The Biden administration's proposal to increase the capital gains tax in the U.S. is creating an urgency for privately held companies to sell, a factor helping to drive the flurry of private equity M&A deals in 2021 after the COVID-19 pandemic depressed transaction activity in 2020, ClearRidge Managing Director Matthew Bristow said in an interview with S&P Global Market Intelligence.

Privately held companies need a triggering event to push them to start a sale process or to respond to buyout offers, and "tax changes are probably one of the biggest triggers that exist," Bristow said.

Year-to-Aug. 31, the number of all-cash transactions involving U.S.-based private equity sellers and target companies soared 89.3% to 301 compared to the same period in 2020, according to Market Intelligence data. The number of stock deals over the same period also rose 63.6% year over year.

Under the proposal, the capital gains tax would increase to 39.6% from the current rate of 20%, or to 43.4% from 23.8% if the net investment income tax is taken into account. The new rate could be retroactive to April 28, when President Joe Biden first announced the proposed tax hike as part of his American Families Plan, or May 28, when the U.S. Treasury Department released the administration's Fiscal Year 2022 Budget Tax Proposals.

If the tax hike proposal becomes law and retroactive to either April 28 or May 28, deals closed after such date would result in investors realizing gains at the new rates instead of the previously lower rates.

The potential for a higher capital gains tax is helping boost private equity M&A activity and speeding up deal timelines in the U.S. after a slowdown caused by COVID-19 in 2020. |

Shorter timelines

The timeline for finalizing deals is shortening, as the concept of even a potential tax change "increases the likelihood that the two sides would compromise and actually close the transaction," Bristow said.

If the new tax rates come into force, the effective date would be Jan. 1, 2022, and many sellers are rushing to exit their businesses by the end of 2021, added Brian McNeely, a partner at Reagan Consulting Inc., in emailed comments.

M&A activity involving U.S.-based private equity sellers in 2021 picked up a day after the tax proposal was first announced, with 171 deals announced from April 29 through Aug. 31, up 3% from 166 in the preceding period, Market Intelligence data shows.

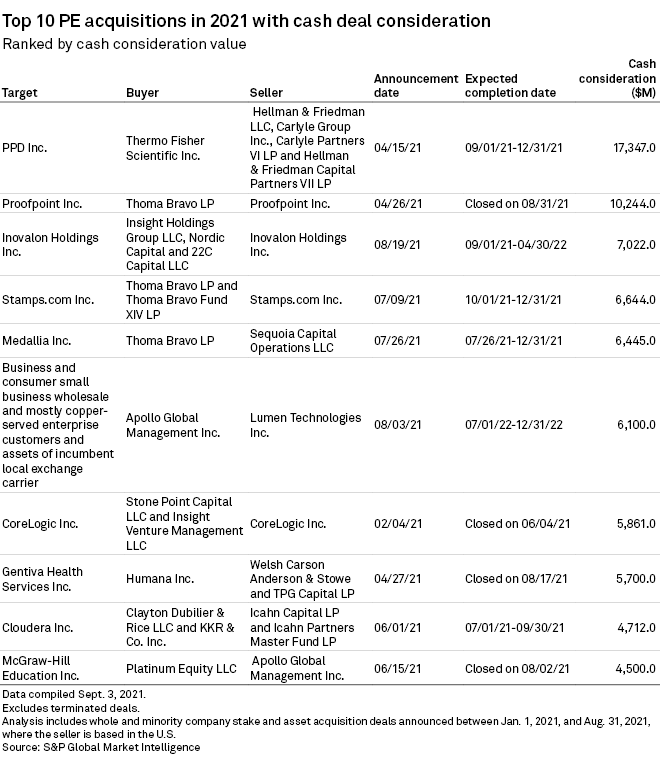

Four of the blockbuster private equity buyout deals struck in 2021 so far have closed well ahead of the projected tax hike implementation date, and several others are expected to wrap up before the end of the year, according to Market Intelligence data.

In August, Thoma Bravo LP finalized its deal to take cybersecurity company Proofpoint Inc. private for roughly $10.24 billion, while Apollo Global Management Inc. sold e-learning company McGraw-Hill Education Inc. to Platinum Equity LLC in an approximately $4.5 billion transaction. TPG Capital LP and Welsh Carson Anderson & Stowe also wrapped up the sale of a 60% stake in home healthcare provider Gentiva Health Services Inc. to Humana Inc. for $5.7 billion during that month.

In June, Stone Point Capital LLC and Insight Venture Management LLC, or Insight Partners, closed their takeover of CoreLogic Inc. in a deal valued at about $5.86 billion.

Tax impact on PE deals

When asked whether the potential tax increase would dampen private equity deal activity once implemented, Bristow said that would be "giving too much weight to the tax environment alone." Historically, there is no direct correlation between higher capital gains tax and lower transaction activity. "I think other factors come into play," he said.

The proposed higher tax rate is unlikely to impact the type of deal — cash or stock — as every transaction is unique. "That's a tax consequence negotiated among the parties," Bristow added.

McNeely, on the other hand, said that if and when the tax hike goes into effect, "sellers could be less likely to sell their business due to the reduction in their after-tax proceeds and as a result, buyers will have fewer opportunities to acquire companies."

The planned increase could also lead to more stock-for-stock versus all-cash transactions, "assuming the sellers can get comfortable with receiving greater than 50% of the buyer's stock as consideration and are willing to hold it for a period of time," McNeely explained.

Despite the potential for a doubling of capital gains tax, Bristow and McNeely both believe that the private equity playbook is likely to remain the same over the next year. The likelihood of the tax hike actually going into effect is still up in the air and Bristow believes a moderate increase is more likely than what was initially proposed.

The breadth of the new tax rate proposal, which is being drummed up to help fund the Senate Democrats' $3.5 trillion economic spending plan, is also getting pushback from some lawmakers, but they are aiming to resolve their differences and release a draft of the budget proposal by Sept. 15.