Life insurance sales and premium premiums grew in the second quarter, leading to a bit of a shake-up on the list of insurers that control the most share of the market.

"Strategically, life insurance is becoming more important," CFRA analyst Cathy Seifert said in an interview. "In the aftermath of COVID, the value proposition of life insurance has increased."

In a tight labor market, life insurance as a piece of an employee benefit package is also likely to be more frequently used as a way to increase hiring and incentivize individuals to work, Seifert said.

During MetLife Inc.'s second-quarter earnings call, Ramy Tadros, president of the insurer's U.S. business, said the company has seen a "significant increase" in workers seeking protection, and noted that employers are also focused on benefits when engaging with their talent.

"We're seeing very high receptivity and more strategic dialogue, I would say, with some of the large employers on how to utilize those benefits to attract, retain and motivate talent," Tadros said.

Although there appears to be a secular demand tailwind emerging out of the pandemic for term life insurance and other life insurance industry products, Piper Sandler analyst John Barnidge said a few more quarters will have to pass before the strong sales trend can be confirmed across the board. Part of the reason for the increase could be the result of a "pulling forward" of demand, he said. The pandemic may be raising awareness of the need for life products and causing some people to buy coverage earlier than they otherwise would have, Barnidge added.

A recent report from Deloitte based off of a recent survey shows that the way consumers want to buy life insurance is changing as well.

For example, interest in agent-driven sales has been decreasing with just 41% of consumers saying they preferred to buy in-person in 2020, down from 64% of consumers who had that preference in 2011.

The report also found that there has been a 30% to 50% increase in online life insurance sales since January 2020 among companies that have the strongest digital capabilities.

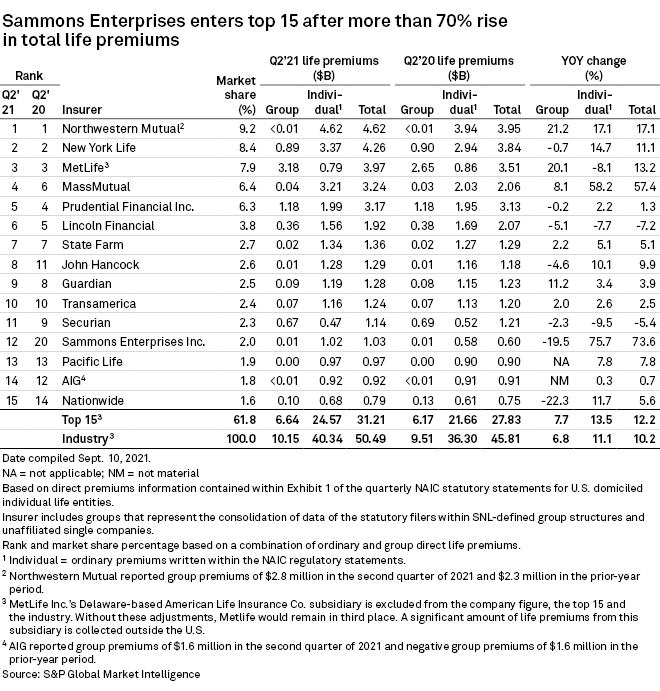

The three largest players in the life insurance market retained their spots from a year earlier. Northwestern Mutual, New York Life and MetLife controlled 9.2%, 8.4% and 7.9%, respectively, of the market during the second quarter.

Massachusetts Mutual Life Insurance Co. moved up two spots year over year to the No. 4 position, as its group life premiums rose 8.1% and its individual life premiums soared 58.2% year over year. Prudential Financial Inc. and Lincoln National Corp. each slipped a rung as MassMutual climbed.

Sammons Enterprises Inc. jumped to 12th from the 20th spot a year earlier, thanks to its strength in the individual life space. Its individual life premiums rocketed up 75.7% year over year even as its group life premiums declined 19.5%.

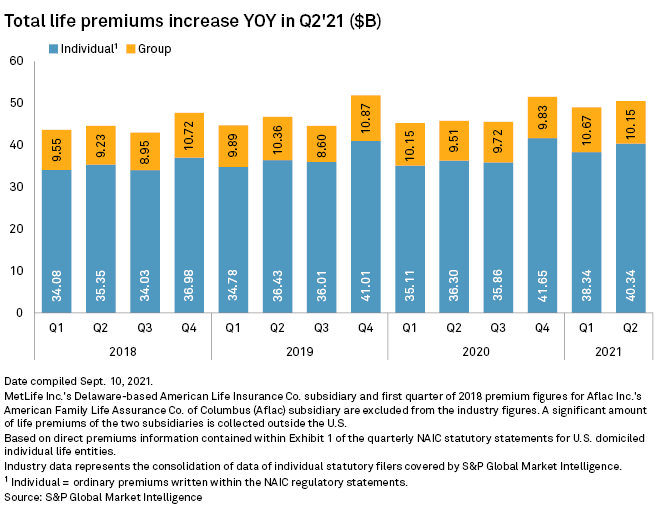

Second-quarter individual life premiums for the industry amounted to $40.34 billion, an increase from $38.34 billion three months earlier. However, group life premiums came in at $10.15 billion, a slight drop from $10.67 billion in the first quarter of 2021.