Hurricane Ian devastated Southern Florida communities, but banks in the area are unlikely to suffer long-term negative effects, according to equity analysts.

While banks in the impacted areas could see an uptick in loan loss reserves, insurance should shield them from meaningful credit losses. Further, storms such as Hurricane Ian often lead to longer-term positives, such as a resurgence of local economic activity as communities rebuild and insurance funds flow through, equity analysts said.

Major uptick in losses unlikely

Sorting out the storm's impact and insurance coverage will take time, but actual charge-offs versus reserved levels were low in previous storms like hurricanes Harvey and Irma in 2017 and Hurricane Dorian in 2019, Raymond James analysts David Feaster and Michael Rose wrote in a note prior to Ian's impact.

While banks in the area may report some weakness in fourth-quarter 2022 and first-quarter 2023 earnings, "realized losses could be much less severe," the analysts wrote.

In the case of Hurricane Katrina, several banks recorded tens of millions in loan loss provisions, but most of these reserves reversed over time thanks to insurance proceeds and federal disaster assistance, a group of Hovde analysts wrote in another note.

"Whether this will be the case from Ian remains to be seen, but the results of these large storms can often be a resurgence in local economic activity following rebuilding efforts and inflows of insurance funds," the analysts wrote.

Hurricanes usually end up being more of a problem for insurance companies than for banks because any sizable loans are insured for hurricane damage, especially in Florida where hurricanes are common, Piper Sandler analyst Stephen Scouten said in an interview.

"Economies after a hurricane do really well and they get an influx of insurance money and they get new construction," Scouten said. "From an economic perspective and from a banking perspective, they end up being fairly nice positives in the long run. From an insurance perspective, not so much."

One area where banks might see an uptick in losses is in auto, which might be less insured, but banks are not as exposed to that lending segment as in they were past, Scouten said.

"If I were to highlight any segment of a bank's balance sheet, it would be auto, but again, not a big dollar amount," he said.

St. Petersburg, Fla.-based Climate First Bank avoided any serious damage from the storm and does not anticipate any major loan losses or credit risk from any of its lenders in impacted areas, CEO Ken LaRoe said in an interview.

"We had a couple of loan borrowers that were impacted, but not terribly," LaRoe said. "Our operations are pretty insured."

Near-term impacts

For now, many businesses are shut down and a large number of workers are displaced, said Dr. Chris Westley, the dean of Florida Gulf Coast University's business school.

"Both of those things make it much harder for businesses and debtors to make their loan payments," Westley said. "So, just from that perspective, it's a problem."

Some banks have temporarily waived late fees for loan payments to assist customers as they deal with the fallout of the catastrophic storm. For example, Climate First has paused late fees for loan payments and overdraft fees on deposit accounts until Oct. 28.

One area that is particularly devastated is Sanibel Island, one of the most popular tourist destinations in the state and a major contributor to Southwest Florida's hospitality industry, Westley said.

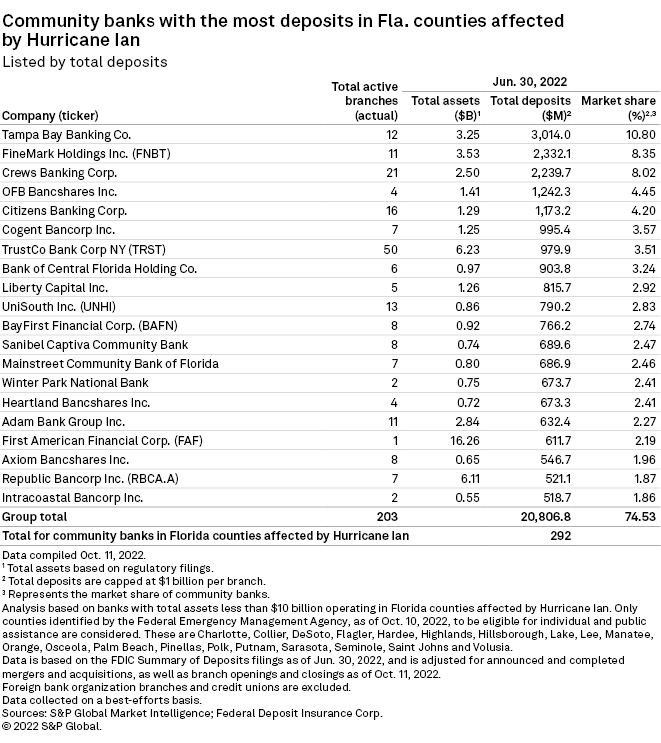

Sanibel Captiva Community Bank, which ranked 12th among community banks by total deposits in Florida counties impacted by Hurricane Ian, declined a request for an interview in a brief statement to S&P Global Market Intelligence.

"Unfortunately, we are still in the thick of it down here," Marketing Director Amy McQuagge said in the statement. "The photos and video of the destruction does not do it justice. It will be a long time before our community fully recovers and rebuilds."

Banks' exposure

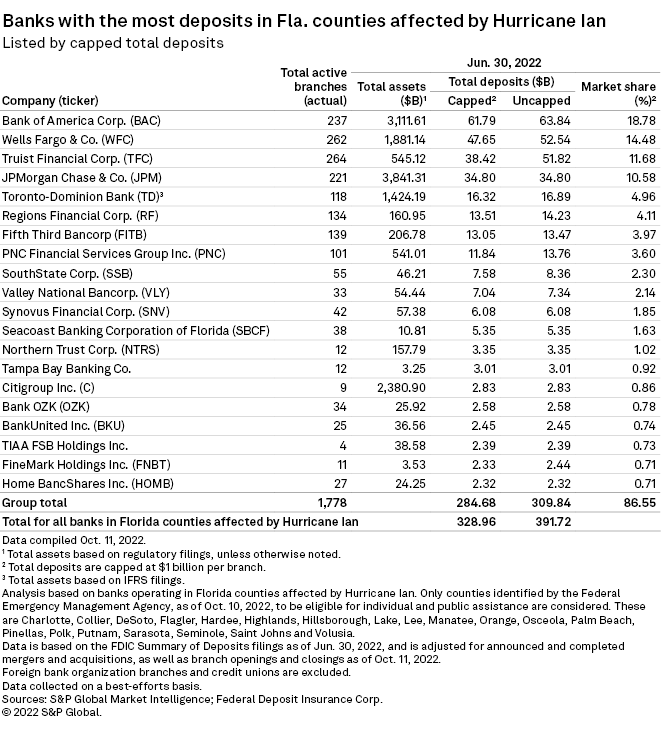

An analysis by Market Intelligence found that at least 2,209 bank branches and $328.96 billion in capped deposits were impacted by Hurricane Ian.

Bank of America Corp. topped the list with $61.79 billion in capped deposits. Wells Fargo & Co. came in second, with $47.65 billion in capped deposits, more than $14 billion less than Bank of America.