Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Nov, 2024

By Beata Fojcik

Georgia's two largest banks expect to build on the record profits achieved in the third quarter despite political turbulence in the country.

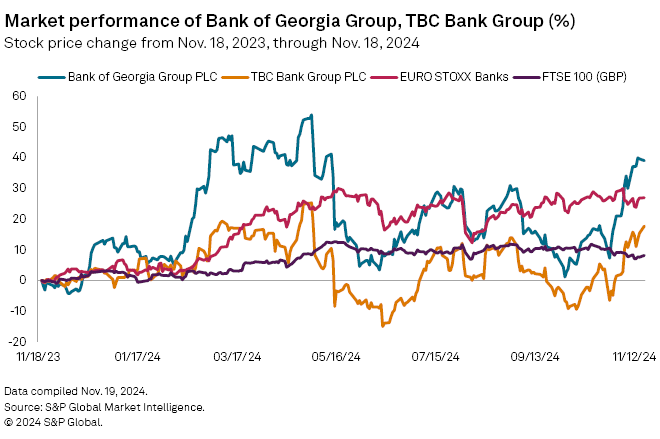

The share prices of TBC Bank Group PLC and Bank of Georgia Group PLC — both of which are listed on the London Stock Exchange — plummeted following the Oct. 27 elections. The ruling Georgian Dream party won the ballot, but opposition parties have contested the result, prompting protests in the country.

Yet the stocks have recovered since then as the lenders expressed confidence that the political situation will not dent the strong growth prospects for the Georgian economy and that they can further improve on the profits recorded in the latest quarter.

"What we hear from the government is that [it] wants to continue pro-business policies and basically be disciplined regarding the budget," Bank of Georgia CEO Archil Gachechiladze said during a Nov. 12 earnings call. "So we are very positive on the macro story."

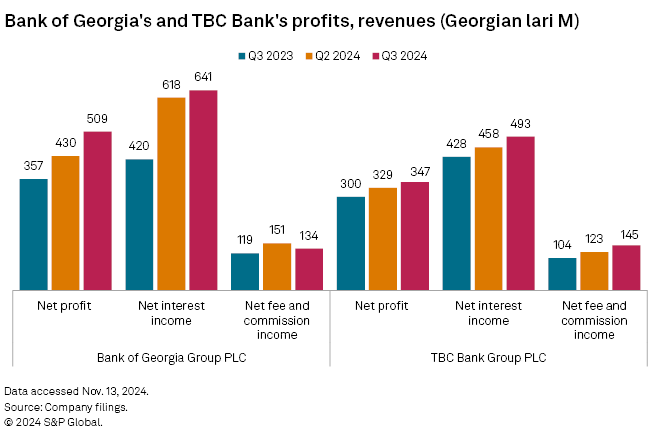

A positive domestic macroeconomic environment helped TBC Bank and Bank of Georgia report third-quarter net profits of 347.3 million Georgian lari and 509.3 million lari, respectively, up by 15.6% and 42.5% year over year.

TBC Bank's performance was also bolstered by its operations in Uzbekistan, contributing 9% to its net profit. Bank of Georgia grew profit 17.1% year over year in its home market and was further aided by the acquisition of Armenia-based Ameriabank CJSC in early 2024.

Georgia — which counts transport and logistics, mineral extraction, hydroelectric power and tourism among its key industries — grew real GDP 9.9% in the first nine months of 2024, TBC Bank said, raising its 2024 GDP growth forecast to 9.4% from 7.4% as of the second quarter. Bank of Georgia maintained its real GDP growth forecasts for the country at 9% for 2024 and 6% for 2025, with the increase "being underpinned by strong domestic demand, resilient external sector inflows, and prudent macroeconomic management."

"Here at TBC, we see no change to our operating environment," TBC Bank CEO Vakhtang Butskhrikidze said on a Nov. 6 earnings call.

Strong economic growth in Bank of Georgia's key markets prompted Cavendish analysts to raise profit forecasts for the group by 6% to 7% for 2024 through 2026, following an earlier upgrade of between 5% and 8% after the second quarter. The analysts also raised their stock target price for the bank to 7,250 pence after the third-quarter results.

On track to hit targets

Despite the political uncertainty stemming from the election, both banks confirmed their financial targets, including a 2025 net profit target of 1.5 billion lari and a return on equity (ROE) ratio above 23% for TBC Bank and a medium-term ROE ratio above 20% for Bank of Georgia. The third-quarter group ROE ratios were at 26.6% at TBC Bank and 32.1% at Bank of Georgia.

The banks also reaffirmed their dividend goals, with a 2025 payout ratio of 25% to 35% targeted by TBC Bank and a medium-term annual capital distribution ratio between 30% and 50% pursued by Bank of Georgia.

