin said. In the past, CNS disorders have been assessed primarily by symptoms rather than underlying biology, such as protein buildup in Alzheimer's or neurochemical imbalance in depression.

Kaitin remains cautious about the neuroscience renaissance.

"The crux of all this is, we don't have a good understanding of the basic mechanism … of a lot of diseases," Kaitin pointed out. "You're basically operating in the dark with Alzheimer's disease and the other CNS disorders, because there are no good models."

Kaitin said more basic research is needed, otherwise identifying drug compounds to advance to human trials remains a guessing game.

"You could throw drugs at [CNS disorders] and if the drugs work, we'll be back where we were in the 1970s," Kaitin said. "We'll give drugs and stumble on something that seems to work and then we'll come back and develop our theory of disease process from that. That may be one way to do it, but it's not the ideal way to do it."

The mega blockbuster

Nevertheless, Kaitin said CNS companies, especially larger ones like Biogen Inc., "should send a message" about the importance of unmet patient needs.

CNS diseases are the No. 3 most fatal therapeutic area in the U.S., but No. 1 in disability, Leerink analysts said.

Health information technology company IQVIA Holdings Inc. reported that mental health treatments, one of the top 10 prescription categories in the U.S., grew by 26 million prescriptions in 2018. Antidepressant sertraline, marketed by Pfizer Inc. under the brand name Zoloft, was the No. 11 most prescribed medicine in the U.S. in 2018, while alprazolam, better known as Pfizer's Xanax, for anxiety and panic was the No. 19 most prescribed.

Globally, mental health is seventh out of the top 10 leading therapy areas in spending, IQVIA said.

McGuire said neurodegeneration is one of the most significant challenges "of our time."

"A better drug for depression or psychosis, or the first real drug to treat Alzheimer's, that's going to be a mega, mega blockbuster," Kaitin said.

|