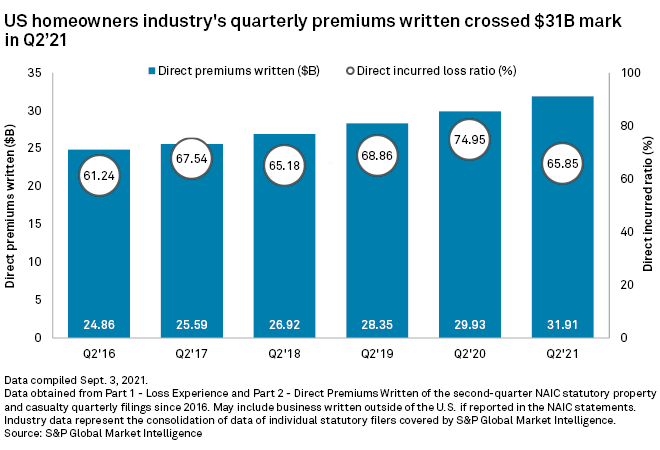

The U.S. homeowners insurance market booked $31.91 billion in direct premiums written in the second quarter, a record quarterly high for the industry, an S&P Global Market Intelligence analysis shows.

Homeowners insurers recorded $29.93 billion in direct premiums written during the same period a year ago.

State Farm Mutual Automobile Insurance Co. retained its spot as the largest writer of homeowners insurance in the U.S. with $5.86 billion of direct premiums written during the quarter, equivalent to year-over-year premium growth of 8.7%.

Allstate Corp. remained in the second spot with $2.73 billion direct premiums written, representing yearly premium growth of 5.5%, while United Services Automobile Association ended the quarter as the third-largest writer of homeowners insurance with premium growth of 7.4% year over year.

Farmers Insurance Group of Cos. and Liberty Mutual Insurance held onto the fourth and fifth spots, respectively. Farmers Insurance ended the quarter with $2.05 billion of direct premiums written, while Liberty Mutual reported about $2 billion of direct premiums written during the period.

Among the top 20 homeowners insurers, Tokio Marine Holdings Inc. recorded the largest year-over-year premium growth in the second quarter at 30.5%. The insurer jumped to the 15th spot with $306.9 million direct premiums written during the period.

Homeowners insurance and other business lines with material catastrophe exposures showed significant declines in their direct incurred loss ratios relative to the prior-year period. The U.S. homeowners insurance market as a whole reported a 65.85% direct incurred loss ratio in the second quarter, compared with 74.95% in the second quarter of 2020.

The cost of homebuilding materials rose sharply in the period due to inflationary pressure amid tightening supplies and soaring demand for homes, but large insurers like Allstate can handle escalating prices for homebuilding materials through inflationary provisions in their policies, according to company executives.

Glenn Shapiro, president of personal property-liability at Allstate, during a second-quarter earnings call said the company is "really well-positioned" to continue making a profit in homeowners insurance due to a sustained and systemic advantage that affects its claims capabilities, catastrophe management, reinsurance, risk selection and product capability and pricing.

"Having purchasing power and having really good deals in place over the long term on flooring, roofing and other products used in home repair helps hedge that inflation," he said.