It was a tough first quarter for the European high yield bond market. Primary issuance collapsed, deals were postponed, secondary prices fell, liquidity dried up, and outflows dominated.

That all changed in mid-March, however, when the European Central Bank announced fresh stimulus measures. Suddenly, it felt as if the market was on its feet for the first time in 2016.

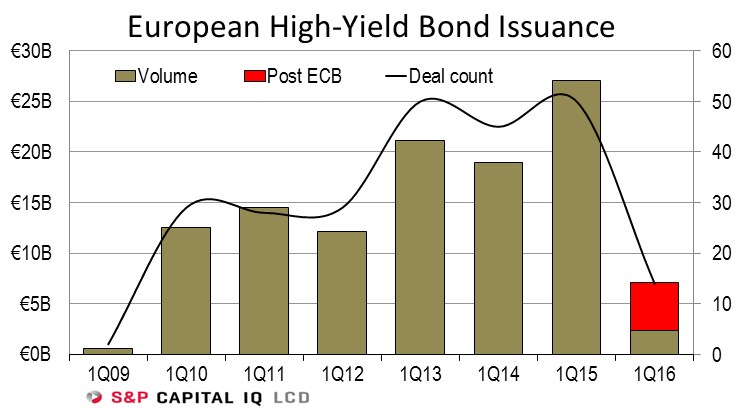

Starting with the bad news: 2016 is the worst opening quarter for European high yield issuance since 2009, with just €7.1 billion of supply printed (only €540 million priced in the very dark days of 2009’s first quarter). This contrasts starkly with the record first-quarter volume of €27.1 billion issued last year, while the average 1Q volume from 2010 through 2015 was €17.7 billion.

The market turned in mid-March, however, after the European Central Bank announced a 20% increase in its monthly bond purchase programme, which will now include investment-grade corporate bonds.

Following that event conditions in high yield vastly improved — the Crossover tightened more than 100 bps, and by March 24 LCD’s bond flow composite was 324 bps higher than the last reading in February, while issuance picked up as money poured into accounts.

The week after the ECB announcement, European high-yield funds saw the third-largest weekly inflow on record, at €1.11 billion. Moreover, the new-issue yield for double-B rated bonds tightened by 93 bps, to 3.84% (through the end of March), the tightest it has been since May 2015.

Looking ahead, high-yield players are hoping that the ECB effect will be similar to what happened during the first quarter of last year, in that accounts will be awash with cash, and more issuers will look to come to market. The early signs are that this is, indeed, happening. — Staff reports

This story – along with numerous other charts detailing 1Q European high yield bond activity – first appeared on www.lcdcomps.com, LCD’s subscription site offering complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.

![]() Follow LCD News on Twitter

Follow LCD News on Twitter