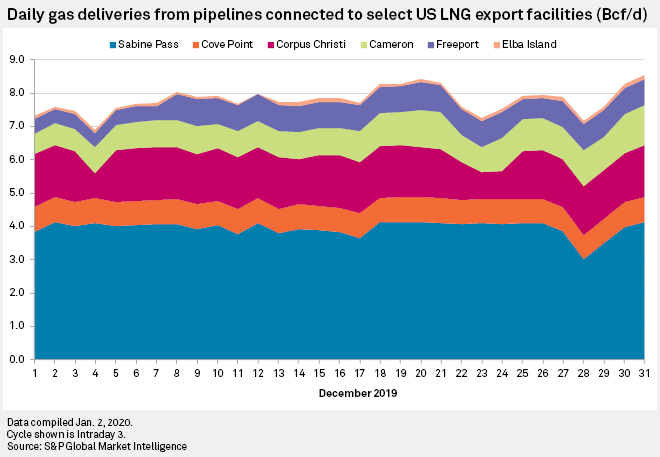

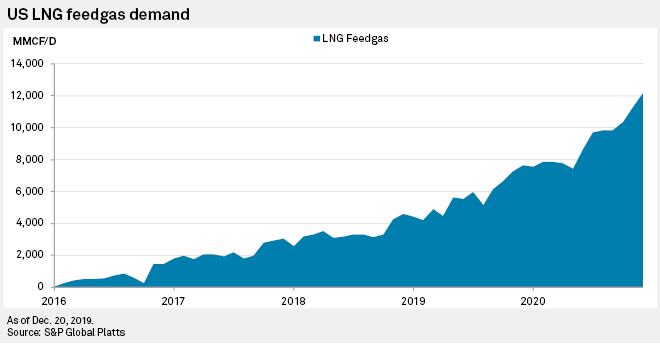

Total daily natural gas flows to the six operational U.S. LNG export facilities topped 8.5 Bcf on the final day of December 2019, capping a remarkable rise in feedgas deliveries over the year with an ongoing ramp-up of U.S. LNG export capacity.

The Dec. 31 feedgas volumes set a new record high and amounted to more than 9% of the dry natural gas the U.S. produces on an average day. Flows over the month averaged nearly 7.8 Bcf/d, according to pipeline flow data from S&P Global Market Intelligence.

The increasing gas flows to LNG facilities provided a key outlet for surging gas production amid low Henry Hub prices and supported the availability of U.S. LNG to serve winter demand in world markets. The U.S. LNG export capacity stands to keep increasing in 2020, but less dramatically than in 2019, with the bulk of the capacity additions coming from new liquefaction units being constructed at the Sempra Energy-led Cameron LNG terminal in Louisiana and the Freeport LNG Development LP facility in Texas.

In December 2019, Freeport LNG started commercial operations on its first liquefaction train after shipping several commissioning cargoes. Freeport LNG also began shipping commissioning cargoes from the second liquefaction unit on Dec. 18, 2019, the last big milestone before substantial completion.

Feedgas flows to the Freeport LNG terminal averaged nearly 0.7 Bcf/d during December and ended the month at about 0.79 Bcf/d. The terminal will be able to produce about 15.3 million tonnes per annum of LNG once all three trains are online. A Freeport LNG spokesperson recently reaffirmed that the third train remains on track to start commercial operations by May.

Cameron LNG also continued to advance through the late stages of construction in December 2019. Sempra announced on Dec. 23 that the second train of three trains at Cameron LNG had begun producing LNG. The first train entered commercial service in August 2019.

Flows to Cameron LNG in December 2019 averaged nearly 0.88 Bcf/d and peaked Dec. 31 at nearly 1.2 Bcf. Sempra expects the second and third trains of Cameron LNG to start commercial operations in the first and third quarters of 2020, respectively, bringing the estimated total capacity of the terminal to 12 mtpa.

Another part of the December 2019 ramp up was additional units coming online at Kinder Morgan Inc.'s Elba Island LNG terminal in Georgia. The terminal shipped its first cargo on Dec. 13. Flows to the terminal during the month averaged about 0.08 Bcf/d and ended the month at nearly 0.11 Bcf/d.

Elba Island LNG is by far the smallest of the major U.S. LNG facilities, with an LNG production capacity of 2.5 mtpa once all 10 of its modular trains are online.

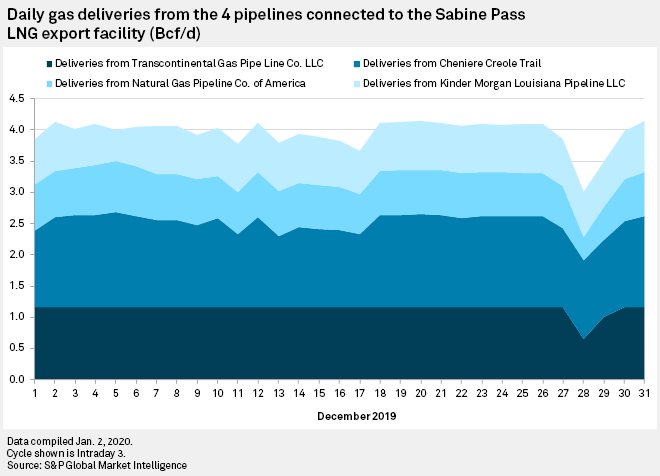

The lion's share of LNG exports comes from Cheniere Energy Inc.'s Sabine Pass LNG terminal in Louisiana, which was the site of the first LNG export from the Lower 48 in 2016. December 2019 feedgas flows to the terminal, where five trains are online at Sabine Pass and a sixth is under construction, averaged nearly 3.96 Bcf/d.

Besides Sabine Pass, Cheniere operates two trains at its Corpus Christi LNG export facility in Texas, where a third train is also under construction. December 2019 flows to Corpus Christi LNG averaged about 1.44 Bcf/d. Each of the Cheniere trains is designed to produce about 4.5 mtpa.

The sixth major U.S. LNG is Dominion Energy Inc.'s Cove Point LNG in Maryland, where December 2019 flows averaged about 0.73 Bcf/d. Cove Point LNG has one liquefaction train capable of producing 5.25 mtpa.

S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.