Global venture capital investment fell 62.9% year over year in September to $21.82 billion from $58.76 billion, according to S&P Global Market Intelligence data.

The number of funding rounds with venture capital participation was also down 30.3% to 1,438 rounds from 2,063 rounds in September 2021. The amount raised via funding rounds slightly inched up from $21.31 billion collected in August.

Private equity growth is expected to slow down over the next five years as inflation and macroeconomic conditions take their toll on investments, according to a recent report from Preqin Inc. This decline is predicted to affect alternative assets broadly, including venture capital, the report said.

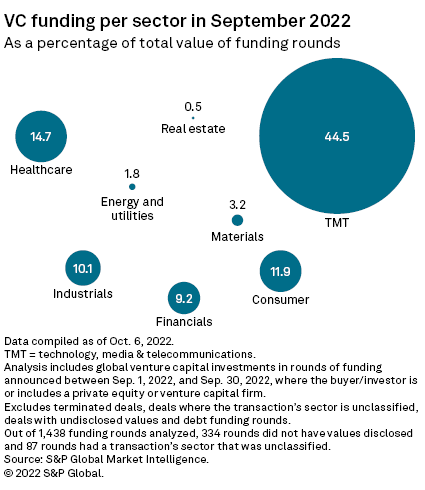

Businesses in the technology, media and telecommunications sector received 44.5% of total venture capital funding in September. Healthcare companies came in second with 14.7%, followed by consumer and industrials, with 11.9% and 10.1%, respectively.

Broadband communications services provider Northwest Fiber LLC, which does business as Ziply Fiber, raised the biggest funding round in September, collecting $450 million in a venture capital round from investors including WaveDivision Capital LLC and Searchlight Capital Partners LP.

Next was Houston-based midstream company Trace Midstream Partners LLC, which secured an equity commitment of $400 million from Quantum Energy Partners LLC in a growth funding round, to form Trace Midstream Partners II. The new entity will develop carbon capture and sequestration assets and support midstream infrastructure across North America.

Pie Insurance Holdings Inc. garnered $315 million in a series D funding round co-led by Centerbridge Partners LP and Allianz X GmbH, completing the top three funding rounds for the month. The fundraiser saw participation from investors including aCrew Capital and Greycroft LP, and is the largest round of financing for any U.S.-based property and casualty insurtech company in 2022, a statement said.

Other transactions include organic food producer and seller Gotham Greens Holdings PBC's BMO Impact Investment Fund-led series E funding round which collected $310 million and Milan-based Satispay SpA's announced $308.6 million series D funding round led by new investor Addition Ventures LLC, which takes the digital payment platform's post-money value to over $960 million.