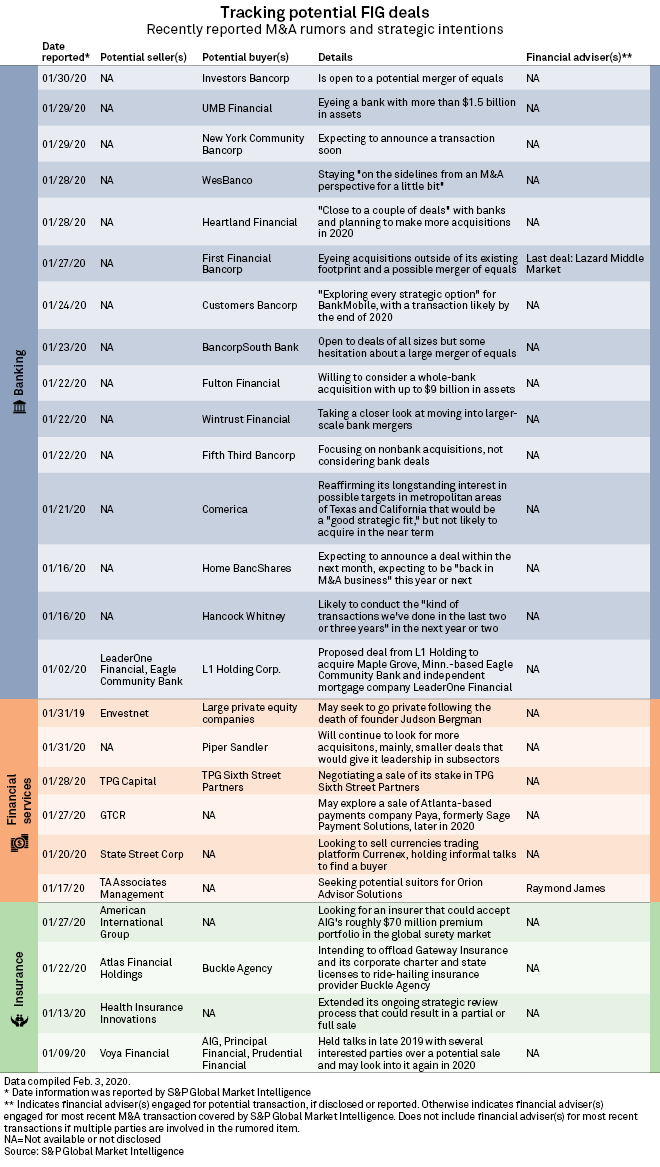

S&P Global Market Intelligence presents a periodic summary of potential deal activity in the financial sector, including rumored transactions. This summary is based on information obtained on a best-efforts basis and may not be inclusive of all potential deal activity.

Banking

* Investors Bancorp Inc. is open to a merger-of-equals but the circumstances would have to be perfect.

*

*

*

* Heartland Financial USA Inc. intends to expand its banking franchise by conducting mergers and acquisitions in 2020.

* First Financial Bancorp. is open to acquisitions outside its current market, into the Midwest, and a possible merger of equals.

* Customers Bancorp Inc. is "exploring every strategic option" for subsidiary BankMobile. The company had earlier tried to spin off the unit in 2018.

* When asked if a large merger of equals could work for BancorpSouth Bank, CEO James Rollins signaled some hesitation about a large MOE, but kept the door open for future deals of all sizes.

* Fulton Financial Corp. would be willing to consider a whole-bank acquisition "between $500 million and $8 billion or $9 billion." The most recent whole-bank deal for Fulton was its 2006 purchase of Columbia Bancorp.

* Wintrust Financial Corp. is taking a closer look at moving into larger-scale bank mergers given the widespread margin pressures hitting the industry.

* Fifth Third Bancorp is not actively looking for a bank deal but is on the hunt for nonbank acquisitions that can boost fee revenue.

* Comerica Inc. remains "very focused on organic growth" and pushed back against the idea that the bank is a likely acquirer in the near term.

* Home BancShares Inc. expects to announce a deal within the next month but noted that the deal is not yet finalized.

* Hancock Whitney Corp. may conduct the "kind of transactions we've done in the last two or three years." The company acquired MidSouth Bancorp Inc. in 2019 and purchased First NBC Bank in 2017.

* A holding company has a proposed deal to acquire Eagle Community Bank. Minneapolis-based L1 Holding Corp. aims to become a bank holding company through the acquisition. In a notice for public comment, the Federal Reserve Board said L1 Holding is also expected to acquire LeaderOne Financial Corp., an independent mortgage company in Overland Park, Kan.

Financial services

* Piper Sandler Cos. will continue to look for acquisitions, and the company would seek opportunities in areas that have little overlap and would look for transactions that could give it leadership positions in subsectors.

* TPG Sixth Street Partners may buy back most of the approximately 33% minority stake held by TPG Capital LP without cash transfer, The Wall Street Journal reported.

* GTCR LLC may sell payment processor Paya Inc., formerly known as Sage Payment Solutions, sometime midyear, sources told Barron's.

* State Street Corp. had informal discussions to find a buyer for currencies trading platform Currenex Inc., sources told the Financial Times.

* TA Associates Management LP is seeking a suitor for Omaha, Neb.-based Orion Advisor Solutions, formerly NorthStar Financial Services Group, Barron's reported. The company is expected to sell for roughly $1.88 billion.

* Envestnet Inc. may seek to go private, and large private equity companies are interested in acquiring the company, Barron's reported.

Insurance

* Atlas Financial Holdings Inc. plans to offload Gateway Insurance Co. and the indirect subsidiary's corporate charter and state licenses to ride-hailing insurance provide Buckle Agency LLC. The deal is expected to be completed in March.

* Health Insurance Innovations Inc. extended its ongoing strategic review process that may lead to a partial or full sale of the company.

* Voya Financial Inc. held discussions with several possible interested buyers, including American International Group Inc., Principal Financial Group Inc. and Prudential Financial Inc. regarding a possible sale, sources told the Financial Times. The firm may hold talks again in 2020 and could be valued at $10 billion or greater in the event of a takeover, more than its market capitalization of about $8 billion.

To see the previous edition of "In Play Today," click here.