Indian banks' prior efforts to strengthen their balance sheets will help them mitigate the impact of asset quality as bad loans ticked higher in the April-to-June quarter following a deadlier wave of the COVID-19 pandemic.

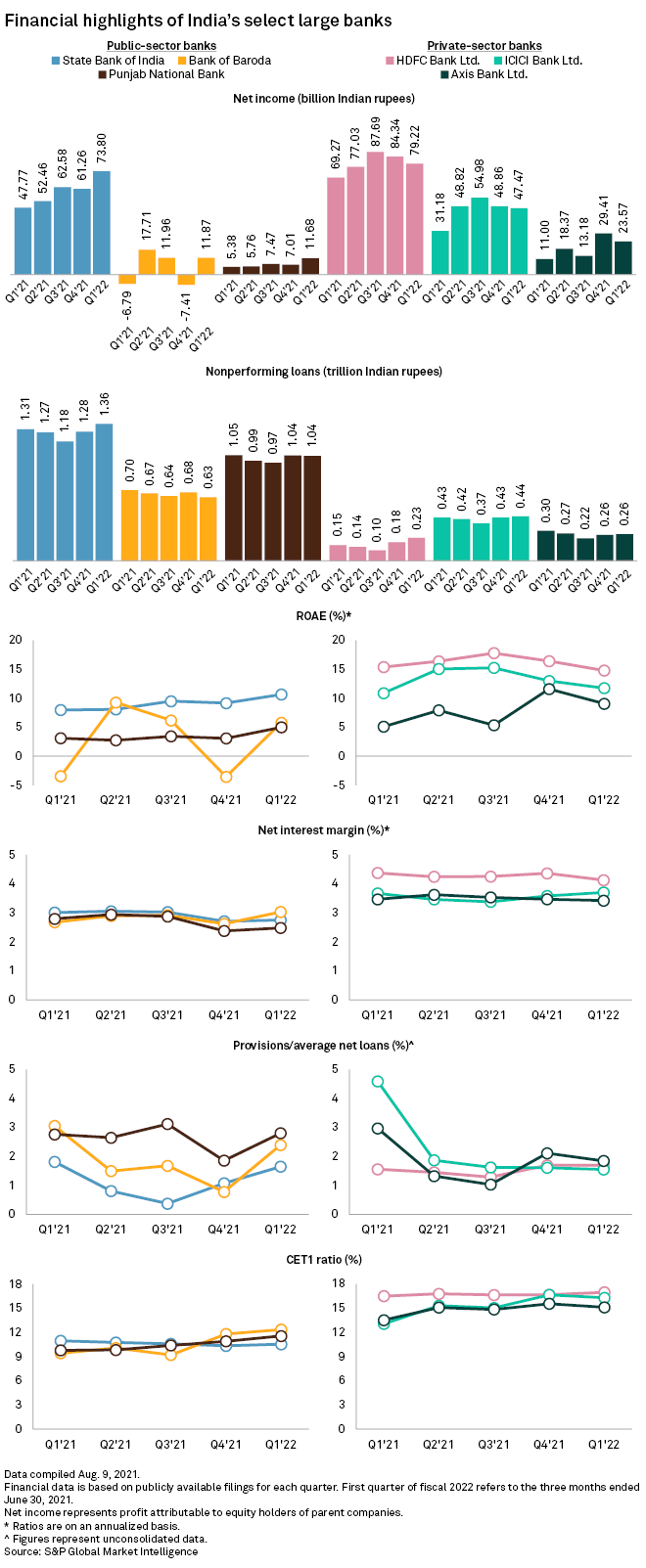

State Bank of India, the country's largest lender by assets, reported total nonperforming loans of 1.36 trillion rupees for the fiscal first quarter that ended on June 30, up from 1.28 trillion rupees in the previous three months and 1.31 trillion rupees in the same period of 2020.

