After aggressively buying into financial stocks in the wake of the collapse of Silicon Valley Bank and other banking turmoil, hedge funds spent much of April selling their exposure to the sector.

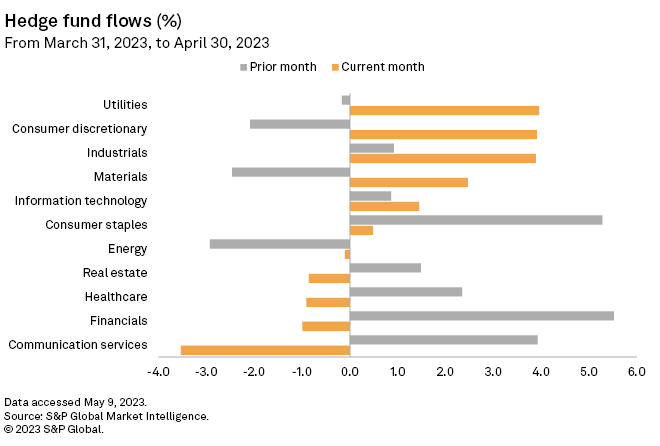

Hedge funds reduced exposure to financial stocks by 1% throughout April after boosting it by 5.5% in March, according to the latest S&P Global Market Intelligence data.

While each hedge fund's trading strategy differs, many likely bought financial stocks as the sector was weakened by Silicon Valley Bank's downfall and then, as the sector recovered, locked in short-term profits and began deploying capital into other sectors, said Christopher Blake, executive director of S&P Global Issuer Solutions. Still, the latest trends in capital flows show that hedge funds are largely taking a significantly bullish view of the stock market so far in 2023 in comparison to other active market participants, despite a relatively flat and often volatile performance in equities.

Hedge funds this year have been "very active moving money across sectors and … opportunistic around major events," Blake said in an email. "So the group is maintaining an overall more bullish outlook on equities but is being very specific in where that capital is going."

Hedge fund flows

On a net basis, hedge funds bought more than $5.69 billion in stocks throughout April. Hedge funds have increased their exposure to stocks by a net $30.75 billion since the start of 2023.

In April, hedge funds increased their exposure to utilities, consumer discretionary, industrials, materials, information technology, and consumer staples stocks, while continuing to decrease their exposure to energy stocks. Hedge funds also sold off real estate, healthcare, financials, and communication services stocks in April after buying them in March.

Institutional investors

Institutional flows remained essentially steady in April, with the moves being less than 0.2% either way in eight of the 11 stock market sectors.

Overall, institutions remained sellers of equities, selling about $19.04 billion in April. But the first three months of the month saw some of the lowest magnitudes of selling from institutions over the past year. A net $1.62 billion in stocks were sold through the first three weeks of April, the smallest outflow from the group over the past year outside of the first three weeks of December 2022, which saw just $117 million in net outflows from the group.

"This feeds into our belief that for institutions, the impact to the market is less about whether they are buyers or sellers, but more how aggressive their selling is," Blake said.

Retail investors

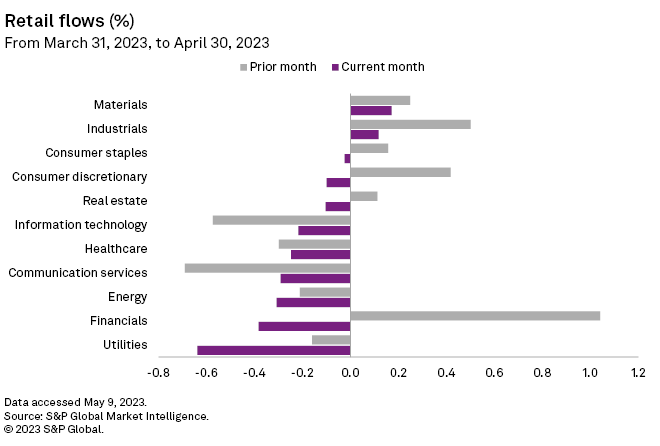

Retail investors reduced exposure to stocks by a net $7.77 billion in April, despite the market's modest rally, which was a sign of "some fatigue," among these investors, Blake said.

"Those who held through more downside early in the year may have been looking to take some money out of the market in reaction to the recovery," Blake said.

This article highlights capital flows data available from S&P Global Issuer Solutions. Data and insights for this article were compiled by Matthew Albert, Mark Buckles and Christopher Blake.

For more information on this product, please contact Christopher Blake, executive director, at christopher.blake@spglobal.com.