Humana Inc. shares slumped after the health insurer reduced its forecast for Medicare membership growth by about half.

The managed care company now expects 2022 net membership growth for its individual Medicare Advantage products of 150,000 to 200,000 members, down from a previous estimate of 325,000 to 375,000.

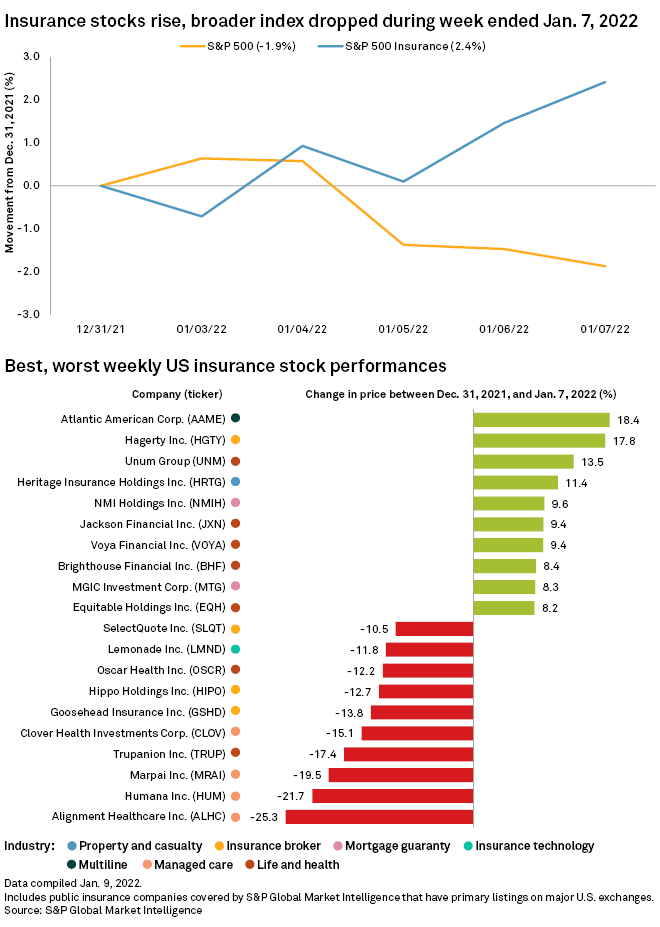

Many big names in the life and property and casualty insurance space put together strong gains and outperformed the broader market. The S&P 500 declined 1.87% for the week ending Jan. 7, to close at 4,677.03.

Humana in a regulatory filing said the weaker forecast is due in part to higher than anticipated terminations during the annual election period. The company also anticipates more terminations for the rest of 2022 than originally projected. Humana continues to expect group Medicare Advantage membership to be generally flat for 2022, as it does not anticipate any large accounts will be gained or lost as it continues to maintain pricing discipline in a highly competitive market.

Humana did reaffirm its EPS guidance for full year 2021 but reiterated that 2022 adjusted earnings would be at the low end of its target growth rate of 11% to 15%. The stock was one of the worst performers in the entire U.S. insurance industry this week, tumbling 21.71%.

Elsewhere in the managed care space this week, Centene Corp., completed its acquisition of Magellan Health, Inc. An S&P Global Market Intelligence analysis found that Centene posted the strongest sequential increase in market capitalization in the fourth quarter, as its shares soared more than 32% in the period. As of year-end 2021, Centene was the eighth-largest publicly traded insurer in the U.S.

The stock got off to a rocky start in its first week of trading in 2022, however. Centene closed down 7.35%.

Life and health insurers were generally among the insurance industry's strongest performers this week. Unum Group added 13.51% and Brighthouse Financial Inc. rose 8.44%. MetLife Inc. gained 7.63% and Lincoln National Corp. added 7.09%.

Earlier in the week, American International Group Inc. sold third-party administrators Fortitude P&C Solutions Inc. and Fortitude Life & Annuity Solutions Inc. to Fortitude Group Holdings LLC, marking the final step in Fortitude Re's acquisition of AIG's legacy insurance operations.

AIG's shares climbed 6.82%.

Many of the top property and casualty names also found themselves among the best-performing insurance stocks as the new year began. Evercore ISI Group this week raised its rating for The Progressive Corp. to outperform from in-line. Progressive rose 6.36% of its share price during the week; The Allstate Corp. was up 7.05%.