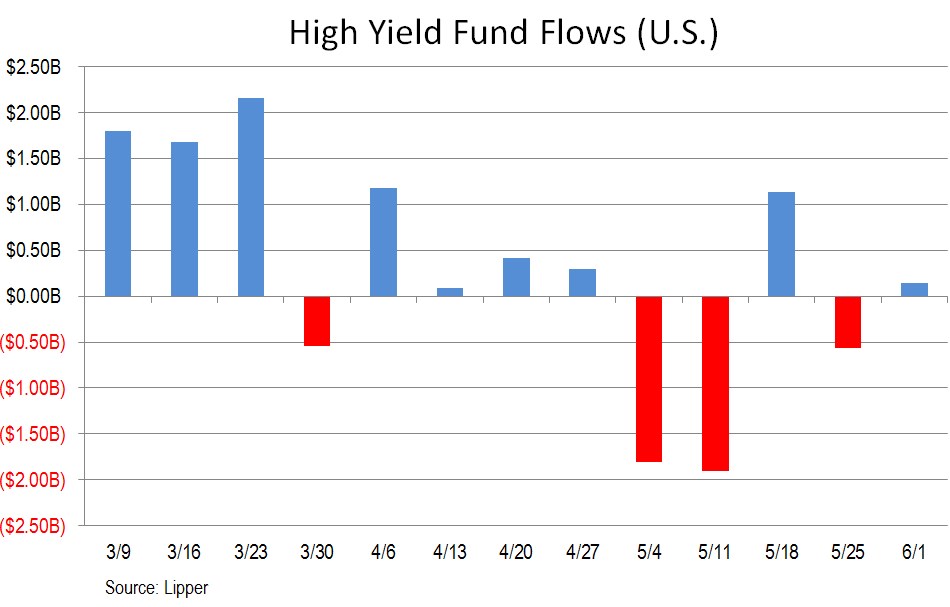

U.S. high-yield funds recorded an inflow of $145 million in the week ended June 1, according to the weekly reporters only to Lipper. The inflow dents last week’s outflow of $562 million and represents the second inflow over the past three weeks for a net infusion of $718 million over that span.

Take note, however, that this week was yet again essentially all ETF-influenced, with ETF inflows of $159 million backed out by outflows of $15 million from mutual funds, for an inverse 110% reading. In contrast, last week’s outflow was 91% due to ETF redemptions.

Whatever that might say about fast money, hedging strategies, and other market-timing efforts, this week’s net infusion drags the trailing four-week average to shallower waters, at negative $297 million, from negative $785 million last week.

The year-to-date total infusion expands a bit to $6.7 billion, with 27% ETF-related. Last year at this point, after 22 weeks, the $9 billion net inflow was similarly 32% ETF-related.

The change due to market conditions this past week was positive $459 million, which is essentially nil against total assets of $191.2 billion at the end of the observation period. ETFs account for about 20% of the total, at $38.6 billion. — Matt Fuller

![]() Follow Matthew and LCD News on Twitter

Follow Matthew and LCD News on Twitter

This story first appeared on www.lcdcomps.com, LCD’s subscription site offering complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.