Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Dec, 2022

By Zeeshan Murtaza and Dylan Thomas

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity is courting the potentially massive retail investor market, hiring a slew of wealth managers, exploring blockchain's potential to expand private fund access and launching products tailored to the global mass affluent.

One of those products was Blackstone Real Estate Income Trust Inc., or BREIT, a $70.4 billion private real estate fund. Launched in 2017 by Blackstone Inc., it is by far the largest nontraded real estate investment trust in the U.S., with more than 5,000 properties in its portfolio.

The semi-liquid nature of the fund was meant to appeal to individual investors. And it did, as BREIT raised $25.6 billion in the 12 months ended Sept. 30. But outflows picked up this fall as investors — perhaps worried about the outlook for real estate or simply aiming to rebalance their portfolios — began withdrawing billions from BREIT.

That is when the trouble started. BREIT was forced Dec. 1 to gate redemptions after they exceeded limits, first monthly then quarterly, a decision that sent the price of Blackstone shares tumbling on the NYSE.

The events raise some big questions for Blackstone and the alternative assets industry at large: Did retail investors truly understand what they were getting into with BREIT? And how big a setback is this for the industry's efforts to tap retail investors, a market Blackstone COO Jonathan Gray said could be worth $80 trillion?

Oppenheimer & Co. Inc. senior analyst Chris Kotowski and Kevin Gannon, CEO of investment banking firm Robert A. Stanger & Co. Inc., took a shot at answering those questions earlier this week.

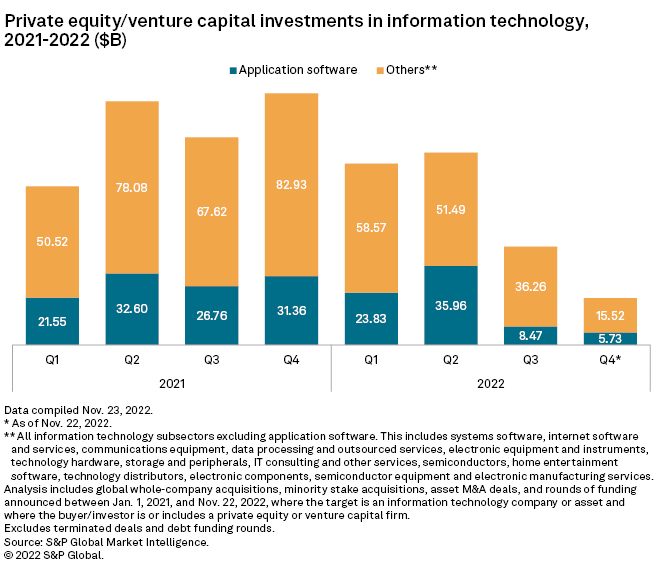

CHART OF THE WEEK: Application software deals resilient

⮞ Private equity-backed deals for application software businesses declined 15.6% year over year through the end of the third quarter, but that is a relatively modest drop against a much steeper 25.4% decline in dealmaking in the wider IT sector.

⮞ Deals for application software — sometimes referred to as enterprise software when used across a business enterprise — are dominant in the IT sector, making up a third of 2022 transactions by volume and accounting for more than two-thirds of aggregate deal value in the sector through three quarters of this year.

⮞ The subsector's resiliency has a lot to do with its stickiness, said Bruce Daley, a senior research analyst at 451 Research, explaining that once a business starts relying on application software, it is difficult to cancel the subscription without interrupting operations.

DEALS AND FUNDRAISING

* X-Energy Reactor Co. LLC., a developer of small modular nuclear reactors and fuel technology for generating clean energy, will go public through a merger with Ares Acquisition Corp., a special purpose acquisition company sponsored by Ares Management Corp. The deal, which values the company at roughly $2 billion, is expected to close in the second quarter of 2023.

* KKR, through KKR Health Care Strategic Growth Fund II SCSp, is buying Clinisupplies Ltd., a continence-care products company, from Healthium Medtech Ltd.

* Thoma Bravo received capital commitments of more than $32.4 billion for its buyout funds Thoma Bravo Fund XV LP, Thoma Bravo Discover Fund IV and Thoma Bravo Explore Fund II.

* Sentinel Capital Partners raised $5.2 billion for two of its funds, garnering $4.3 billion for Sentinel Capital Partners VII LP and $835 million for Sentinel Junior Capital II LP.

ELSEWHERE IN THE INDUSTRY

* Tiger Infrastructure Partners LP purchased International Aerospace Coatings Inc. and Eirtech Aviation Services Ltd. in a deal with Vance Street Management LLC. Both target companies provide aviation aftermarket solutions.

* Medical Specialists of the Palm Beaches Inc., a primary care-focused physician group practice, received a capital injection from Ascend Partners.

* Bernhard Capital Partners Management LP purchased Boston Government Services LLC and Sterling Engineering & Consulting Group LLC, subsequently forming a dedicated U.S. Department of Energy services platform.

* Investcorp acquired a majority stake in CrossCountry Consulting LLC, a business advisory firm. Public Sector Pension Investment Board invested, and Riordan Lewis & Haden Inc., or RLH Equity Partners, will remain an investor.

* Antin Infrastructure Partners bought a majority stake in Optical Telecommunications Inc., a fiber broadband provider in Florida.

FOCUS ON: INTERNET SOFTWARE AND SERVICES

* Cinven Ltd. and Ontario Teachers' Pension Plan Board are purchasing group.ONE and dogado group. Following deal completion, the acquired companies, which provide online-presence services, will be combined.

* Arlington Capital Partners is selling Octo Consulting Group Inc., a provider of digital modernization services to the U.S. government, to International Business Machines Corp. in a deal that could close by year-end.

* Merchant Investment Management LLC made a minority equity investment in Succession Link LLC, a networking and communication platform linking financial professionals considering M&A.

451 Research is part of S&P Global Market Intelligence.