Mines in the Upper Midwest, like the Knight Hawk mine in southern Illinois, produce fuel that powers much of the region's electricity production. That could change as coal plants retire and new wind and solar facilities come online. |

Coal still dominates the power generation sector in many Great Lakes states like Indiana, Illinois and Ohio. But they are beginning to embrace renewable energy, as well. And some believe that the region has the potential to become the next hot spot for renewable energy development.

A recent Ball State University study found that expanding the use of renewable energy in Indiana will "stabilize energy prices, offer more permanent supply, reduce the local labor demand shocks associated with shifting fuel extraction and move energy production into more Indiana communities than is the current experience."

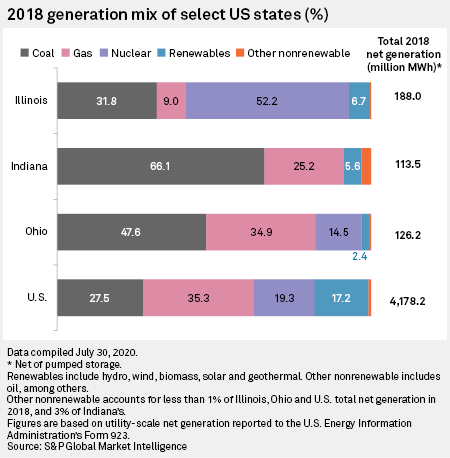

Roughly 66% of Indiana's power comes from coal-fired plants, according to an S&P Global Market Intelligence analysis. Another 25% comes from gas, while only 5.6% comes from renewable sources. The state's renewable portfolio standard calls for 10% of the power mix to come from renewable energy by 2025, but it is nonbinding.

"Developing renewable energy growth will make Indiana more attractive to firms and households who favor lower prices and fewer emissions, it will lead to [fewer] environmental restrictions on firm location and will generate employment growth above what we can experience with continued reliance on fossil fuels," the study said.

Still in single digits

The transition to renewable energy has been equally sluggish across the Upper Midwest, relative to other regions. Nationwide, renewable sources fuel more than 17% of net generation, but many Midwestern states have not cracked double digits in terms of renewable energy's share of generation, according to S&P Global Market Intelligence data.

In Illinois, coal has a 31.8% share of net generation, nuclear has 52.2% and gas has 9%. Renewable resources make up 6.7% of net generation.

Illinois's renewable portfolio standard calls for one-quarter of the state's power to come from renewable sources by 2025. Brad Klein, senior attorney with the Illinois-based Environmental Law & Policy Center, said the RPS, enacted in 2007 and strengthened in 2016, jumpstarted the wind energy industry in the state, which is now ranked sixth in the nation in terms of installed wind power capacity with 5,659 MW. The 2016 law also included provisions to expand solar programs in the state, and "we're now seeing the solar industry really kind of gearing up and becoming a compliment to the historically strong wind industry," Klein said.

The Solar Energy Industries Association ranks Illinois 30th in the nation in terms of installed solar capacity, with 275 MW.

Mired in controversy

In no state has the energy transition been more controversial than Ohio, which has been in the national spotlight as U.S. prosecutors pursue a racketeering investigation tied to the passage of a controversial 2019 bill that propped up nuclear and coal plants and froze the state's renewable portfolio standard at 8.5% in 2026.

The state's biggest utility, American Electric Power Co. Inc., has been drawn into the federal investigation surrounding the bill, known as H.B. 6. AEP Chairman, President and CEO Nicholas Akins has in recent days defended his company's donations to a nonprofit that advocated for the passage of the bill.

Fossil fuels account for nearly 83% of power generation in Ohio, with coal taking 47.6% of total net generation, according to S&P Global Market Intelligence data, and gas taking 34.9%. Nuclear has a 14.5% share, while renewable sources make up only 2.4% of net generation.

