Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Jul, 2022

By Alex Blackburne and Camilla Naschert

|

Instead of feeding electricity into the grid, this wind turbine in Brande, Denmark, powers an on-site electrolyzer to produce green hydrogen. |

In Europe's anticipated green hydrogen boom, technology-makers are planning to rapidly expand their domestic manufacturing footprints — but the quest for gigafactories comes with challenges.

EU officials want to make Europe the world's manufacturing center for electrolyzers — the technology used to turn renewable power into green hydrogen — but industry executives speak of multiple obstacles across regulation, financing, demand stimulation and the supply chain that must be overcome before ambitious growth plans can be unleashed.

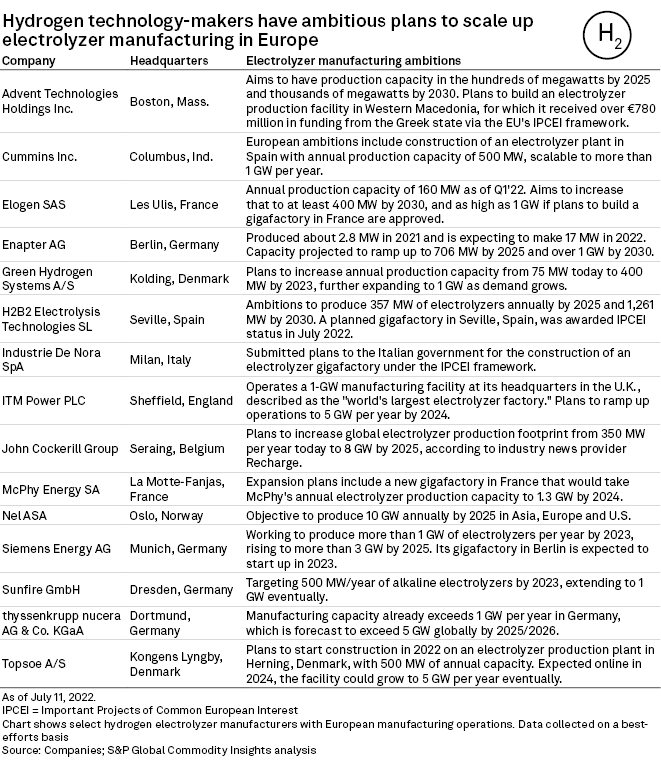

Manufacturers like ITM Power PLC, McPhy Energy SA, Nel ASA, Siemens Energy AG and Thyssenkrupp Nucera AG & Co. KGaA are each aiming to produce multiple gigawatts of equipment in Europe annually by the mid-2020s, helping propel Europe to the front of the pack.

"We are facing another industrial revolution. It will happen in this decade," said Alexey Ustinov, vice president in the electrolyzer division at U.S.-based Cummins Inc., whose manufacturing plans in Europe include the construction of a 500-MW electrolyzer production plant in Spain that could be scaled up to more than 1 GW per year. Several gigafactories will benefit from a €5.4 billion public funding package announced by the EU on July 15 for projects in the hydrogen value chain.

"Europe has the unique chance to become the technology, design and production hub for hydrogen equipment," Ustinov said in an interview.

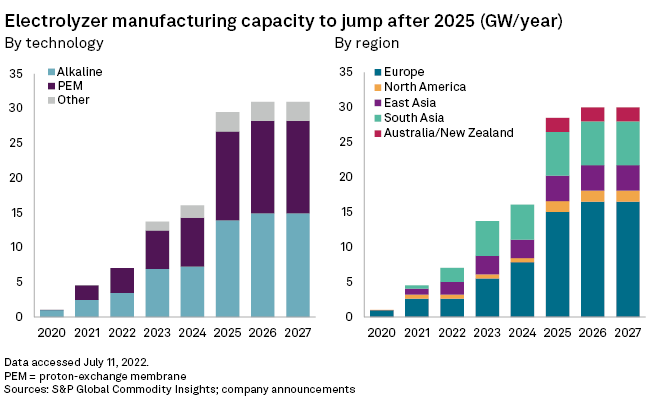

Global electrolyzer manufacturing capacity is expected to grow to about 31 GW per year by 2027, according to S&P Global Commodity Insights analysis of firm company announcements. Around half of that will be in Europe, with growth set to accelerate in the second half of this decade.

Still, the International Energy Agency said a lack of manufacturing capacity is a key bottleneck for the deployment of green hydrogen.

Hydrogen must 'leapfrog'

To kickstart the industry, the European Commission brought together 20 electrolyzer-makers for a pledge to increase the EU's electrolyzer-making capabilities to 17.5 GW per year by 2025 from just 1.75 GW today. The scale-up is "both an unprecedented challenge and a significant industrial opportunity," the commission said in June.

