Institutional investors were net sellers of top publicly traded energy pipeline companies in North America during the third quarter, in contrast to an increasing interest in pure-play shale drillers amid soaring share and commodity prices, an S&P Global Market Intelligence analysis of SEC filings showed.

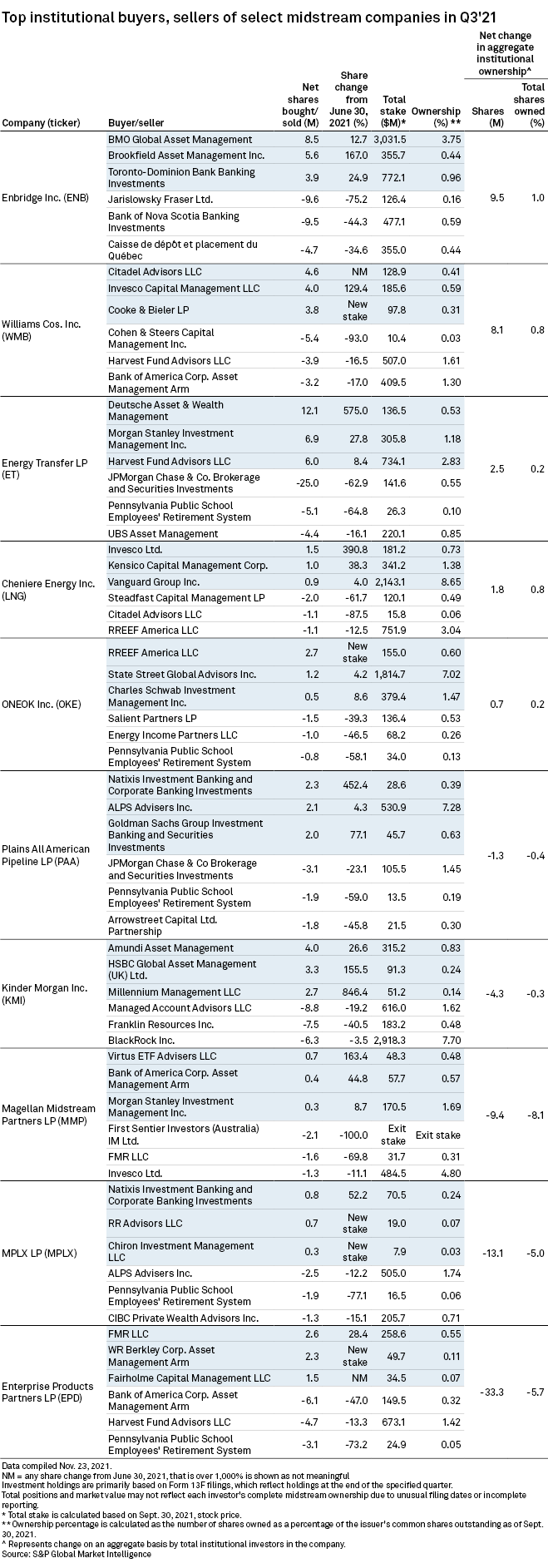

But some of the major pipeline companies still saw notable gains in institutional ownership during the period. Enbridge Inc. was institutional investors' top purchase out of the group, followed by Williams Cos. Inc. and Energy Transfer LP.

Enbridge announced late in the third quarter that it had completed construction of its Line 3 pipeline replacement project, positioning the company to start providing Western Canada with ample heavy crude pipeline capacity into the U.S. Pipeline shortages from Canada to the U.S. have long weakened Canadian crude prices.

Enbridge also emphasized its efforts to position itself for the energy transition during the quarter. The company in September announced a partnership to buy upward of 2 Bcf per year of renewable natural gas from Vanguard Renewables LLC, which sources the fuel from farm and food waste.

Some analysts have pointed to a paradigm shift in North American midstream equities as the sector's era of building large pipeline projects winds down, with the ups and downs of U.S. production increasingly viewed as a key driver of future cash flows over capital expenditures, construction and contracting customers. But the growth of U.S. LNG exports continues to offer financial upside for midstream companies.

Enterprise Products Partners LP saw the largest sell-off during the third quarter, with institutional investors shedding more than 30 million shares of their combined positions in the midstream giant.

Magellan Midstream Partners LP experienced the biggest drop-off in aggregate institutional ownership as the company's percentage of total institutional shares owned declined by over 8%.