Huntington Bancshares Inc. and PNC Financial Services Group Inc. are building out their mortgage business lines through M&A amid the adverse impact of rising interest rates on mortgage activity.

In early November, Huntington National Bank announced its acquisition of PhysicianLoans, a mortgage lender offering home loans to doctors, and PNC Bank NA announced it acquired substantially all the mortgage servicing rights of SecurityNational Mortgage Co.

Though the mortgage market has contracted greatly as a result of rising rates, industry experts still view the deals as strategic, as PNC builds out a mortgage business line viewed as more attractive in the current environment and Huntington makes further inroads to bank a niche customer base.

Further, the banks will benefit from an improved environment when the mortgage market rebounds, Jeff Davis, FIG managing director at Mercer Capital, said in an interview.

"The mortgage business could become very good again," Davis said. "If someone paid a nominal price to get capacity this year, then you would harvest that next year or in 2024."

Value of mortgage servicing

With its acquisition of SecurityNational, PNC is joining other large banks that have sought to pick up mortgage servicers in recent years. In a rising-rate environment, mortgage servicing becomes more attractive than origination, industry experts said.

"The servicing side has become more valuable," Stephens analyst Terry McEvoy said in an interview. "The mortgage origination side is clearly struggling."

Mortgage servicing is more attractive in the current environment because mortgage servicing rights show up as an asset on a bank's balance sheet and tend to have a longer lifespan as early repayments become less likely, Davis said.

"As rates rise, it's much less likely that the mortgage will be repaid early," Davis said. "What's happened with servicing portfolios is the expected life has extended dramatically compared to earlier this year."

Still, at $89.7 million, the acquisition of SecurityNational is not a significant transaction for a bank the size of PNC, McEvoy said.

Banking doctors

Though Huntington is acquiring a mortgage originator during a depressed home-buying environment, the company is accomplishing a larger strategic goal with the PhysicianLoans deal.

PhysicianLoans' Doctor Loan product provides mortgages to medical doctors, dentists and veterinarians. That customer base, many of whom are early career physicians with few assets but great earnings potential as long-term clients, is attractive, according to Davis.

"There's sort of a strategic angle to it," Davis said. "It's a niche within that niche, so to speak, of private banking."

With the acquisition, Huntington is building out its suite of physician services and advancing its mortgage lending strategy while also allowing the company to "grow and deepen" its banking relationships with PhysicianLoans' customers, according to a press release.

Huntington is not the only bank to pursue the doctor client base. KeyBank NA, the banking subsidiary of KeyCorp, in March 2021 launched a digital bank product targeting doctors and dentists through its Laurel Road brand.

Specialty

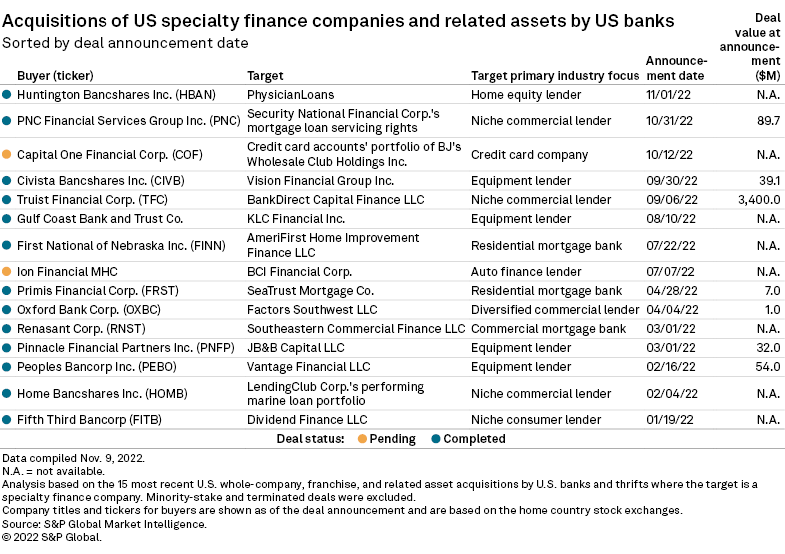

The deals are two of only 16 specialty finance deals with a bank as a buyer so far this year. Like Huntington and PNC, a handful of other banks have struck mortgage-related deals this year despite the tough home-lending environment.

However, the rate of specialty finance acquisitions has steadily declined over the last decade, according to S&P Global Market Intelligence data.