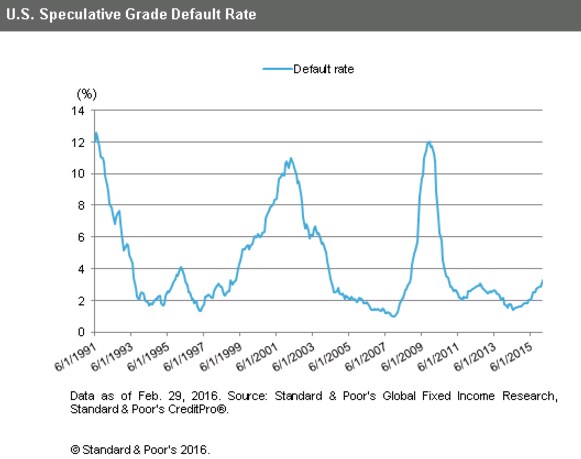

The U.S. trailing 12-month speculative-grade corporate default rate is estimated to have increased to 3.8% in March, from 3.28% in February and 2.82% in January, according to S&P Global Fixed Income Research (S&P GFIR). The current observation estimate represents the highest level in nearly six years, or since the rate was at 4.17% in September 2010.

There were 12 corporate defaults during the month. Sub-par debt buybacks produced defaults for mortgage lender Prospect Holdings andTown Sports International; skipped interest spurred defaults for Chaparral Energy, Foresight Energy, Linn Energy, Templar Energy, and auto-parts company UCI Holdings; bankruptcies were Aspect Software and Southcross Energy; American Media completed yet another distressed exchange; Peabody Energy didn’t make a coupon during the grace period and warned of the ability to continue as a going concern; and Nuverra Environmental Solutions completed an out-of-court restructuring.

Downgrades outpaced upgrades. S&P Ratings Services upgraded 19 companies with total debt of about $207.3 billion and downgraded 48 companies with total debt of about $62.4 billion in March, according to S&P GFIR.

“The resulting downgrade ratio for the month by count is 2.53 to 1. In comparison, the downgrade ratio was 2.2 to 1 for full-year 2015, 1.02 to 1 for full-year 2014, and 0.9 to 1 for full-year 2013,” explained Diane Vazza, head of S&P GFIR.

Looking ahead, the S&P GFIR holds firm its forecast for the U.S. speculative-grade default rate to increase to 3.9% by the end of 2016.

Today’s report, titled “The U.S. Speculative-Grade Corporate Default Rate Grew To 3.8% In March,” is available to subscribers of premium S&P GFIR content at the S&P Global Credit Portal.

For more information or data inquiries, please call S&P Client Services at (877) 772-5436. — Staff reports