Proceeds from Hong Kong technology, media and telecom IPOs rose sixfold year over year in the fourth quarter of 2021, while the number of listings also increased.

Four companies raised a total of $1.39 billion in the quarter, up 531.8% annually, according to data from S&P Global Market Intelligence.

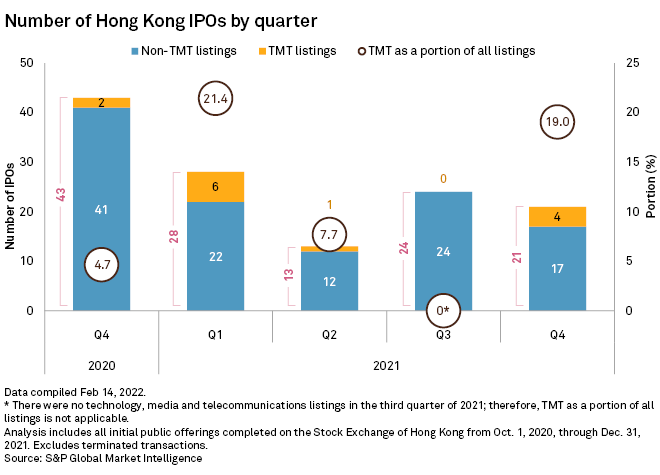

A total of 11 technology, media and telecom, or TMT, companies listed on the Hong Kong Stock Exchange, or HKEX, last year, compared to 20 in 2020.

The complete lack of TMT IPOs in the third quarter of 2021 is unusual, with the sectors frequently making up about 20% of all HKEX debuts. IPO timelines were impacted by investor caution over regulatory developments in China and the U.S, experts said. Online music platform Cloud Village Inc. and electric-vehicle maker NIO Inc., for example, put their listings on hold.

Activity could pick up, though, as Chinese companies that are unable to raise money in the U.S. due to regulatory scrutiny and investment bans look for alternative equity markets.

In December, the U.S. Securities and Exchange Commission announced more stringent oversight and disclosure rules for foreign companies. The Holding Foreign Companies Accountable Act requires issuers to establish that they are "not owned or controlled by a governmental entity."

China's internet regulator, meanwhile, introduced cybersecurity reviews for companies seeking overseas listings. The Cyberspace Administration of China, or CAC, said the rules apply to online platforms with data on more than 1 million Chinese users.

The CAC's review into ride-hailing app DiDi Global Inc. contributed to the company's decision in December 2021 to delist from the New York Stock Exchange, after just five months of trading. Didi said it would pursue a listing in Hong Kong instead.

One company that successfully navigated regulatory obstacles to list in the fourth quarter was Chinese artificial intelligence company SenseTime Group Inc. The company raised $740.7 million in its Hong Kong debut in December, despite the U.S. government banning citizens from taking part in the IPO at the last minute, alleging that the firm's facial recognition technology can be used in ways that enable human rights abuse. SenseTime has denied the accusations.

Of the four TMT IPOs in the fourth quarter of 2021, SenseTime is the only company that has improved on its IPO price, with its share price up 56.1% as of Feb. 28, 2022.

Three Chinese tech companies have had their preliminary listing plans approved by the HKEX. App-based logistics company Gogox Holdings, consumer contact solutions provider TI Cloud Inc. and Hangzhou Bioer Technology Co., which makes high tech life science instruments, have each published a Post Hearing Information Pack, or PHIP, on the stock exchange's website.

A PHIP is a "near final draft listing document" and must be published before any bookbuilding commences.

Chinese tech conglomerate Alibaba Group Holding Ltd. holds shares in Gogox Holdings. Huitongda Network Co. Ltd., which is a transaction and service platform that targets rural China, listed on the exchange Feb. 18. The company counts Alibaba China, China Life Insurance and China Renaissance among its shareholders.