U.S. property and casualty insurers in the first quarter saw homeowners premiums increase year over year for the 11th-consecutive three-month period, according to an S&P Global Market Intelligence analysis of quarterly statements.

The industry logged $21.90 billion in homeowners premiums in the quarter, up 5.1% from the prior-year period. Direct incurred losses fell to $9.03 billion from $9.49 billion a year earlier. The industry's loss ratio improved by 4.5 percentage points year over year to 53.28%.

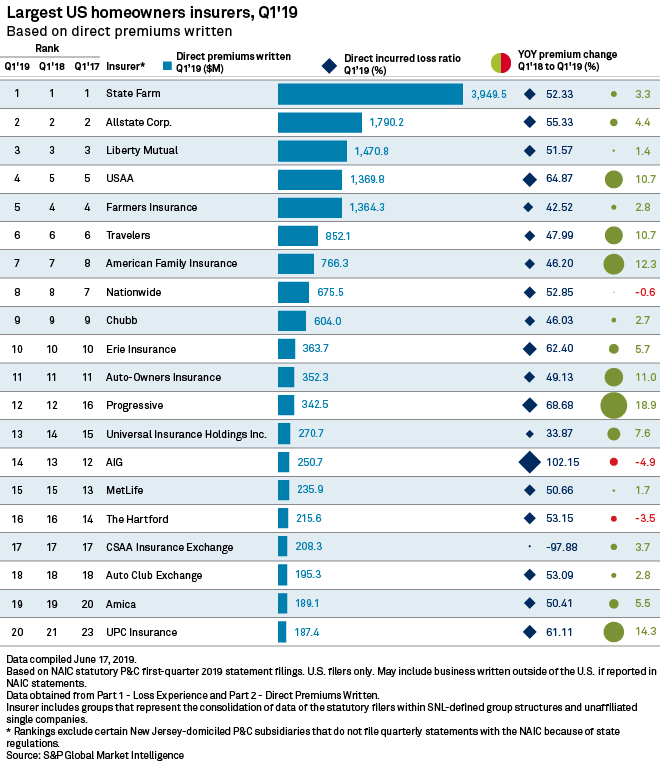

Seventeen of the 20 largest homeowner insurers in the U.S. reported premium growth in the quarter. Of those 17, six posted double-digit premium increases on a year-over-year basis. The 20 largest homeowners insurers account for 71.5% of the industry's total written premiums.

Progressive Corp. had the strongest premium growth among the top 20 homeowners insurers at 18.9%; the company wrote $342.5 million in homeowners premiums in the first three months of the year. However, that growth is comparatively lower than the 30.3% premium increase that it recorded a year ago.

American International Group Inc. slipped one position in rankings to 14th as a result of a 4.9% premium reduction in its homeowners segment. AIG was the only insurer in the list that posted a loss ratio of more than 100% in first quarter.

United Insurance Holdings Corp. secured a spot in the top 20 largest homeowners insurers ranking for the first time, replacing Heritage Insurance Holdings Inc., thanks to 14.3% premium growth in the three months ended March 31.

S&P Global Market Intelligence offers a variety of tools to analyze the underwriting performance of insurance companies. Click here for a template to review quarterly underwriting information for insurance companies. Quarterly underwriting information by line of business is available in Parts 1 and 2 of the NAIC quarterly statements filed by U.S. insurance subsidiaries. This information is also available in the U.S. Insurance Statutory Financials database in MIOffice. |