Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Jun, 2022

| A Tesla electric vehicle charging in Vermont on April 27, 2022. EV-makers already struggling with a shortage in semiconductors and other car parts must now battle to secure affordable metals. Source: Robert Nickelsberg/Getty News Images via Getty Images |

Rising battery metal costs have contributed to a slump in electric vehicle sales, slowing the transition to a low-carbon economy.

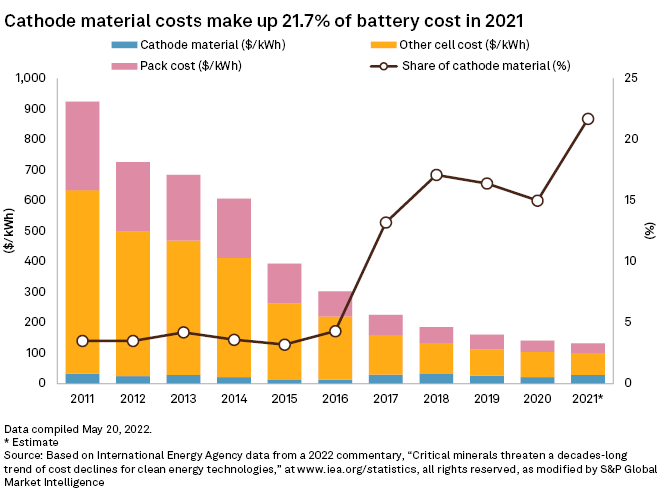

The average cost of making lithium-ion batteries used for EVs is increasing for the first time in roughly a decade, largely due to the inflated cost of key metals including lithium, cobalt and nickel. The trend has been toward lower costs for years as manufacturers scaled up production. But recent inflationary pressures on these raw materials have forced EV producers to increase the prices of their cars, together with pandemic-related lockdowns in China and supply chain challenges in the opening weeks of the second quarter.

Costly metals are undermining efforts to slash emissions in the transportation sector as consumers turn away from the already pricey cars. Sales of EVs plunged 35.6% in April in China, the U.S. and Europe's top four markets, according to S&P Global Commodity Insights senior analyst Alice Yu.

The dip in EV uptake may only be a temporary glitch, as aggressive efforts to increase extraction of the key metals and experiments with alternative battery chemistries should eventually push down costs, according to industry experts. But in the near term, EV makers already struggling with a shortage in semiconductors and other car parts must now battle to secure affordable metals.

"One possible consequence of high materials costs is a delayed transition, especially if consumers shy away from adopting these clean technologies," Tae-Yoon Kim, an analyst at the International Energy Agency, said in an interview. "The risks as we see from these rising material prices are either a slower or more expensive transition unless these material cost increases are also offset by the other cost reduction efforts."

"Inflation is biting," especially in EV markets outside of China, Commodity Insights' Yu said May 31. "Some customers are delaying passenger EV purchase decisions, while others are trading down for a cheaper model despite having to wait months, or well into 2023, for some models."

A perfect storm

The price for lithium shot up to record highs in the early months of 2022, after more than doubling in 2021. The lithium carbonate CIF Asia price increased 105% quarter over quarter in the first three months of 2022, reaching a high of $47,500 per tonne on March 31.

In the wake of the war in Ukraine, EV makers are also undergoing sticker shock for other key metals.

The price of nickel shattered records when it surged past $48,000/t in early March, with trading breaking down on the London Metal Exchange and resuming March 16 after a six-day halt. LME nickel cash prices had cooled to $26,731/t as of May 25, but the price remains 57.2% higher year over year.

Moreover, concerns over possible sanctions against Russia following its invasion of Ukraine have rocked nickel markets, with buyers of the base metal worried they will not be able to access supply from the major high-grade nickel producer.

Limited availability of cobalt has also inflated cobalt prices in recent months. Supply chain hiccups and fears over access to cobalt from Russia have tightened supply for the coveted critical mineral. Russian company PJSC MMC Norilsk Nickel produces approximately 2.7% of the world's mined cobalt, according to Market Intelligence data. The LME three-month cobalt price jumped 16.3% between January and March, peaking at $82,000/t before settling at $75,000/t in mid-May. The price for cobalt is still 71.8% more than in 2021 as of late May.

"Battery value chains are strained and disrupted," said Ulderico Ulissi, battery research lead at RhoMotion, a U.K.-based firm focused on EV research. "Customers have been starting to see a bit of an increase in EV costs. That is for several reasons, not only because of raw materials. One of the big problems in the automotive industry is also a semiconductor shortage and the effect of lockdowns in China."

A dent in demand

"By the end of 2022, we may see more upticks in battery prices, and that may be more reflected in the electric vehicle prices, with ripple impacts on consumers," the IEA's Kim said.

Tesla Inc. raised prices for some of its products in 2022 due to rising raw material costs and limited supply of key battery materials, CEO Elon Musk explained during an April 20 earnings call.

"There's a lot of cost pressure there. That's why we raised our prices," Musk said. "If there are not significant increases in lithium extraction and refinement and other raw materials such that everyone is competing for a limited amount of raw materials then, obviously, that will drive prices to high levels."

California-based EV maker Rivian Automotive Inc. raised prices for its R1T electric pickup and R1S SUV by about 20% early in 2022, only to cancel the price increases for existing reservations after backlash from customers, according to reports.

"We've seen the price of lithium hydroxide go up quite considerably over the last several months, and that has affected everyone," Robert Scaringe, founder, CEO and chairman of Rivian, said on a May 11 earnings call. "Making sure that we have confidence on supply as we look out in the latter part of this decade and where we see risk of scarcity for those key precursor materials, that's something we're very focused on."

EV sales in Europe tumbled 36.9% in April to under 160,000 units, according to Benchmark Mineral Intelligence. The China Passenger Car Association reported Tesla's EV sales in China dropped 98% in April to 1,512 sales, largely due to factory shutdowns in China amid COVID-19 lockdowns. Yet tight metal markets also remain a source of concern for the Texas-based EV giant.

"Right now, we think mining and refining lithium appears to be a limiting factor, and it certainly is responsible for quite a bit of cost growth in the [battery] cells," Musk said. "It is, I think, the single biggest cost growth item right now absolutely on a percentage basis."