Insurance stocks generally fared better than the broader markets this week, and investors gave Canadian life insurers a lift as they reported earnings results.

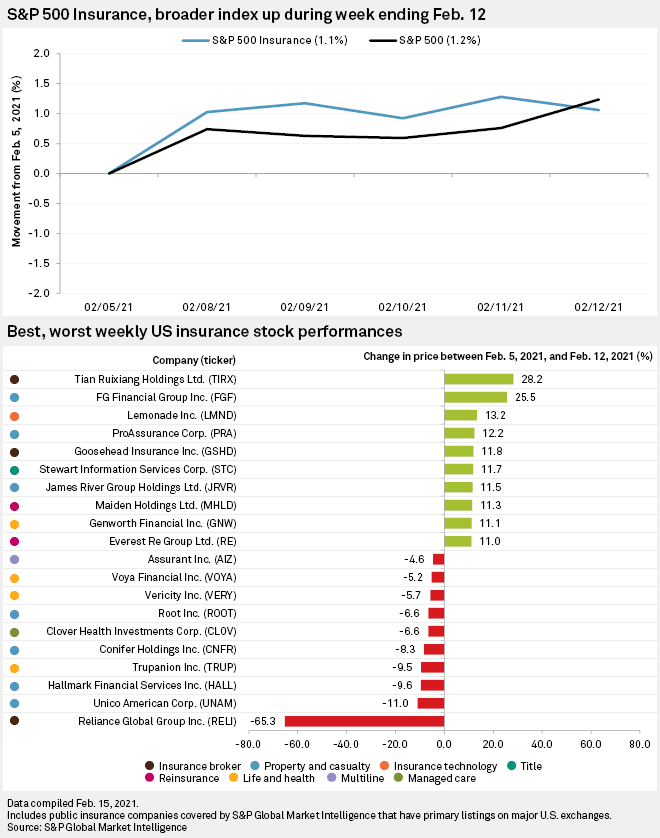

The S&P 500 rose 1.23% to 3,934.83 for the week ending Feb. 12, while the SNL U.S. Insurance Index increased 1.72% to 1,209.87.

Shares of Great-West Lifeco Inc., Manulife Financial Corp. and Sun Life Financial Inc. outperformed the broader markets and the industry index. Sun Life this week logged higher year-over-year income for the fourth quarter of 2020, while Manulife's core earnings number was nearly unchanged from the year before.

Manulife demonstrated consistent strength in Asia, and Credit Suisse analyst Mike Rizvanovic sees continued resilience on the horizon for the business.

"We see further gains ahead, which could be enhanced by more deployment into the region given [Manulife's] sizable excess capital as of [the fourth quarter]," Rizvanovic wrote in a Feb. 12 research note to clients.

Manulife's shares gained 3.79% for the week, and Sun Life improved 2.38%. Great-West Lifeco traded down after the release of its earnings, which showed a decline in base earnings compared to the 2019 fourth quarter. The company nevertheless ended the week with a 4.30% gain, topping the weekly advances of its Canadian peers.

Investors were not as enthusiastic about shares of U.S.-based life companies that reported earnings during the week. The stocks of Brighthouse Financial Inc. and Voya Financial Inc. each lost value. Voya saw its share price fall Wednesday during trading following the company's earnings release, and Brighthouse saw its share price slip on Thursday after the publication of its quarterly results.

The market remains wary of names dependent on interest rates, which look to remain low well into 2022, CFRA analyst Cathy Seifert said in an interview.

"There is still a hesitancy or a concern about what the impact a prolonged low interest rate environment is going to have on their balance sheet integrity and on their profit margins," she said. Seifert contrasted investors' regard for Voya's shares with that of MetLife Inc., which has taken steps to reduce its interest rate exposure.

Brighthouse Financial posted a year-on-year decline in adjusted EPS, which came in below analysts' expectations for the fourth quarter of 2020. Many of the larger life insurance names are trading at a significant discount to most any multiple, which makes the case for Brighthouse and its annuity-driven business a tough one, Seifert said.

"The rationale for owning Brighthouse becomes very difficult for a number of reasons," she said.

Brighthouse ticked down about 0.10% for the week, while Voya was one of the biggest decliners, falling 5.17%. MetLife shares had a strong week, rising 5.88%.

Willis Towers Watson PLC saw its stock price advance after reporting a year-over-year uptick in adjusted income. It finished the week with a 1.57% gain. Traders gave Centene Corp.'s shares a bump after it reported a climb in full-year income. The health insurer's shares lagged the insurance index with a 0.54% increase for the week.

Reinsurance Group of America Inc. booked lower adjusted operating income for the fourth quarter of 2020, but with EPS that exceeded analysts' expectations. The company's stock price edged upward the following day and closed up 3.16% on the week.