|

|

The world's second-largest listing in 2024 will likely boost Hong Kong's leading position as an IPO venue in the China region, where equity fundraising has fallen to the lowest level in three years.

The Hong Kong listing of Midea Group Co. Ltd. in September raised HK$31.2 billion (US$4 billion) and helped revive interest in Chinese equities markets. The follow-on public offering of China's largest home-appliance maker was second only to Lineage Inc.'s US$5.1 billion IPO in July.

"The overwhelming response, with an oversubscription of eight times, to Midea's IPO reflects the appetites of investors — both foreign and domestic — for quality Chinese companies," said Wilson Zhang, global executive head of equity at China International Capital Corp., in a Nov. 18 interview.

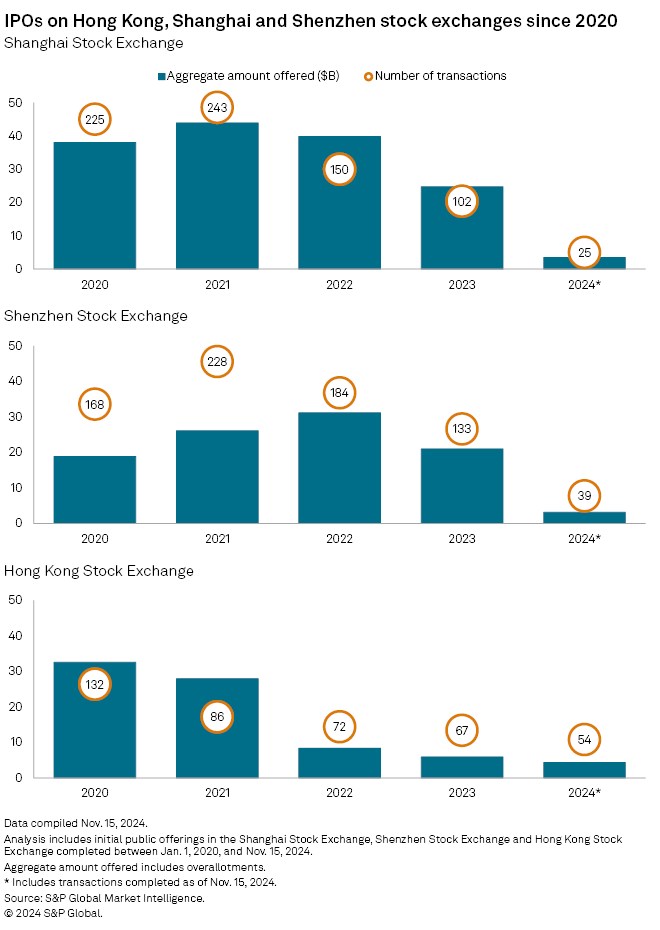

IPO activity declined significantly in all three major exchanges in China, both in terms of deals and amounts raised. By Nov. 15, Hong Kong Exchanges and Clearing Ltd. (HKEX) hosted 54 IPOs, with an aggregate US$4.34 billion raised, according to S&P Global Market Intelligence data. IPO fundraising in Hong Kong in 2024 will fall short of the US$5.90 billion raised via 67 deals in 2023. IPO activity on both mainland China bourses, Shanghai Stock Exchange and Shenzhen Stock Exchange, is significantly lower in 2024 compared to 2023, the data shows.

The success of the Midea IPO gave a leg up to regulators in mainland China, who are now increasingly keen on helping companies list in Hong Kong as part of a wider Stock Connect program, CICC's Zhang said. "This is definitely positive for the business outlook of China-based brokerage firms," Zhang said.

CICC was one of the lead sponsors and bookrunners for the Midea IPO.

Beijing will support more quality companies from the mainland to list and issue bonds in Hong Kong, He Lifeng, China's vice premier, told the Global Financial Leaders Summit in Hong Kong on Nov. 19. The government will also support mainland Chinese financial institutions to expand their businesses in Hong Kong, He said.

Hong Kong has rebounded as one of the top five global venues for equity fundraising following the Midea listing, KPMG said in an Oct. 3 report. The government's strategic initiative is "expected to enhance liquidity inflows, which could significantly boost the number of large IPOs in Hong Kong for the remainder of 2024 and beyond," according to the KPMG report.

