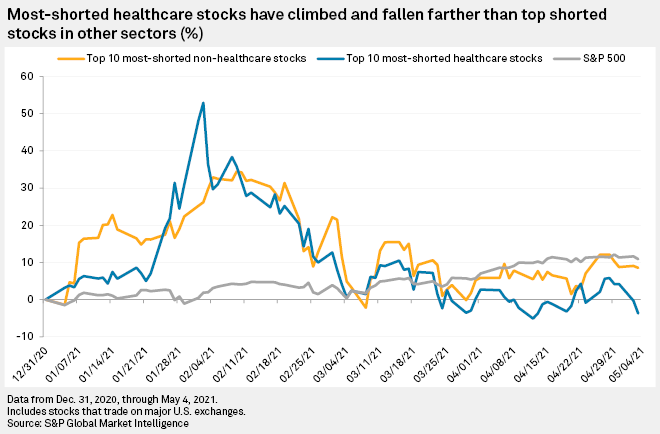

The most-shorted U.S. healthcare stocks have been on a wild ride so far in 2021.

Investors continued to overwhelmingly short healthcare companies through mid-April as these stocks shot to highs well above the S&P 500 and their own sector's averages before falling to levels below other heavily shorted equities, according to the latest S&P Global Market Intelligence data.

Share prices for these healthcare stocks have been more volatile so far in 2021 than stocks in other sectors such as consumer discretionary, according to the data.

The 10 most-shorted healthcare stocks, eight of which are biotechnology companies, collectively rose 53% from the start of the year to Feb. 2. As of May 4, however, they were down 3.7% on the year.

The 10 most-shorted non-healthcare stocks, however, peaked up 34% from the start of the year to Feb. 10 and remained up nearly 8.6% on the year as of May 4. The S&P 500 closed May 4 up 10.9% on the year.

Analysts have said that healthcare stocks, primarily biotechnology companies, have been shorted in response to the threat of increased regulatory scrutiny from the Biden administration on matters including pharmaceutical company mergers and rising prescription drug prices.

But the volatility in heavily shorted stocks ramped up, even compared to the S&P 500's healthcare sector, as vaccinations spread throughout the U.S.

Since the first U.S. COVID-19 vaccination Dec. 14, 2020, the most-shorted healthcare stocks have climbed by over 42% in early February and settled down 10.5% on the year on May 4, 2021. By comparison, the S&P 500 healthcare sector has risen by 11% since the first vaccine was administered.

Short sellers borrow stock and sell it in anticipation that they can replace it at a later date at a lower cost if the share price falls. If their plays are successful, short sellers profit from the difference between the price at which they sell the stock and the price at which they repurchase.

The strategy drew unprecedented attention earlier this year after a band of retail traders caused GameStop Corp. stock to rise steeply in response to the heavy speculative betting on the retail game company's pending demise.

Short interest in the S&P 500 was at 2.26% as of mid-April, down 21 basis points from where it was at the start of the year, but roughly flat from the start of the month.

Short interest in the U.S. healthcare sector was at 5.18% as of mid-April, the highest of any domestic sector, and up from 4.86% a month earlier. It remained below its recent peak of 5.34% at the end of December 2020.

The consumer discretionary sector remained the second-most-shorted sector as of mid-April at 4.41%, down from 5.57% at the end of December.