High commodity prices might get in the way of carbon emissions cuts at oil and gas companies, energy policy analyst David Victor said in a recent interview.

"Companies are going to be inclined to not change very much because of high oil prices right now," Victor said, pointing to Exxon Mobil Corp. as an example. The supermajor is experimenting with hydrogen hubs and carbon capture, but Exxon's big news recently is that its offshore crude oil project in Guyana will come online this year, Victor noted.

Victor's expertise includes Exxon's business model. The University of California San Diego professor authored the white paper used as the rationale for activist hedge fund Engine No. 1 LP's successful campaign to replace three directors at Exxon, with the aim of speeding up the supermajor's climate change efforts.

Looking across the industry, Victor — co-director of the university's Deep Decarbonization Institute — said he expects the huge amounts of cash generated by extracting and selling oil and gas to lock incumbents into doing what they have always done.

David Victor |

Make room for energy experiments

Oil and gas companies already operate with the baked-in uncertainty of commodity price fluctuations, but Victor said the companies transitioning to a low-carbon future still need deep changes in their corporate culture to better allow for failure. Experimenting with new products and processes during the transition to lower carbon will create lots of projects, and most will fail, Victor said.

"That's what the European majors are doing," Victor said. "You have to build different kinds of companies if you're going to have a different risk profile and have different return profiles for alternative energy. If you're going to be in offshore platforms for wind as opposed to offshore platforms for producing oil, the cultural changes are really, really a difficult thing to do."

European supermajors such as BP PLC or Shell PLC and U.S. independent Occidental Petroleum Corp. are experimenting with carbon-reducing projects like renewables and carbon capture faster that U.S. majors Exxon and Chevron, Victor said.

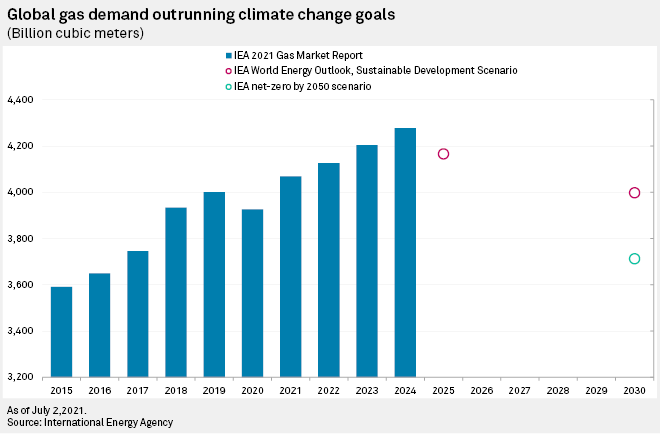

The oil and gas industry has increasingly incorporated climate change into how companies describe their strategies but is still grappling with an uncertain future, Victor said. Forecasts for future natural gas use — critical for power generation and integrating renewables into the grid — vary widely, Victor noted.

What business wants is certainty and how to lower emissions is uncertain right now, Victor said.

"Tough luck, get used to it," Victor said at CERAWeek by S&P Global.

Magnifying the message

Victor's academic and professional career brought him to the oil and gas industry through a circuitous route, one that started with flying small aircraft as a teen to ultimately pursuing atmospherics, ozone science and climate change as a political scientist. "Once you're working on climate, you are working on energy," Victor said.

With the 2021 shift in Exxon's board membership in the background, Victor was invited to be on a panel at the March CERAWeek conference in Houston. Victor drew a standing-room crowd at the Agora pavilion for emerging technologies, across a skybridge in a separate building from the main presentations.

"I think it's no accident that people who say things that I say are over at the Agora and not across the street in the big hall," Victor said.

The fallout from the Russian invasion of Ukraine — sending oil and gas prices higher because of energy security worries — largely grabbed the attention of conference attendees. Still, Victor thinks his message got through.

"What I see is, everyone recognizes that they've got to get serious about these issues," Victor said, "and, for the most part, we don't have a lot of strategies."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.