Twitter Inc.'s newest director and largest shareholder is both a power user and an outspoken critic of the microblogging platform.

On April 4, Twitter's management agreed to appoint Elon Musk, CEO of Tesla Inc. and Space Exploration Technologies Corp., to a two-year director term expiring in 2024, according to an SEC filing. Twitter CEO Parag Agrawal and Musk confirmed the move in an exchange on the platform April 5.

"[Musk is] both a passionate believer and intense critic of the service which is exactly what we need on @Twitter, and in the boardroom, to make us stronger in the long-term," Agrawal wrote.

Musk replied that he is looking forward to making "significant improvements to Twitter in coming months."

The appointment followed a disclosure that Musk acquired a 9.2% stake in Twitter. As a condition of the board appointment, Musk agreed not to acquire more than a 14.9% stake in Twitter.

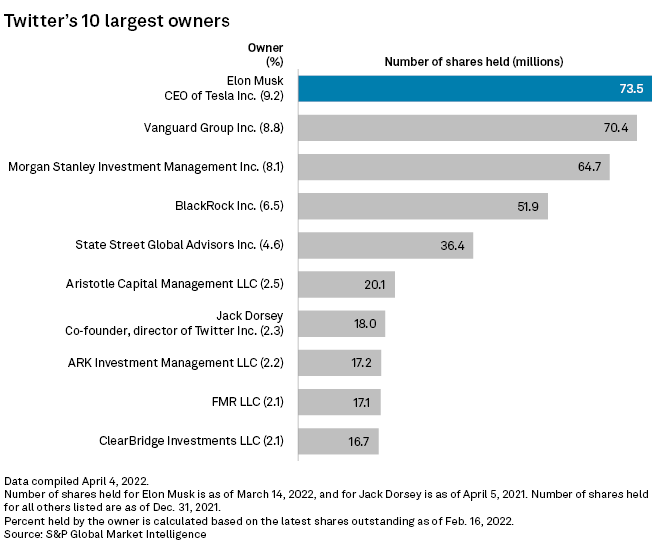

Even at 9.2%, Musk's new Twitter stake made him the largest shareholder in the social media company, ahead of institutional investors including Vanguard Group and Morgan Stanley Investment Management, which hold 8.8% and 8.1% stakes in Twitter, respectively. Twitter co-founder and director Jack Dorsey holds a 2.3% stake.

Musk has more than 80 million Twitter followers, making Musk one of the 10 most-followed accounts on the platform and giving the executive considerable influence. Through regular Twitter polls, Musk has fueled discussions about free speech on the social media network. Musk has also alleged that Twitter's recommendation algorithm is biased and raised the question of whether the service should provide users with an edit button for published Tweets.

Kagan analyst Seth Shafer said the company already devotes much of its resources to addressing those issues, but finding a middle ground may be mutually beneficial. Kagan is a media research group within S&P Global Market Intelligence.

"Twitter can make some incremental changes and appear responsive," Schafer said, "while Musk can wield some influence without any of the headaches that a more active role would entail."

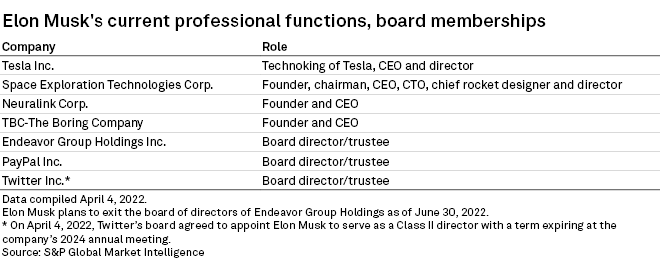

Musk already juggles roles in several companies. In addition to leading Tesla, Musk is the founder and CEO of SpaceX, Neuralink and TBC-The Boring Company. Musk is also a director of Endeavor Group Holdings and PayPal.

Musk recently explored the possibility of launching his own social media network.

"It is clear that he sees both a financial and a strategic incentive in owning such an asset," Truist Securities Managing Director Youssef Squali said. "Becoming the largest shareholder of an iconic, global, established platform at scale gives him that immediately, and at likely a cheaper cost than having to build it from scratch."

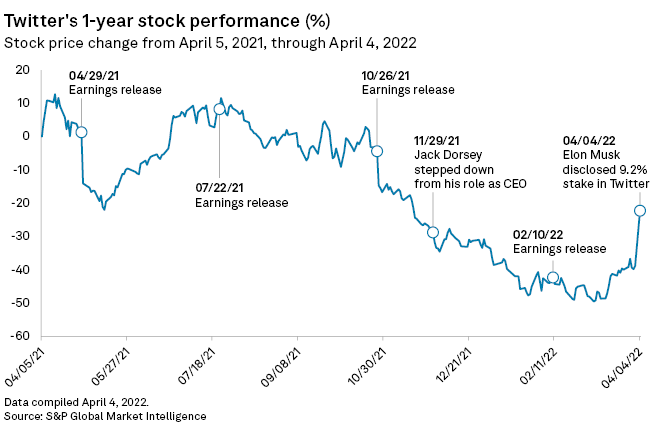

Twitter's shares rose nearly 30% following Musk's stake disclosure. The one-day bump helped to reverse some of Twitter's recent price losses, but the stock remained down 22% on the one-year chart. Musk's shares were worth more than $3 billion as of market close April 4.

While investors should be happy with the spike in Twitter shares, Kagan's Shafer said more clarity is needed about Musk's longer-term intentions.

"Outside of running a Twitter poll on his account asking if followers think that Twitter's algorithm should be open-source and transparent, Musk hasn't detailed concrete changes or steps he'd like to see the company make to address any of his concerns," Shafer said.