The green bond market will grow at a faster pace in 2019, driven by strong investor demand, a greater focus from governments on addressing climate change and an increasing number of repeat green bond issuers, according to a report by Moody's.

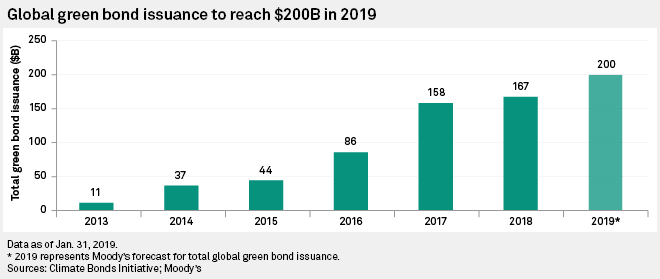

Green bond issuance, which accounts for a tiny fraction of the overall bond market, has grown exponentially since its inception from virtually nothing in 2012 to $167 billion in 2018. While demand slowed last year as overall global bond issuance dwindled, Moody's is expecting the market to rise 20% and hit $200 billion in 2019.

"After a slow 2018, green bond issuance will grow more rapidly in the year ahead," said Matthew Kuchtyak, a green bonds analyst at Moody's and lead author of the report. "We continue to see a number of factors supporting the long-term growth of the sector, including more active participation from U.S. nonfinancial corporates."

Investors will drive growth because demand for green and sustainable investments continues to outstrip supply, Moody's said. It cited figures from the U.S. Forum for Sustainable and Responsible Investment, which said that at the start of 2018 in the U.S., assets under management using sustainable, responsible and impact investing strategies grew 38% to $12.0 trillion from $8.7 trillion at the start of 2016.

Sovereign impact

The report also said growth would receive a boost from increasing government commitment to addressing climate change and meeting the goals of the Paris Agreement on climate change, which aims to limit the global temperature rise to below 2 degrees C above pre-industrial levels. Sovereign green bond issuance accounts for $29 billion of green bond issuance globally, which should encourage the private and public sector to issue green bonds, Moody's said.

The harmonization of the global green bond standards could have a significant impact on growth, the report said, citing efforts by the European Commission to establish a green bond label. Investors have complained about the lack of clarity of what is a green investment product, and the EC is currently working on a classification system, or taxonomy, with a view to introducing a label on green financial products.

"Given the market interest in a global green bond standard to boost investor confidence, we see the development of the green taxonomy in Europe as a potential step toward global harmonization," the report said.

Repeat issuers propel growth

Moody's is expecting the number of repeat issuers to bolster growth, saying that while only about a third of green bond issuers have issued more than once, they account for three-quarters of total issuance in value terms, making them the main drivers of global green bond issuance.

The rating agency also predicted that the green bond market would continue to diversify in 2019, moving away from a market dominated by international development banks such as the European Investment Bank and World Bank. Financial corporates, boosted by Chinese banks, account for 30% of issuance in 2018, up from just 4% in 2014. Nonfinancial corporates were the second-largest issuers, at 18% of total issuance.