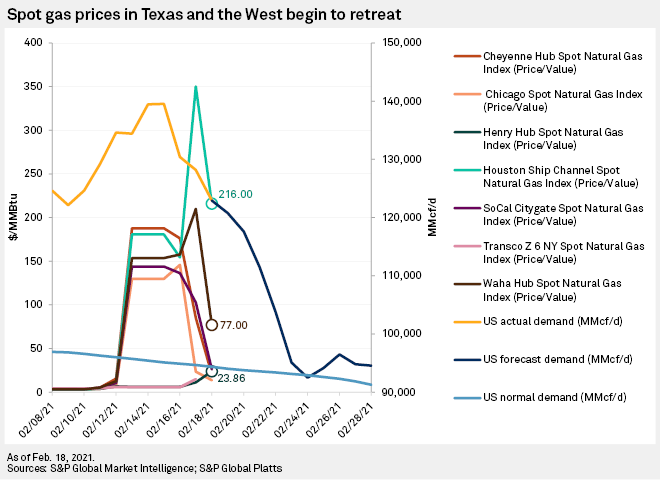

Natural gas utilities are looking for ways to finance the sky-high cost of recent gas purchases during a historic cold snap and winter weather in the U.S. West and Southwest, creating new hurdles for local distribution companies already managing cost recovery challenges during a yearlong pandemic.

In an early sign of the new challenge, eight-state gas distributor Atmos Energy Corp. on Feb. 19 reported that it had accrued roughly $2.5 billion to $3.5 billion in natural gas purchases — chiefly for its Colorado, Kansas and Texas jurisdictions — due to "unforeseeable and unprecedented market pricing" during the winter storm. The company said it had approximately $3 billion in total liquidity, including about $800 million in total cash assets.

Atmos said it was considering several options to cover the costs, generally payable at the end of March, including deploying available cash, tapping short-term or long-term debt, and issuing equity. The company said it believes that it can strike a cost-effective way of financing the extraordinary costs through a "balanced financing strategy" and regulatory mechanisms authorized by state utility commissions in some of its territories.

The Texas Railroad Commission, the state gas utility regulator, on Feb. 13 authorized local distribution companies to record extraordinary gas purchase costs in a regulatory asset account. Utilities could later seek to recover costs logged in the accounting mechanism in a subsequent process. The goal is to defer the costs to a later time and reduce the impact on customers.

The State Corporation Commission of the State of Kansas followed suit with a similar authorization on Feb. 15.

Atmos and other utilities purchase gas at wholesale rates and then pass the price on to customers. Southwest Gas Holdings Inc. on Feb. 17 alerted customers in its Arizona, California and Nevada service territories to surging gas prices. It reminded ratepayers of the pass-through and warned them to conserve gas to prevent blowing out their monthly bill.

The elevated gas prices during the storm have raised the prospect that many ratepayers will be unable to pay their bills when they come due in the coming weeks. This in turn threatens to leave utilities with more customers in arrears and mounting bad debt, or outstanding balances that are unlikely to ever be recovered. The situation follows a period when arrearage and bad debt levels are already elevated among utilities due to the COVID-19 pandemic and economic downturn.

In an extreme case, a liquidity crisis could force a utility into Chapter 11 bankruptcy. Other adverse outcomes could include stock price dilution for companies that issue equity to cover the unexpected costs or a plunge in investor sentiment should a bank refuse to lend money to a utility.

"Given [Atmos'] robust balance sheet and constructive regulatory set-up, we believe any meaningful underperformance would be unwarranted," Goldman said in a Feb. 22 research note.

However, the financing needs could impact Atmos' 2021 earnings, the analysts said. If Atmos were to issue $1 billion of additional long-term debt at interest rates of 2% to 3%, the move could produce a negative EPS impact of 12 cents to 18 cents per share in 2021, or 2.5% to 3.5% of Goldman's estimate for $5.06 per share. Atmos on Feb. 19 reaffirmed full-year 2021 EPS guidance of $4.90 to $5.10. The S&P Capital IQ consensus normalized earnings estimate currently sits at $5.10 per share.

There are already signs that lending will remain available to gas utilities in good standing. One Gas Inc. on Feb. 22 entered into a credit agreement with Bank of America NA for a $2.5 billion unsecured term loan facility, with proceeds going toward natural gas purchases resulting from the winter weather events and repayment of debt. In a filing with the SEC, the company disclosed that it had spent roughly $2.2 billion in aggregated natural gas purchases across its three-state footprint in February.

"Due to the historic nature of this winter storm, One Gas experienced unforeseeable and unprecedented market pricing for gas costs in our Kansas, Oklahoma, and Texas jurisdictions," the company said in the filing.

One Gas said it had access to approximately $3.1 billion in liquidity, including about $297 million in total cash and cash equivalents, $296 million through existing debt facilities, and $2.5 billion through the new credit agreement.

One Gas is also subject to the Texas and Kansas commission regulatory treatment. The company has filed with the Oklahoma Corporation Commission seeking similar authority to record a regulatory asset to account for "extraordinary expenses."

Shares of Atmos were down about 4% from the previous closing price just before market close on Feb. 22, at $89.40. Share of One Gas fell nearly 6% at the session low of $69.73, before paring losses to trade down about 5%.