Just a few weeks after being sworn in, SEC Chair Gary Gensler has already made a strong impression in how the regulator is responding to the events of GameStop and Archegos Capital. Just a few weeks after being sworn in, SEC Chair Gary Gensler has already made a strong impression in how the regulator is responding to the events of GameStop and Archegos Capital.Source: Mark Wilson/Getty Images via Getty Images |

Gary Gensler has hit the ground running.

Less than three weeks on the job, the newly minted chair of the U.S. Securities and Exchange Commission gave Wall Street and Washington, D.C. a glimpse into his priorities May 6 during a wide-ranging House Financial Services Committee hearing dedicated to assessing the regulatory response to the GameStop Corp. saga.

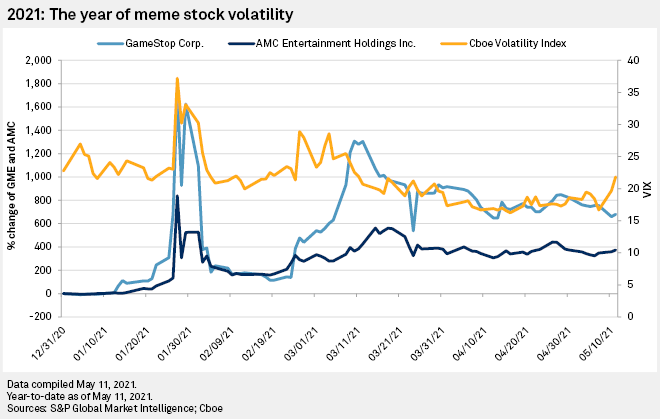

And while Gensler's agenda is likely broader than tackling the market shocks surrounding the meme stock trading volatility and worries surrounding the collapse of Archegos Capital, the SEC chair has already begun laying the groundwork for rules to increase short-selling disclosures, add transparency to the stock loan market and accelerate trade settlement times. Gensler has also directed the SEC staff to examine the effects that game-like features have on investors and the payments that help create liquidity in today's equities markets — complicated issues that signal how assertive Wall Street's watchdog looks to be under its new leader.

"He's not letting any moss grow," IEX Group Inc. Chief Market Policy Officer John Ramsay said in an interview of Gensler's push for a report on the GameStop situation, which is expected this summer. "There's a large and expanding agenda for him to address, but if anyone can do it, he can. He'll push things through if necessary to get done what he thinks is the right answer. It sure is going to be a very interesting few years."

Gensler, a former The Goldman Sachs Group Inc. executive, was widely lauded as one of the most aggressive regulators in the post-financial-crisis era when he led the Commodity Futures Trading Commission. At the SEC, he appears to be picking up where he left off by digging into issues argued over for years across Wall Street, while also looking to complete some of the SEC's long-overdue directives under the Dodd-Frank Act of 2010.

Isaac Boltansky, director of policy research for Compass Point Research & Trading LLC, counted at least a half dozen issues during the hearing that Gensler said he had already directed or asked the SEC staff to begin looking into.

"It serves as a clear reminder that the SEC is going to be one of, if not the, most active agencies in the financial regulatory ecosystem," Boltansky said in an interview. "This is the Gensler that we saw at the CFTC. The CFTC was able to accomplish an inordinate amount, especially after Dodd-Frank in the rulemaking realm, often at sheer will from Gensler himself. He is who we thought he would be."

Here is a breakdown of what Gensler had to say about some of the issues of the day:

Gamification

Lawmakers pushed Gensler at the hearing to use the full extent of the SEC's powers to explore whether individual investors are being harmed by the gamification of trading. Over the retail trading bonanza of the past year, consumer advocates and some in the nation's capital have become increasingly worried about whether the flashy animations and, in some cases, actual games featured in a handful of brokerages' apps are prompting investors to trade more often and in complex products and strategies. Academic studies have previously found that more frequent trading from individual investors can be detrimental to their returns in the long run.

Rep. Sean Casten represents the Chicago suburb that was home to 20-year-old Alex Kearns, who died by suicide in 2020 after struggling to reach Robinhood about an options trade that appeared to have gone wrong. At the hearing, the Illinois Democrat said trading apps like Robinhood Markets Inc.'s are using human psychology to drive more trading on their platforms and, in turn, make more money off of payment for order flow. Casten's point is also at the heart of an ongoing case in Massachusetts, where state officials are suing Robinhood for breaking customer protection rules by enticing younger and inexperienced investors with its app. Robinhood has rejected the commonwealth's characterization, writing in a recent blog post that it does not believe its "customers are as naïve as the Massachusetts Securities Division paints them to be."

To Gensler, the gamification of trading has incited concern about whether individual investors' interests are being properly protected and whether the SEC's rules are suited for an era where many are buying and selling stocks from their phones.

"I think we need to evaluate our rules, and we may find that we need to freshen up our rule set," Gensler said. "If we don't address this now, the investing public — those saving for their futures, retirements, and education — may shoulder a burden later."

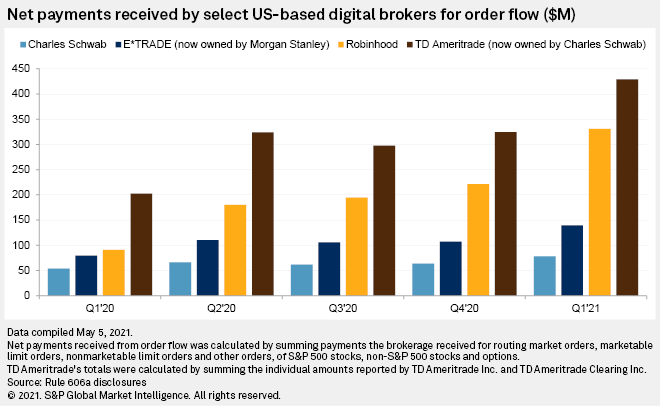

Payment for order flow

Beneath the gamification worries is payment for order flow. Through the controversial payment for order flow, or PFOF, structure, retail brokerages including The Charles Schwab Corp. and Robinhood send their clients' orders to wholesale trading firms like Citadel Securities Americas LLC and Virtu Financial Inc. to be executed. The wholesalers pay the brokerages for those orders and usually provide better prices than what is available on stock exchanges. In return, the wholesalers capture a small part of the spread on each trade they execute.

|

Proponents of the system are quick to point out that PFOF has helped enable an era of retail investing where individual investors can buy or sell a stock without paying commission fees, which were sometimes as high as $6 per trade only a few years ago. But it has plenty of skeptics, including Gensler, who at the hearing said the practice helps entrench some wholesalers with more power over retail order execution and could create a conflict of interest at brokerages when they face a choice between getting a larger fee from a wholesaler or routing to another with better execution quality for their customer. Critics have also raised concern about whether payment for order flow incentivizes brokerages to push their customers to trade more.

What the SEC could do about PFOF has emerged as one of the central questions in the post-GameStop market.

The regulator has studied the issue before. It has pursued better disclosures around the model, with its most recent action in 2018 requiring the brokerages to disclose how much they earn from the payments every quarter. The day after testifying, though, Gensler said on CNBC "disclosure alone may not do it."

Transparency

Still, Gensler made it clear during the hearing that requiring more transparency from the market would be a key strategy for his SEC.

The agency's five commissioners, including Gensler, are expected to soon consider new rules around requiring more disclosures from market participants around short selling and stock lending. Gensler additionally told lawmakers that the SEC would be pursuing a rulemaking around climate disclosures.

"I think transparency is at the heart of efficient markets," Gensler said. "Disclosure regimes are important for companies, and that's a form of transparency. But I think that's at the heart of investors being able to take risks."