Indian banks may see slower net interest margin expansion after posting strong profits for the fiscal fourth quarter ended March 31, as deposit costs increase and loan yields stabilize following successive interest rate hikes.

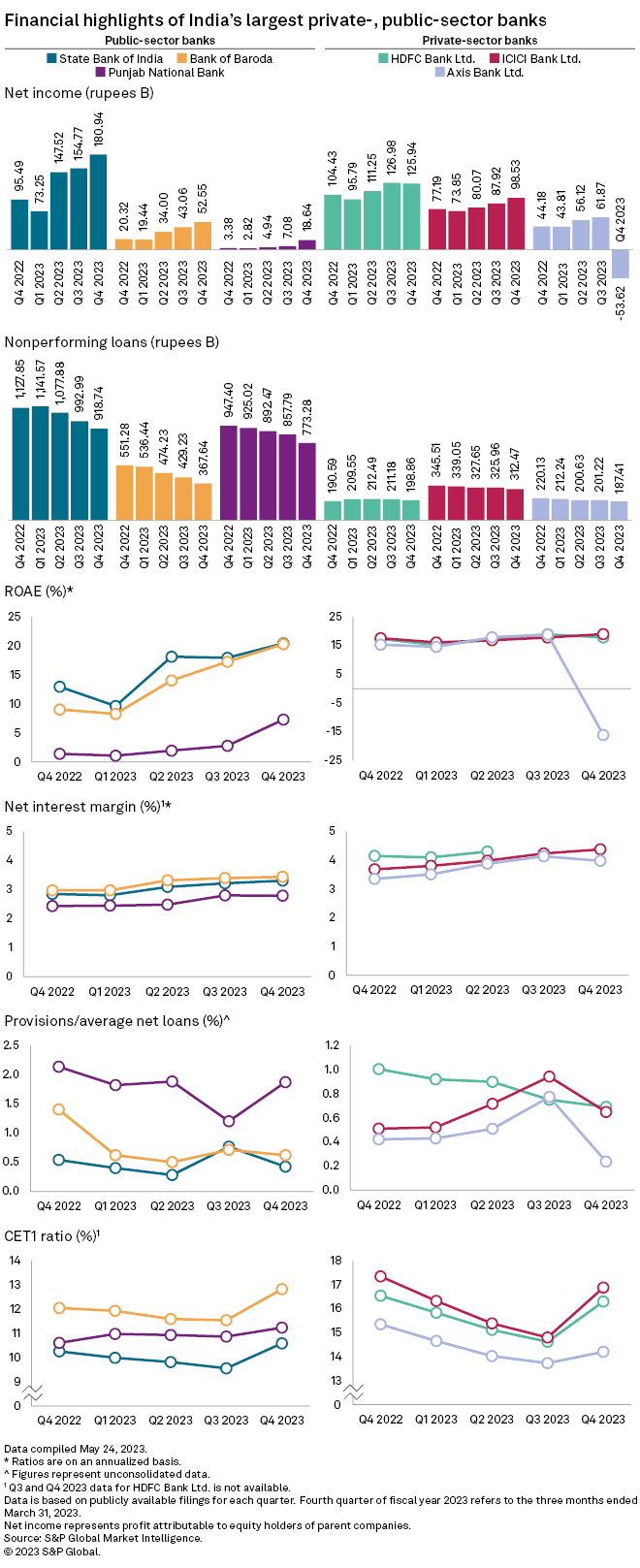

Helped by higher net interest margins (NIMs) and lower credit costs, most major Indian banks delivered year-over-year growth in net income in the fiscal fourth quarter, with some posting record-high profits. State Bank of India, the country's largest bank by assets, reported a net income of 180.94 billion rupees, up 89.5% year over year from 95.49 billion rupees, while Bank of Baroda's net income more than doubled year over year. Private lender HDFC Bank Ltd. reported a 20.6% year-over-year increase in its fiscal fourth-quarter net income.

While fiscal 2023 was an extraordinary good year for Indian banks, "we do expect some reversal of NIM expansion in fiscal 2024 as deposit costs continue to rise with a lag and yields on loans stabilize," said Punit Srivastava, research analyst at Daiwa Capital Markets India.

Srivastava expects loan growth to slightly slow down in fiscal 2024, though it may continue to be in the mid or high teens. On the other hand, "credit costs are likely to continue to be low in the near term," Srivastava added.

NIM moderation ahead

India's banking sector is "strong and stable" with an overall capital ratio of 16.1%, net nonperforming asset ratio of 1.16% and provision coverage ratio of 73.20% as of the end of 2022, Governor Shaktikanta Das of the Reserve Bank of India said in a May 29 speech. Das warned though that banks "should maintain constant vigil on external risks and build-up of internal vulnerabilities" as it is "times such as these that complacency may set in."

With the end of the rate-hike cycle in sight, NIMs at most Indian banks are likely to moderate, analysts said.

Banks have benefited from the Reserve Bank of India's policy rate hikes, allowing them to reprice their floating rate-linked assets. The rate-hike environment, however, has seemingly run its course, as the central bank held the benchmark repo rate at 6.50% in April. Cumulatively, the Reserve Bank of India has increased its rate by 250 basis points since May 2022.

Except for HDFC Bank, all six of India's largest banks by assets recorded year-over-year increases in NIMs in the quarter ended March 31, according to S&P Global Market Intelligence data. ICICI Bank logged a 69-basis-point rise in its NIM, followed by Axis Bank Ltd. with a rise of 63 basis points and

On-balance-sheet liquidity has been largely consumed and higher deposit growth, along with lagging repricing, would lead to margin softness for most banks in fiscal 2024, Anand Dama, senior research analyst at Emkay Global, wrote in a May 24 note.

Bankers agree

Bank of Baroda CEO Sanjiv Chadha said during a May 16 earnings call that the lender is conscious that India is nearing the end of the rate-increase cycle and that the bank tried to make sure incremental deposits are such that they can get repriced again once the rate cycle turns.

Deposits costs have also started to reflect higher deposit rates or higher rates at which deposits are being raised incrementally, ICICI Bank CFO Anindya Banerjee said during the lender's April 22 call. The CFO added that the bank believes NIMs are at peak levels and will likely moderate.