Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 May, 2023

By Sanne Wass

The nascent sustainability-linked bond market faces one of its biggest tests to date as a growing number of issuers approach their first target deadlines.

|

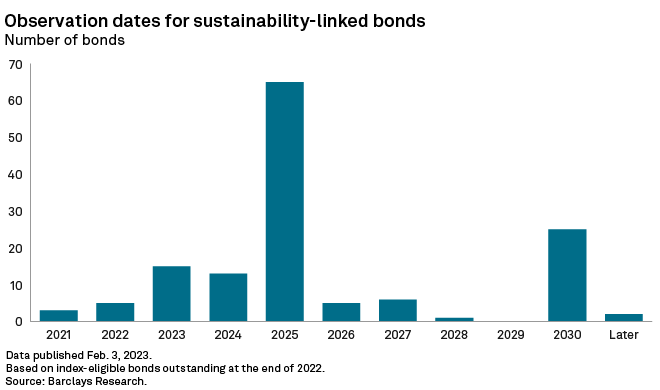

Fifteen index-eligible sustainability-linked bonds (SLBs) have observation dates in 2023, according to Barclays research. Several issuers risk higher coupon payments as external factors, such as the war in Ukraine and the resulting energy crisis, have impacted their sustainability performance, the research found.

While missed targets could lead to higher funding costs and sell-offs of bonds, experts are optimistic that the impact on the broader SLB market will be positive and drive maturity of the instrument.

"These 'failures' will likely result in negative headlines ... Yet, missing a sustainability-linked target is not necessarily a negative," NatWest sustainable finance experts said in an April 18 note.

A sustainability-linked bond, first issued by Italian energy group Enel SpA in 2019, is a form of

|

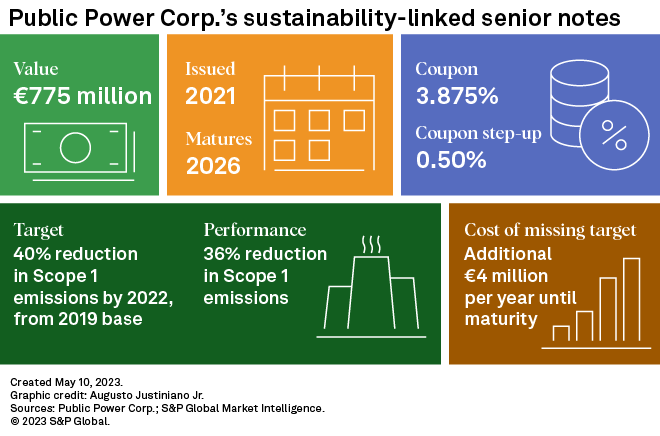

Greek state-owned utility Public Power Corp. SA (PPC) missed a target on €775 million worth of sustainability-linked senior notes in 2022, becoming one of the first SLB issuers to do so. This triggered a coupon step-up of 50 basis points, which will cost PPC an additional €4 million per year until maturity in 2026, the company said in a statement in March.

Target misses can provide data points around the resulting impact on bond price, liquidity and investor behavior and thereby help the SLB market evolve, according to NatWest. Such information can be used by issuers to inform future structures and step-ups, while investors can better price the step-up risk for similar instruments, it said.

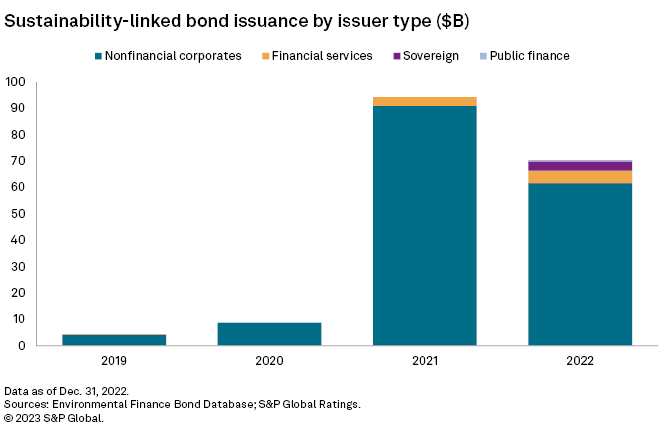

Global SLB issuance grew 10-fold in 2021 to $94.38 billion, but levels tailed off in 2022 to $70.45 billion amid growing skepticism over the instrument's impact, credibility and structure. Investors have raised particular concern over some targets' lack of ambition.