ICICI Bank Ltd. the second-biggest private-sector lender, said its gross nonperforming assets rose by 72.31 billion rupees in the first quarter, mainly from its retail and business portfolio. The bank's total NPAs rose to 440 billion rupees at the end of the first quarter, from 430 billion rupees a year ago. State-run Bank of Baroda reported fresh slippages of 51.29 billion rupees in the first quarter, versus 27.40 billion rupees in the prior-year period.

Banks "have been taking steps to fortify their balance sheets over the last year or so to face the asset quality impact. These have been through enhancing capital base, increasing provisioning cover and having adequate amounts of liquidity," said Krishnan Sitaraman, senior director at CRISIL, a unit of S&P Global Inc.

Second wave

India's economy took a severe hit during the second wave of the coronavirus, with the number of daily cases peaking above 400,000 in May. Unlike in 2020, when the entire country was placed under a strict lockdown to slow the spread of the virus, the federal and state governments were caught unprepared to handle the sudden surge of the more-virulent delta variant. Cases have tailed off in recent weeks as the government stepped up vaccinations. Daily new infections fell to 25,166, the lowest since March, according to the country's health ministry on Aug. 17.

Still, the high number of COVID-19 cases and deaths — many experts believe the actual numbers were far higher than reported — are expected to have had a bigger impact on the economy in terms of jobs lost and businesses shut. Also, most forbearance measures announced last year, including a Supreme Court order stopping banks from classifying delinquent loans as nonperforming assets had been lifted after the economy recovered from the initial wave of infections.

The June quarter saw gross NPAs rising, mainly in retail and small and medium-sized enterprise portfolios for banks, Sitaraman told S&P Global Market Intelligence. "That is because these segments have been impacted more by the pandemic and the lockdown measures. The pandemic's second wave has had a much larger health impact and geographical spread as compared to the first," Sitaraman said.

During the fiscal first quarter, Indian banks saw higher-than-expected slippages of more than 200% year over year that largely arose from retail and SMEs, according to an Aug. 16 research note from Jefferies. Slippages were higher than expected as new COVID-19 restrictions affected collections, Jefferies analysts said, adding that some banks have started to recover in July and normalcy may return in the fiscal second or third quarter.

The quarter "was a tad weaker than expected in terms of earnings and management outlook ... [but] most banks seem well placed with buffers," Jefferies said.

Stressed borrowers

Banks are now seeing the full extent of borrower stress with a one-time debt restructuring facility and the Supreme Court's standstill on NPA recognition no longer available. The nation's top court allowed banks to resume classifying bad loans as NPAs in March, reversing an order from Sept. 30, 2020, when it had stopped lenders from declaring any new bad loans in an effort to give borrowers more time to repay.

"In the absence of regulatory measures such as moratorium, the gross NPA formation due to the recent wave of COVID-19 is being upfronted in the first half of the current fiscal [year] for the system, including us," said Sandeep Bakhshi, CEO of ICICI Bank, during a July 24 earnings call. Bakhshi expects the bank's gross NPA additions to be lower in the second quarter and "decline more meaningfully in the second half of fiscal 2022," based on expectations of economic activity.

Stress tests by the Reserve Bank of India indicated that the bad loans of all banks may rise to 9.80% by March 2022 from 7.50% in the same month of this year under a baseline scenario. However, the bad loans ratio could rise to as high as 11.22% by March 2022 under a "severe stress" scenario for key macroeconomic indicators, the central bank said in its biannual Financial Stability Report released July 1. Similar stress tests reported in January had indicated that bad loans of all banks may rise to 13.5% by September.

"Many banks have set aside higher provisioning buffers and raised capital in the last one year or so. This should help them absorb the rising stress in their retail book," said Nikita Anand, an analyst at S&P Global Ratings.

"On the other hand, banks with lower provisioning buffers and weaker capitalization could see a sharp impact on their profits and capital levels," Anand said. "This could be more acute for banks with significant underlying exposure to small business owners or unsecured retail products where loss given default could be higher."

As of Aug. 18, US$1 was equivalent to 74.27 Indian rupees.