Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Mar, 2022

By RJ Dumaual and Husain Rupawala

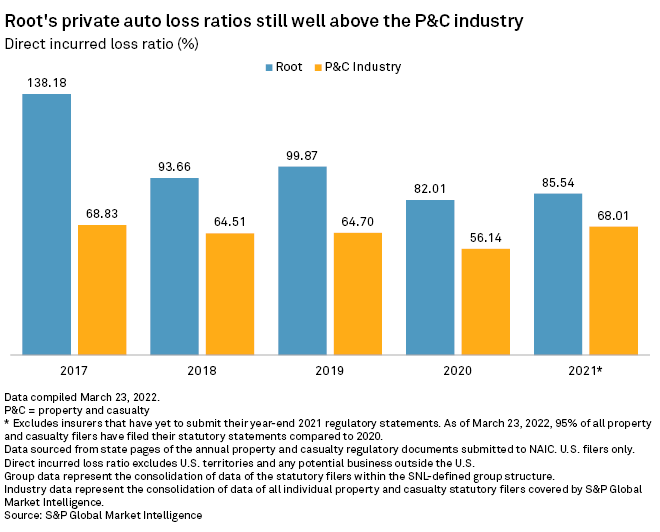

Root Inc.'s loss ratio has been well above the industry's average for the last several years, according to an S&P Global Market Intelligence analysis, but there is some optimism that the insurtech could be turning the corner.

Loss ratio remains high, but improving

Root has made big progress since posting a loss ratio of 138.18% in full year 2017, more than double the P&C industry's average at the time. The insurtech posted a loss ratio of 85.54% in 2021, and in January said it was continuing with a cost-cutting drive by laying off approximately 330 employees, or 20% of its workforce.

The loss ratio trend may have peaked and rate actions will help improve the company's loss ratio, Chief Insurance Officer Frank Palmer said on an earnings call.

Commentary about the loss ratio trend peaking is "not out of the realm of possibility," Kaenan Hertz, managing partner at Insurtech Advisors LLC, said in an email. Root has shrunk its policyholder base, minimized the direct channel and cut expenses, which should help the loss ratio, Hertz added.

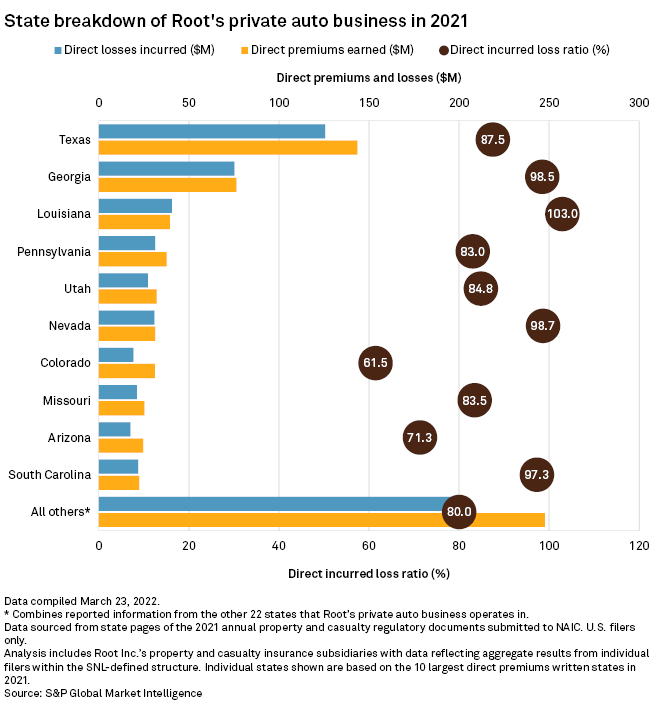

State-by-state loss ratios

Root posted a loss ratio of 87.5% in Texas, its biggest state with direct premiums earned of $143.6 million. The insurtech did, however, incur direct losses of $125.7 million in the Lone Star State. The insurtech recorded direct losses incurred of $75.2 million and $40.6 million, and had loss ratios of 98.5% and 103.0% in Georgia and Louisiana, respectively.

Hertz said Root is now "leaner and better positioned" to rebuild following the moves, adding that recently hiring a CFO with an insurance background will help them put in place the "right checks and balances."

The insurtech expects gross written premiums to significantly decline year over year in the first half of 2022, although CEO Alex Timm does not expect the drop-off in new business to materially increase cash burn. Timm added that the company thinks the opposite will occur because new business typically with a higher first-term loss ratio causes "a bit of a strain" on cash burn.

Hertz does not expect insurtechs to significantly slow down the amount of cash they use up, saying that the only real lever they can pull is marketing. But lower marketing spend will likely lead to reduced premiums, which will "exacerbate" their ability to raise new capital, Hertz said.

"In some ways, they are stuck between a rock and a hard place," Hertz said.