Major Indian banks posted income gains in the July-to-September quarter, allowing them to build capital buffers and reduce bad loans as they prepare for relatively slower economic growth in the coming quarters.

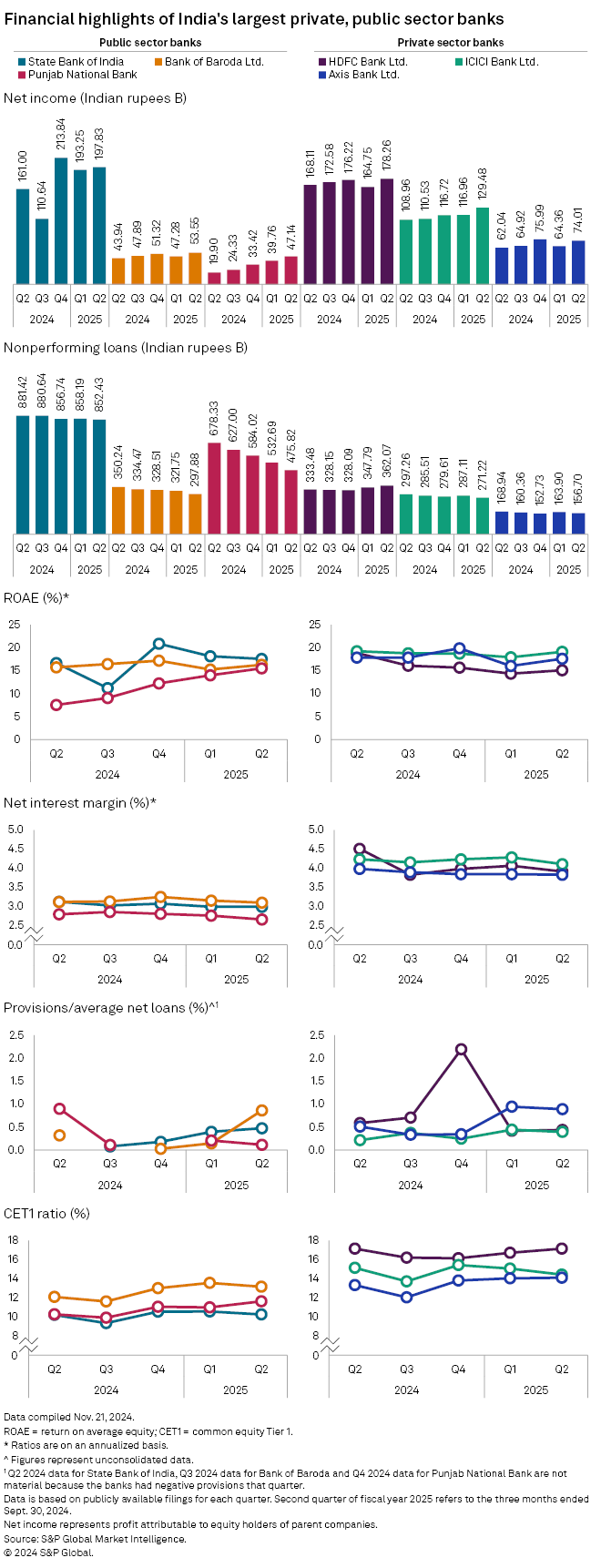

State-owned banks outclassed their private-sector peers in growing profits in the fiscal second quarter even amid erosion in their net interest margins (NIMs). State Bank of India, the country's biggest bank by assets, reported a 22.9% year-over-year increase in net income to 197.83 billion rupees. Bank of Baroda reported net income of 53.55 billon rupees, up 21.9%, while Punjab National Bank's net income for the quarter jumped 136.9% to 47.14 billion rupees.

In contrast, private-sector banks had a more muted second quarter. HDFC Bank Ltd., the country's largest private-sector bank by assets, reported net income of 178.26 billion rupees for the second quarter, up 6% year over year. ICICI Bank Ltd's net income for the quarter rose 18.8% year over year to 129.48 billion rupees. Axis Bank Ltd. reported net income of 74.01 billion rupees, up 19.3% from the prior-year period.

India's economic growth slumped to a surprise 5.4% expansion in the July-to-September quarter, compared with 8.1% a year ago, the government reported Nov. 29. Growth may improve in the second half of the fiscal year to March 31, 2025, but S&P Global Market Intelligence economist Hanna Luchnikava-Schorsch expects to lower the 6.8% full-year forecast. Other economists also expect a more muted GDP and credit growth compared to previous quarters when India was the world's fastest-growing major economy.

Government banks shine

Public-sector banks improved their performance in the fiscal first half ending March 31, 2025, as they benefitted from reforms and regular monitoring that resulted in processes for credit discipline and the resolution of stressed assets, the Ministry of Finance said in a Nov. 12 release.

"These measures have led to a sustained financial health and robustness of banking sector as a whole, which is reflected in the current performance" of the state-owned banks, according to the statement.

Aggregate net profit grew 25.6% year over year to 855.2 billion rupees, while net nonperforming asset (NPA) ratio declined 34 basis points to 0.63% as of September, the ministry said.

"Profit growth has been substantial this quarter boosted by the noninterest income," Bank of Baroda CEO Debadatta Chand said during the bank's Oct. 25 media briefing after announcing the fiscal second quarter earnings. The bank's gross NPA ratio is "trending downwards," Chand said, noting that the lender improved its gross NPA level to 2.5% at the end of the fiscal second quarter, compared with the target of around 3.0%.

Reining in bad loans

Aggregate nonperforming loans at Bank of Baroda fell to 297.88 billion rupees as of Sept. 30, from 350.24 billion rupees a year prior, according to Market Intelligence data.

Punjab National Bank cut its aggregate nonperforming loans to 475.82 billion rupees from 678.33 billion rupees over the same period.

The bank had set an aim of bringing its gross NPA level to around 5% by the end of the fiscal year on March 31, 2025, which it achieved by the end of June 2024. "So, we have revised our guidance that our gross NPA will be around 4% by the end of March '25," Punjab National Bank CEO Atul Kumar Goel said at the bank's Oct. 28 earnings call. Gross NPA eased to 4.48% in the September quarter from 4.98% three months prior, Goel said.

Some private-sector banks also posted declines in nonperforming loans, though their NPA ratios remained stable at lower levels compared with their state-owned peers.

ICICI Bank's nonperforming loans declined to 271.22 billion rupees as on Sept. 30 from 297.26 billion rupees a year ago, while Axis Bank's fell to 156.70 billion rupees from 168.94 billion rupees. HDFC Bank posted an increase in nonperforming loans to 362.07 billion rupees from 333.48 billion rupees, according to Market Intelligence data. That pushed HDFC Bank's net NPA marginally higher to 0.4% in the September quarter from 0.3% in the prior-year period.

As of Dec. 5, US$1 was equivalent to 84.72 Indian rupees.