Funding from the Saudi Real Estate Refinance Co. is helping bolster smaller lenders in Saudi Arabia's burgeoning but highly concentrated mortgage market that is dominated by three banks.

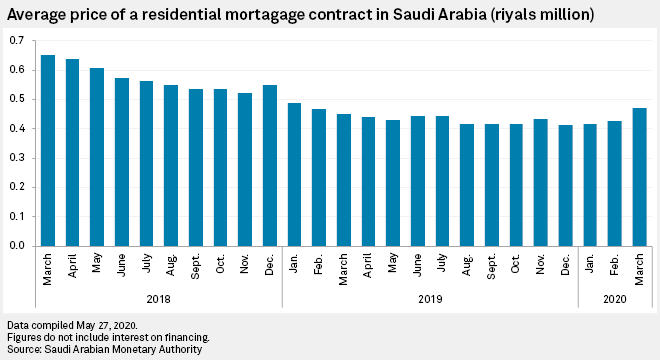

Al Rajhi Banking & Investment Corp., National Commercial Bank and Riyad Bank have an estimated market share above 60%, according to an Al Rajhi Capital report. Banks in the country wrote residential mortgage loans worth 26.50 billion Saudi Arabian riyals in the fourth quarter of 2019, roughly equal to the total value of residential mortgage loans issued in the entire first half of 2019 and more than the entirety of 2018, according to the Saudi Arabian Monetary Authority. This rate is expected to slow in the second quarter, with movement restrictions in place due to the pandemic.

The Saudi Real Estate Refinance Co., or SRC, often compared with the U.S.'s Fannie Mae, is a publicly owned mortgage refinance company. It aims to refinance 10% of Saudi Arabia's total residential mortgage market by 2020-end, and has plans to reach 20% of the total market, but CEO Fabrice Susini concedes that those targets have been extended due in part to the "dynamic growth in the mortgage market in the past year."

"We are happy about that [growth], but we [as a refinancer] are not where we want to be," Susini said in an interview. He added that the company is aiming for a total balance sheet deployment of 23.5 billion riyals by the end of this year, comprising mortgage portfolio acquisitions, warehousing and other funding drawdowns.

The SRC was established in 2017 with an "equity envelope" of 5 billion riyals from the Public Investment Fund, the country's largest sovereign wealth fund, of which 1.5 billion riyals is paid up, said Susini. To date it has deployed around 2.8 billion riyals, 70% of which is portfolio purchases, he said. Additional funding has come from domestic sukuk — an Islamic finance certificate similar to a bond — worth 750 million riyals, part of a domestic sukuk program worth up to 11 billion riyals. It also plans to tap international markets in 2020, he said.

Underdeveloped market

Susini said the SRC has a broad goal of growing home ownership across the country in line with Vision 2030, especially for lower-income Saudis.

Despite the rapid growth of the mortgage market, most analysts consider it underdeveloped, with around 200,000 residential mortgage contracts in a country with a population of around 33 million. "We are very much at the beginning of the growth of this market," said Susini.

That is reflected in high profit rates on mortgages, which are in place partially to encourage banks to develop the sector, said Susini.

"It's much cheaper to borrow for a washing machine or a car than it is for a home loan, which is unusual when you compare it with other G-20 countries or countries in the region," said Susini.

"As the volume is picking up, we are trying to push the competition to lower prices for borrowers, but also the sustainability of the system including the budget, because a lot of these loans are supported by the government," he said.

A large portion of home loans have been issued to workers in the public sector and only a small portion in the private sector. One upside is that — with banks exposed to salary risk rather than asset risk — banks should not see increased costs of risk for their mortgage loan books this year, as the risk of job losses in the public sector is limited, said Mohamed Damak, an analyst with S&P Global Ratings in Dubai.

But banks will need to lend to a larger cross-section of the population to meet the target of 70% home ownership by 2030, from 50% in 2018.

The challenge for banks will be to adapt their model away from a high-margin residential mortgage lending model, "towards a lower margin per unit of origination," said Susini.

Targeting mortgage finance companies, smaller banks

When the SRC began lending in 2018, its first customers were mortgage finance companies, which make up around 5% to 6% of the residential mortgage market. They had traditionally relied on banks — key competitors — for liquidity, which "can seem a bit strange," said Susini.

The SRC's focus shifted to banks in 2019, especially smaller banks that lack access to the diverse funding sources available to larger banks, he said

Five mortgage finance companies and three banks — Banque Saudi Fransi, Bank AlJazira and Saudi British Bank, which is majority-owned by HSBC Holdings PLC — have signed deals with the SRC.

However, the SRC will also acquire portfolios from any bank to allow them to diversify their funding sources and move loans off their balance sheets, said Susini. The SRC assumes the durational and interest risk of long-term fixed loans in a portfolio it acquires, with access to a broader set of hedging tools than domestic banks.

Extra funding not enough

While finance houses that signed deals with the SRC have grown their mortgage loan books, overall the sector has lost market share to banks.

That reflects in part the importance of salary assignments for lending, said Mohamed Badat, chief commercial officer at Bidaya Home Finance Co., a finance company that has received SRC finance.

"That is the determining factor of who actually has market share within the financial services sector, because whichever bank has the salary signed has the option of selling all of their lending products to the consumer," said Badat. He estimates that mortgage houses had about 6% to 8% market share of incremental mortgage growth in 2019, compared with about 10% before.

To compete with banks, finance companies need to be more efficient in the mortgage process, including use of digital onboarding, said Badat.

Salary assignment also points to the difficulties for smaller banks and challengers.

Although Emirates NBD Bank PJSC is the second-largest lender in the United Arab Emirates, it is effectively a challenger bank in Saudi Arabia, where it has four branches and permission to open a further 20. It launched its mortgage product in the fourth quarter of 2019 and Naser Yousef, the CEO of Emirates NBD KSA, described home-financing products as a "crucial pillar to our wider expansion and growth in the kingdom."

"While the leading banks do have a strategic advantage in that they have a copious customer base to tap into, this is not something new to us," said Yousef, adding that the bank was the first in Saudi Arabia to begin offering nonpayroll financing in 2007.

As of June 1, US$1 was equivalent to 3.75 Saudi Arabian riyals.