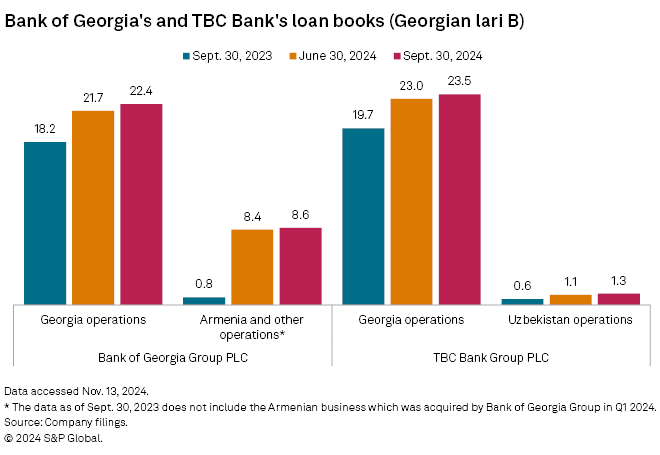

Both banks anticipate continued strong lending growth in the coming quarters. The gross loan book at TBC Bank increased by 22% year over year and 3% quarter over quarter at the group level to 24.8 billion lari as of Sept. 30. The bank's CFO, Giorgi Megrelishvili, said the 19% year-over-year growth in the Georgian business was driven by the "exceptional performance" of the country's economy. He expects the strong growth will continue in the fourth quarter and could reach or even exceed 15% in 2025.

Bank of Georgia's loan book grew 63.4% year over year as of Sept. 30, driven largely by the consolidation of Ameriabank but also by a 23.6% increase within its Georgian operations. The bank confirmed its medium-term annual lending growth target of roughly 15%, revised in the second quarter from about 10% following the Ameriabank acquisition.

As of Nov. 18, Bank of Georgia's stock had gained 39% in the last 12 months and 30% since Oct. 27, S&P Global Market Intelligence data shows. The stock offered a 19% potential upside to the target price.

TBC Bank Group's stock has risen almost 18% in the last 12 months and almost 26% since Oct. 27, offering an upside of almost 97.1% as of Nov. 18.

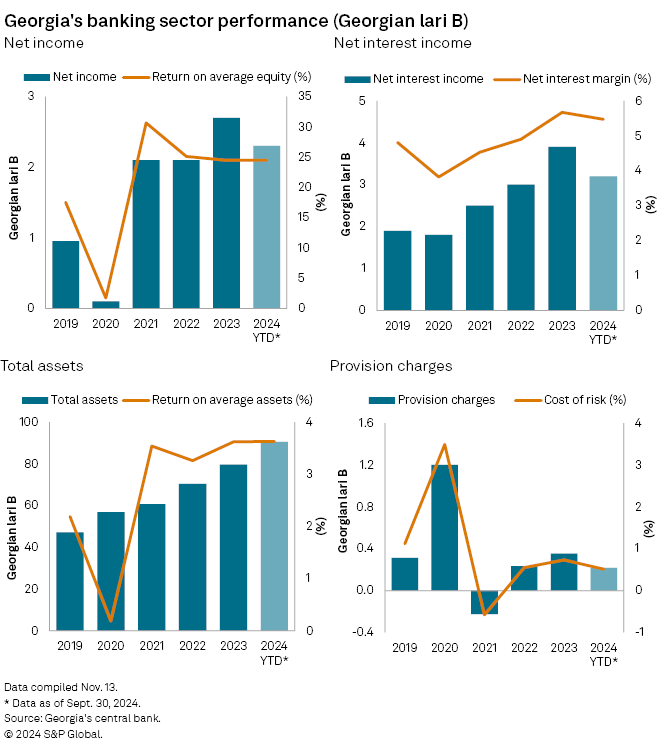

Sector snapshot

Banks operating in Georgia jointly posted net profit of 2.3 billion lari and net interest income of 3.2 billion lari for the first nine months of 2024, according to Georgia's central bank data. Both metrics were nearing the results for full year 2023 and have already exceeded the sector's performance from previous years.

After the third quarter, the aggregate cost of risk in the Georgian banking sector was 0.51%. Total assets have grown consistently in the last few years, while gross loans increased 13% since the start of the year, reaching almost 60 billion lari.

Economic risks for banks operating in Georgia are balanced, according to an Oct. 22 S&P Global Ratings report. Lenders are supported by good macroeconomic growth prospects, although increased domestic political and policy volatility could present a downside risk to macroeconomic projections, it said days before the elections.

Ratings expects loans in the Georgian banking sector to grow roughly 15% per year in 2024 and 2025, driven by consumer and corporate lending, and cost of risk to remain below 1% over the same period.

As of Nov. 22, US$1 was equivalent to 2.74 Georgian lari.