Jane Harf, executive director of the nonprofit Green Energy Ohio, said that H.B. 6 sent the message that Ohio is not open for renewable energy development. Yet polls show the majority of Ohioans support renewable energy, she said, and the political scandal around H.B. 6 creates an opportunity for Ohio to "take back our leadership role in renewable energy, to resume doing the things that will really make a difference whether it's environmental, whether it's economic development, whether it's jobs."

Renewable energy innovation is occurring in Ohio: The state was set to host the first freshwater offshore wind farm in the U.S., the 20.7-MW Icebreaker Wind Project (Lake Erie Offshore Wind Project). The Ohio Power Siting Board approved the project but said it cannot operate at night from March 1 to Nov. 1, to mitigate its impact on birds and bats. The developer, Lake Erie Energy Development Corp., said such a prohibition would be fatal to the project.

The end is near

As in the rest of the country, Great Lakes-area utilities can foresee the end of the coal era. Indiana still has roughly 15,000 MW of coal-fired capacity, according to the Energy Information Administration. But since 2010, when coal had a 90% share of total generation in the state, roughly 3,400 MW of coal capacity has retired, and an additional 3,100 MW are scheduled for retirement in the next decade, the EIA said.

Unfortunately, "there's no leadership from the governor's office or the legislature in terms of supporting the energy transition," said Wendy Bredhold, senior campaign representative for the Sierra Club's Beyond Coal Campaign in Indiana.

Gov. Eric Holcomb is a Republican, and the GOP has a supermajority in the General Assembly.

"Every year, it's something that either delays the energy transition or helps utilities charge customers more money," she said.

"We want to move to renewable energy as fast as possible," said Republican state Rep. Ed Soliday, chair of the Utilities, Energy and Telecommunications Committee. But the issues are complicated, he said. For one, many counties have in place bans or moratoriums on renewable energy development. And he has concerns about the reliability of the grid with increasing levels of renewables.

"We can get there," he said of the transition to renewable energy. "The question is, 'What's the right rate and how much reliability will we give up and how soon?' And what we're trying to take is a very data-driven, factual approach to it and in the midst of it is all this hyperbole."

Soliday also co-chairs the 21st Century Energy Policy Development Task Force, which was appointed to study Indiana's power generation mix. It will deliver recommendations to the governor in December for potential legislation. Propping up the coal industry is unlikely to be among them.

"I couldn't save coal if I were the Apostle Paul — not with natural gas selling for what it's selling for," Soliday said.

Northern Indiana Public Service Co., a subsidiary of NiSource Inc., in October 2018, announced it would retire nearly 2,100 MW of coal capacity by 2028. Executives for NiSource said in an Aug. 5 earnings call that, on top of $400 million in renewable energy projects approved by regulators, it expects to invest up to an additional $1.6 billion in renewable energy in coming years. But NIPSCO will continue to operate its 563-MW, natural-gas-fired Sugar Creek Facility, which came online in 2012 and is expected to remain online for its 40-year life, said Tara McElmurry, spokeswoman for NIPSCO.

Northern Indiana Public Service Co. in October, 2018, announced it would retire nearly 2,100 MW of coal capacity by 2028. Bredhold, of the Sierra Club, said the announcement was groundbreaking. But it will continue to operate its 563-MW, natural-gas-fired Sugar Creek Facility, which started operating as base load in 2012 and is expected to remain online for its 40-year life, said Tara McElmurry, spokeswoman for NIPSCO.

Still, the company found after issuing requests for proposals that "renewables were far cheaper than coal generation, and at the time natural gas generation, too," said McElmurry.

"We project our cost savings to be around $4 billion for our customers after we transition away from coal to renewables," the spokeswoman said.

Brad Klein of the Environmental Law & Policy Center, who tracks renewable energy developments in states across the region, said that low energy prices in the region have dampened investors' enthusiasm for renewable energy projects. But as renewable energy prices continue to fall and technologies evolve, the energy transition will accelerate in the Great Lakes states.

"There's a moment in time in every market where you go from very, very slow growth to rapid short-term growth," Klein said. "And we're seeing that in several Midwestern states at this time; we're right at the inflection point."