The EU's longer-term ambitions require even faster growth. As part of its REPowerEU strategy, drawn up in response to Russia's war in Ukraine, the bloc is targeting 10 million tonnes of annual hydrogen production capacity by 2030, which it said will need between 90 GW and 100 GW of electrolyzers.

This is doable considering the speedy expansion trajectory for 2025 and beyond, according to Brian Murphy, senior analyst on hydrogen and low-carbon fuels at Commodity Insights. Still, achieving scale will be a challenge for the nascent industry, which only started making concrete growth plans around three years ago. "It is huge deployment, getting from initial interest to fully scaled industry in 10 years," Murphy said in an interview.

"While other industries are growing organically, the hydrogen industry has to leapfrog," Hergen Wolf, director of product management at Germany-based manufacturer SunFire GmbH, said in an email. "In history, there has not been an example for such steep growth."

Beyond expanding the size of factories, electrolyzer-makers are also looking ahead to the scale-up of the equipment they produce. According to a 2021 report from consultancy Aurora Energy Research, most electrolyzer projects to date have been in the 1 MW to 10 MW range. By 2025, typical projects will be more like 100 MW to 500 MW, requiring much larger electrolyzers.

"We need to do in three to five years what the wind-turbine manufacturers have done in 25 years, in terms of scaling the core capacity of the product," Jens Holm Binger, head of investor relations at Danish electrolyzer-maker Green Hydrogen Systems A/S, said in an interview. "That is a huge challenge because the future potential demand is so significant."

Europe has technology edge

In the hunt for growth, rewards are significant, too. "Given the interest and potential scale, a company that wins this can make huge profits," Murphy said.

Research and development efforts span every part of the electrolyzer, but focus areas differ by technology. Developers of proton exchange membrane, or PEM, electrolyzers, seen as efficient and more suitable for load-following, are focusing on durability and the reduction of precious metals usage in the equipment, Murphy said. For alkaline electrolysis, development focuses on improved load-following, given the variability of renewables input expected in Europe.

Looking at project announcements where equipment manufacturers are named, European technology dominates across the globe, according to Murphy.

European lawmakers emphasized early on in their policymaking that the EU is keen to hold on to its lead, to avoid repeating mistakes made in the solar sector where manufacturing moved to China. East Asia is set to have 3.65 GW of annual electrolyzer manufacturing capacity by 2027, according to Commodity Insights, though Chinese capacity is likely underestimated due to the opacity of the market.

While Chinese electrolyzers are cheaper, it is difficult to assess their performance, Murphy said. "Particularly on PEM, there isn't a Chinese company that can compete with the European manufacturers right now," the analyst said.

Murphy expects electrolyzer technologies beyond PEM and alkaline to gain a foothold, such as solid oxide and anion exchange membrane, which rely less on expensive metals.

|

An electrolyzer at Cummins' manufacturing facility in Oevel, Belgium. |

Waiting game around demand, financing

In Seville, Spain, H2B2 Electrolysis Technologies SL has an electrolyzer factory with annual capacity of 90 MW. The company secured the land to scale it up to 1 GW but is locked in discussions about how to finance the facility. The expansion proposal is one of several gigafactories in Europe to have been awarded Important Project of Common European Interest status by the European Commission on July 15, making it eligible for state aid.

For now, H2B2 is playing a waiting game, according to Javier Brey, the company's chief technology officer. "It is very difficult for us to go ahead of the demand," Brey said in an interview. "We are ready to start with the gigafactory but we need to wait for regulation, for a grant, for demand."

This chicken-and-egg conundrum has so far stifled the expansion of electrolyzer-making in Europe. The industry points to an incomplete regulatory framework, uncertain future market demand and supply chain challenges as the three main factors preventing it from scaling up.

Some regulatory clarity was provided in May when the European Commission released long-awaited rules around what makes hydrogen green — even though not everyone agreed with the outcome.

"A genuine market for green hydrogen must be created. The governments' ambitious targets alone are not enough," Sunfire's Wolf said. "For projects to be implemented and final investment decisions to be made, we need a reliable regulatory framework and pragmatic approaches — for example, when it comes to purchasing green electricity."

H2B2 is calling for green hydrogen blending requirements, a rule that Brey said "was incredible for the deployment of biofuels."

The company also wants the European Commission to provide "working capital" support to equipment manufacturers not fortunate enough to be sitting on piles of cash to quickly fund their manufacturing efforts. Most electrolyzer manufacturers are not profitable, even though order pipelines are starting to grow. That is why private capital and loans will likely follow the public funds into the sector.

For Cummins' Ustinov, the most important factor is demand-side funding to provide an incentive for end-consumers to use green hydrogen.

"The real demand is not fully activated," Ustinov said. "Once the funds are released to stimulate demand, then I think we'll have a situation for at least five years where demand outstrips supply."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.