Germany and Italy emerged as Europe's top issuers of green bonds in the third quarter of 2022, with future green bond issuance commitments and targets likely to be influenced by the upcoming United Nations' COP27 climate conference.

Germany led the region with $15.89 billion of internationally aligned green bond issuance, according to data from the Climate Bonds Initiative, or CBI. This is down 7.6% from $17.2 billion a year earlier but up 55% from $10.26 billion in the previous quarter.

Germany, Italy

Issuance in Germany was robust despite reduced volumes from government agencies, said Trevor Allen, head of sustainability research at BNP Paribas Markets 360.

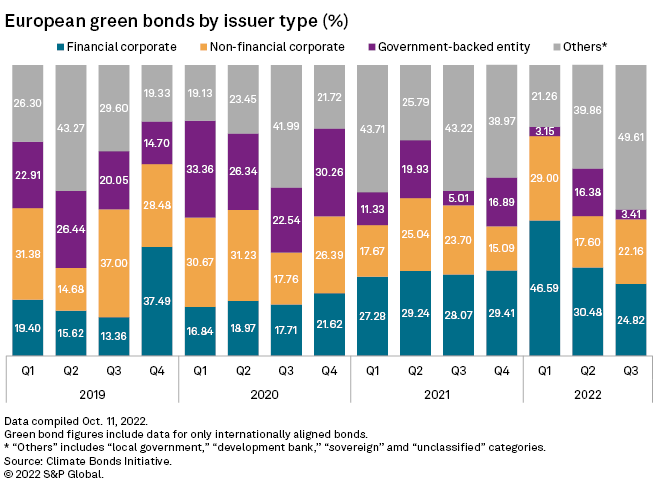

"Germany's track record can be explained by sustained sovereign volumes, exceeding that of France, strong showings from German banks, contrasting to other countries, and German corporates consistently exceeding 2021 volumes," Allen noted.

|

Italy had the second-highest issuance among European countries, with $8.32 billion, ahead of France. This is a sharp increase from $220 million in the previous quarter and $600 million a year before.

Italy's strong showing was mainly driven by a jumbo sovereign issuance worth €6 billion in September, according to Sam Morton, head of European investment-grade research at Invesco. Sustainable debt issuance has gained acceptance across Europe, but France and Germany are expected to remain the "powerhouses" of the sustainable debt market in the region, with sovereign issuance being the key driver, Morton added.

"Italy is likely to remain a large issuer of green/sustainable bonds, but we think it is unlikely to maintain its recent growth trajectory," said Morton.

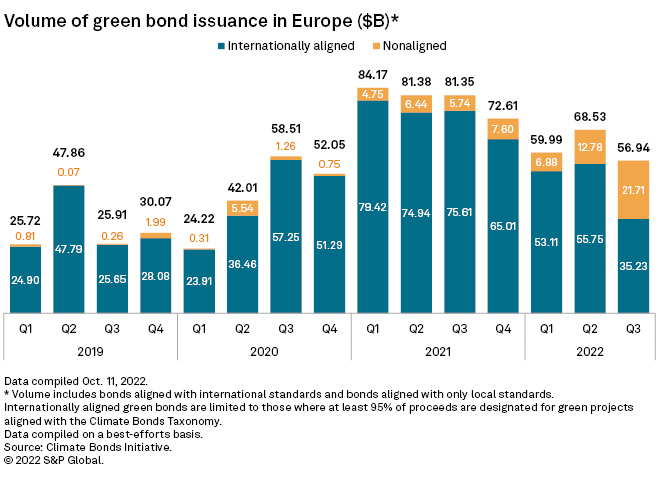

Europe issued $35.23 billion in internationally aligned green bonds in the third quarter, falling from $75.61 billion in the same period last year, CBI data shows. Despite the drop, Europe remained the highest-contributing region to green debt globally during the quarter.

Sustainability-linked bonds

S&P Global Ratings anticipates sustainability-linked bonds, or SLBs, to maintain their streak as the fastest-growing asset class of the environmental, social and governance debt market despite worsening credit conditions so far this year, and also expects green bonds to remain the most popular bond type, the agency said in a Sept. 20 report. Unlike traditional green bonds, SLBs are not ring-fenced for specific environmental or social projects, thus providing more flexibility for issuers.

"Although sustainable debt issuance is a tool to assist economies achieve net-zero targets, we do not believe that the temporary drop in issuance observed in 2022 is likely to have a meaningful impact on the achievement of net-zero targets," said Morton.

But SLB issuance is expected to eventually pick up, mostly driven by corporates adopting "greener" practices, according to Markets 360's Allen. In the fourth quarter, green bond issuance might also benefit from the halo effect of the COP27 climate summit, to be held from Nov. 6 to Nov. 18.

"Around the time of COP27, we would like to see bigger commitments and targets announced from EU sovereigns for 2023," Allen said.

"The energy crisis has highlighted the importance of scaling up renewables, improving energy efficiency and scaling material circularity," said Allen, noting that the sense of urgency has pushed governments to think deeper about how they will meet their net-zero commitments.

Ratings expects 2025 to be a key year for sustainability-linked bonds because many issuers have tied their sustainability performance targets to this year.