Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jan, 2021

Gas utility stocks are paring their fourth-quarter gains as the outlook for the sector's equity prices remains uncertain following a bruising 2020.

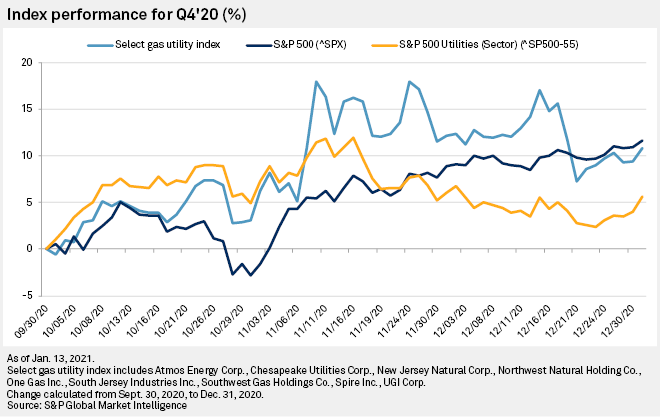

A select index of natural gas utility stocks surged 10.9% in the final quarter of 2020, a substantial improvement from the group's nearly 8% slide during the third quarter. It also contrasts with the full year, during which the gas utilities group fell 17.3%, badly underperforming the wider utility sector's 2.8% drop and the S&P 500's 16.3% gain.

Analysts have previously attributed gas utility underperformance in 2020 to concerns over utilities' capital plans and bad debt loads during the COVID-19 pandemic and downturn, as well as climate-related headwinds and investor preference for high-growth tech stocks. More broadly, investors have ignored the space because it was not a sector that would clearly outperform or underperform during the pandemic, according to Ryan Kelley, portfolio manager of the Hennessy Gas Utility Fund.

"What we had going into the fourth quarter is just a huge disparity in valuations, and I think that like any pendulum, you've got to swing back to the middle," he said.

Kelley stressed how discounted utilities had become to the broader market: the sector was trading at roughly 63% on a relative basis to the S&P 500, despite the two typically trading roughly at parity over the long term. The dislocation persisted throughout much of 2020 even though utility earnings and estimates held up better than some other sectors during the pandemic, he noted. Second-half reporting periods offered further evidence of strong earnings and resilient capital spending plans, helping to boost the sector, he said.

Gas utilities back on the back foot

Gas utilities once again appear to be falling victim to broader market trends. Through Jan. 13, the select gas utilities index has pulled back about 9% from its fourth-quarter peak on Nov. 24, when it was up more about 18% from the start of the period.

Following news of COVID-19 vaccine approvals, investors rushed into stocks poised to rebound once life returns to normal, according to Kelley. While utilities are technically in that recovery group, many investors are focused on equities that could see more rapid growth, he said.

Analysts said investors have also gravitated toward large-cap stocks, a trend that benefits multi-utilities and handicaps gas distributors.

"With the exception of [Atmos Energy Corp.], all regulated gas names fall in the small-mid cap category which has also not helped performance," Nasdaq IR Intelligence senior analyst Massud Ghaussy said.

Ghaussy noted that several gas utility stocks also broke through multiple support levels in the latter half of the quarter. Support levels mark prices at which a downward trend is expected to pause, so when prices break the threshold, it creates further downward pressure.

Outlook uncertain in 2021

During the latest earnings season, many gas utilities offered what analysts wanted to hear: details on their plans to reduce greenhouse gas emissions and adopt fossil fuel alternatives like renewable natural gas, or RNG, and green hydrogen.

However, Ghaussy noted that opportunities to add RNG and hydrogen to distribution systems are still in their infancy and have not served as equity price catalysts. In a Dec. 15, 2020, research note, Morgan Stanley analysts said they expect investor interest in green hydrogen pilot projects to persist but warned that announcements around early phase research and development will not have a meaningful impact on stock prices in 2021.

Kelley said it is difficult to predict the sector's performance in 2021, following a tumultuous year when many long-term climate headwinds converged on the space. However, he agrees with the view that concerns over the industry's decline are overdone.

"I think investors are going to get more comfortable with the fact that natural gas is complementary, in my opinion, to a greener future," he said. "It's not just a transition fuel that will be gone in three years."