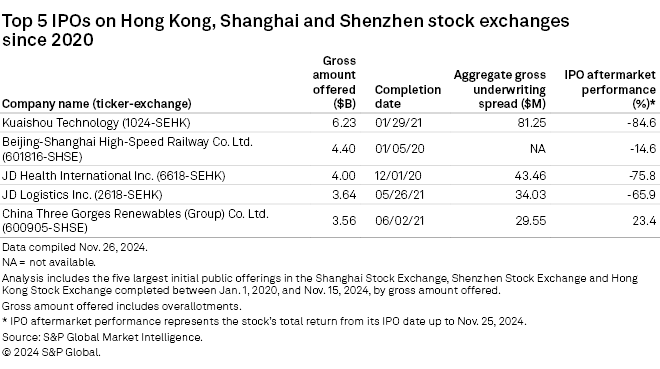

The January 2021 HKEX listing of Kuaishou Technology, a Beijing-based live streaming and online marketing services provider, was the region's largest IPO in the past five years, according to Market Intelligence data. The IPO raised US$6.23 billion and generated aggregate fees of US$81.25 million for investment banks.

Also in the top five were JD Health International Inc. and JD Logistics Inc., which listed in Hong Kong, and state-owned Beijing-Shanghai High-Speed Railway Co. Ltd. and China Three Gorges Corp., which listed in Shanghai, the data shows. Midea was not counted in the top five IPOs as it was already listed on the Shenzhen Stock Exchange. The Hong Kong listing was a follow-on public offering.

Support for new listings

The China Securities Regulatory Commission (CSRC) and the State Council, the top administrative body in mainland China, launched a renewed plan to improve the quality of new listings and enhance the responsibilities of sponsors and exchanges under the National Nine Articles program, which was launched earlier in 2024. The authorities plan to step up their supervision of market institutions acting as gatekeepers of the capital market.

Simultaneously, mainland companies are being encouraged to seek fundraising opportunities in other global financial centers, especially Hong Kong. On Oct. 18, the HKEX and Hong Kong's Securities and Futures Commission jointly announced enhanced rules aimed at shortening the IPO process and "to further elevate Hong Kong's attractiveness as the leading international listing venue in the region."

The CSRC will continue to support Hong Kong in extending the Stock Connect scheme and encouraging share listings of leading Chinese firms, Li Ming, vice chairman of the securities regulator, said in an HKEX forum Nov. 18.

Stock Connect is a mutual market access program through which investors in the mainland and Hong Kong can trade and settle shares listed on the other market via the stock exchanges and clearing houses in their home market.

Hong Kong could host as many as 80 IPOs in 2024 to raise between HK$60 billion and HK$80 billion, Deloitte Capital Market Services Group wrote in a Sept. 25 report. Depending on market conditions and the pace of economic recovery in the mainland, there could be several IPOs with fundraising of above US$1 billion in the near term, according to the report.

Tough policy environment

While Hong Kong could be buoyed by the continual inflow of mainland IPO candidates, Shanghai and Shenzhen may lag for a bit longer amid more stringent policy.

Deloitte slashed its 2024 forecast of IPO proceeds in the two mainboards in Shanghai and Shenzhen to between 25 billion yuan and 43 billion yuan, versus its prior forecast of 74 billion yuan to 84 billion yuan, citing intensive scrutiny on IPO applicants.

The National Nine Articles policy resulted in more than 70% of IPO applications getting blocked, Dick Kay, National Offering Services leader at Deloitte, told S&P Global Market Intelligence on the sidelines of a Sept. 25 conference. Kay expects the tough policy environment to remain in place for a while.

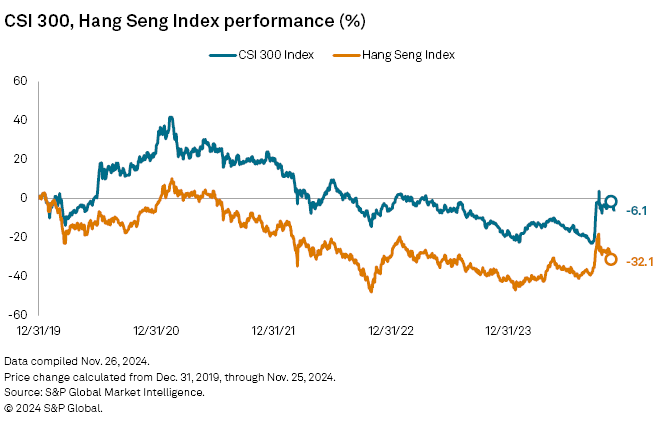

Beijing announced a new stimulus plan on Sep. 24 to boost key areas of the economy, including the capital market, to raise market confidence. The region's stock markets have been sluggish compared with those in countries such as the US, Japan and India, which have seen sharp gains.

The stimulus includes programs that enhance companies' ability to buy back their shares to support the stable development of the stock market. This is in addition to measures supporting the housing sector, which is experiencing a multiyear downturn

As of Nov. 26, US$1 was equivalent to 7.25 Chinese yuan.