Most big banks in the Gulf Cooperation Council have no women board directors, according to an S&P Global Market Intelligence analysis — an indication of the work the banking sector has to do to improve gender balance among its top executives.

|

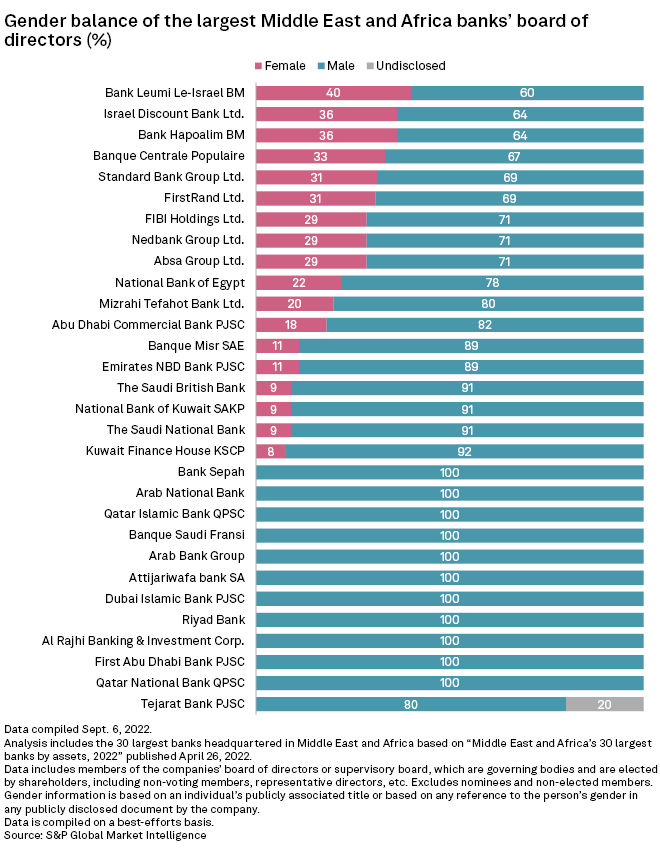

Qatar National Bank QPSC and First Abu Dhabi Bank PJSC — the region's two largest banks by assets as of 2021-end — do not have female board members. The banks did not respond to Market Intelligence's request for comment.

Saudi Arabia's Al Rajhi Banking & Investment Corp., Riyad Bank, Banque Saudi Fransi and Arab National Bank were among 12 banks with zero female directors, from a sample of 30 regional banks.

Both Riyad Bank and Banque Saudi Fransi told Market Intelligence there is no gender condition to qualify for election to the board of directors in Saudi Arabia.

Riyad Bank lays out nomination conditions and requirements that candidates will be evaluated against, a spokesperson said via email. Banque Saudi Fransi said it does not have the authority to choose its board as it is elected by shareholders, but the bank has recently established a board committee focused on environmental, social and governance, a spokesperson told Market Intelligence.

Al Rajhi and Arab National Bank did not respond to requests for comment.

The other banks without female directors — Qatar Islamic Bank QPSC, United Arab Emirates-based Dubai Islamic Bank PJSC, Morocco's Attijariwafa Bank SA, Jordan's Arab Bank Group and Iran's Bank Sepah — also did not respond to requests for comment.

Saudi British Bank stands out

Six Gulf banks in the sample have female board members, most notably The Saudi British Bank, which has Lubna Olayan as its chair. She took over the role in June 2019 following the bank's merger with Alawwal Bank, becoming the first woman in the country to run a publicly traded bank. Olayan was reelected in 2020 for a further three-year term.

Saudi Arabia and the UAE have launched initiatives in recent years aimed at bolstering women's participation in the labor force. Saudi Arabia's Vision 2030 strategic framework includes a goal of increasing the employment rate among Saudi women to 30% from 22%. The Saudi Ministry of Human Resources and Social Development and the Capital Market Authority agreed in December 2020 to support and increase the number of women on the boards of listed companies.

The UAE, meanwhile, is collaborating with Aurora50, which helps organizations with their ESG ratings, to increase women's representation on public and private company boards. The Abu Dhabi Global Market financial center also has a gender equality initiative that seeks to increase diversity across all aspects of work.

Despite recent initiatives, if progress continues at the same pace it has done since 2006, the Middle East and North Africa would take 115 years to close the gender gap, according to the World Economic Forum's Gender Gap Report.

Israeli, South African banks lead

All the Israel-based banks in the sample have women on their boards of directors, with Bank Leumi Le-Israel BM accounting for the highest percentage at 40%, followed by Israel Discount Bank Ltd. and Bank Hapoalim BM at 36%.

Israel's securities regulator wants companies to have women account for 35% of board positions, and the country's supervisor of banks is working toward increasing female representation on banks' boards.

Women are represented on the boards of all South African lenders in the sample — Standard Bank Group Ltd., FirstRand Ltd., Nedbank Group Ltd. and Absa Group Ltd.

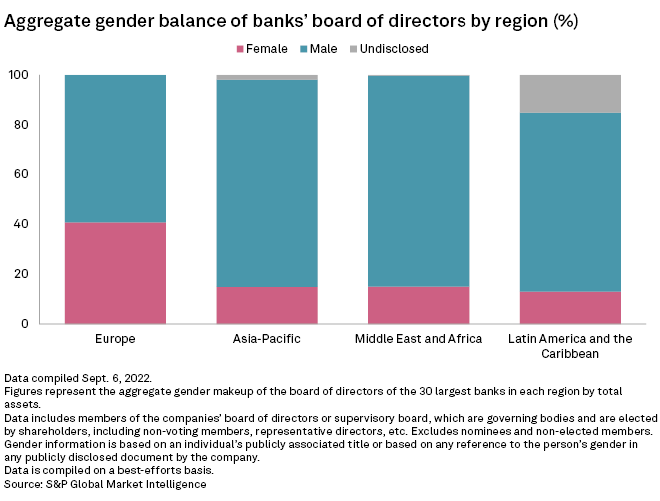

The largest MEA banks are on a par with their peers in Asia-Pacific and Latin America and the Caribbean in terms of the gender balance of their boards of directors, but these banks have a long way to go to close the gap with their European counterparts, Market Intelligence data shows. In aggregate, 14.97% of board members at MEA banks in the sample are women, compared to 40.84% in Europe.