"I don't think it's necessarily a bad thing to see targets being missed," said Michael Ferguson, analytical manager for sustainable finance Americas at S&P Global Ratings, speaking on a webinar March 9. Rather, it shows that the goals have "a degree of ambition," and it could help the market develop more credible and meaningful targets in the future, he said.

"To the extent that they're missed, it will cause companies to recalibrate a little bit and understand whether their targets are susceptible to shocks that are outside their control," Ferguson said.

Important context

For those SLB issuers that underperform on their sustainability targets, the market reaction will likely depend on how ambitious the targets were to begin with and why they were missed.

Geopolitical themes such as the Russia-Ukraine war have impacted a number of SLB issuers, and investors may accept this as a legitimate reason for a missed target, said Nicholas Pfaff, deputy CEO and head of sustainable finance at the International Capital Market Association.

"When that's the reason, then it's perfectly normal that issuers and investors enter into a discussion as to what happened and what can be potentially renegotiated or adjusted in the deal," Pfaff said.

PPC in March said it had reached a 36% reduction in Scope 1 emissions between 2019 and 2022, short of the 40% target it had set in its SLB. This was due to increased lignite-fired generation "in order to safeguard security of supply in the electricity system of Greece" amid the energy crisis, the company said.

There has been no material selling of the bond by ESG-labeled funds since the announcement, said Pilar Auguets, senior director for utilities and transport at Fitch Ratings. Had the missed targets been related to the company's operating performance rather than the energy crisis, it is more likely that investors would have sold the bond, she added.

The market "seems to understand the reasons for not being able to meet the target," a PPC spokesperson told S&P Global Market Intelligence, adding that its ESG investors appreciate the credibility and transparency around the underperformance.

"We consider this miss as a short term impact due to reasons very much out of [our] control," the spokesperson said.

While there has not been any "notable reaction" from the market to the PPC's step-up, the target underperformance may have been gradually priced in over the months leading up to the announcement, said Dean Shahfar, vice president for sustainable finance, debt and financing solutions at NatWest Markets. The trigger coincided with broader market volatility, which may have masked "minor flows" resulting from this trigger, but otherwise secondary performance of PPC's bond has been in line with broader credit over the period, he said.

The cost of other financing instruments, such as sustainability-linked loans and credit facilities, would also increase, said an Enel spokesperson. The expected impact, however, would be "considerably less relevant" than that envisaged for SLBs.

In a scenario where Enel does not meet its 2023 target, that would "not be signaling a change in the group's medium and long-term climate commitments," the spokesperson said, but would rather be caused by exogenous factors such rain levels and the contingent macro situation.

Road to 2030

Investors are generally likely to place more focus on issuers' 2025 or 2030 goals, rather than interim targets, according to Barclays analysts.

"What matters most to us is issuers' longer-term targets, which are the ones we actually expect them to meet to achieve their transition objectives," said Théo Kotula, ESG analyst at AXA Investment Managers.

Missed short-term sustainability targets do not seem to have a major impact on investors' demand and interest for the SLB instrument, Kotula said. However, they have demonstrated the need for investors to look carefully into SLB frameworks and transactions to ensure targets are material and ambitious, he added.

This theme will extend beyond 2023. Among the more-than 150 index-eligible SLBs that have been issued by nearly 100 different entities, the bulk of observation dates will occur in 2025, according to Barclays research from February.

Missed sustainability targets will help the nascent SLB market evolve, Pfaff said. "It took green bonds a good 10 years to reach maturity as a product," he said. "We need to give the SLB product a decade before we really will know how well it's worked in practice."