| An engineer at a solar farm. Solar remained the fastest-growing source of renewable energy in 2021. Source: sinology/Moment via Getty Images |

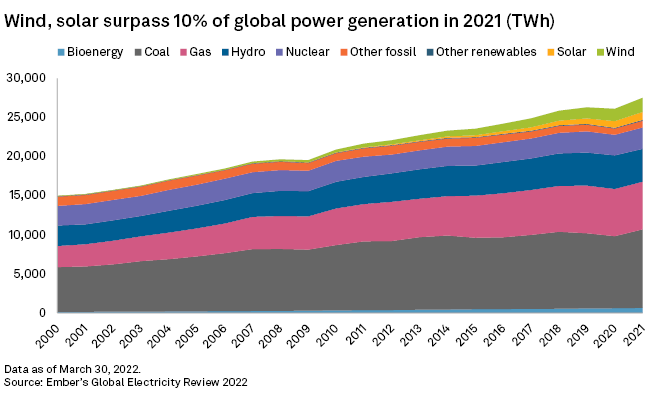

Wind and solar power made up a record 10% of global electricity production in 2021, but power-sector emissions still rose by 7% — the biggest rise since 2010 — as demand rebounded and coal generation increased, energy and climate think tank Ember said in its Global Electricity Review 2022.

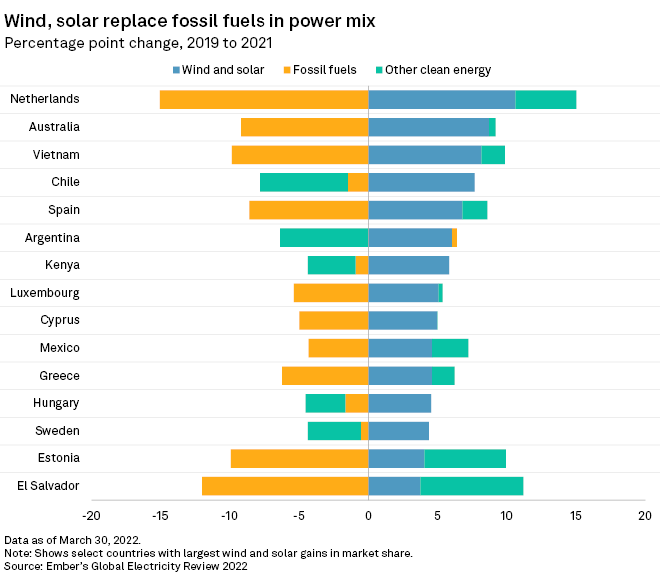

Fifty countries globally now derive one-tenth or more of their power from wind and solar, Ember said in the March 30 report. China, Japan, Vietnam and Argentina hit the milestone for the first time in 2021, while global leader Denmark now generates more than half of its power from renewables.

Yet, a global gas crunch and a pivot away from Russian energy imports amid the country's invasion of Ukraine have seen renewables displace gas, rather than coal, in the power mix, contributing to all-time high CO2 emissions from the power sector of more than 12 billion tonnes.

This decade, wind and solar "need to be deployed at lightning speed to reverse global emissions increases and tackle climate change," Dave Jones, Ember's global lead, said in a statement.

Demand returns

Globally, wind and solar generation grew 17% in 2021, with solar growing 23% to cement its place as the fastest-rising source of electricity generation for the 17th year running.

However, the growth is not enough to get the power sector on track to limit global warming to 1.5 degrees C, which would require wind and solar to sustain compound growth rates of 20% yearly through 2030, Ember said.

2021 also saw the largest ever increase in electricity demand as consumption rebounded after the pandemic slump of the previous year. The 1,414-TWh growth in electricity demand year over year is "the equivalent of adding a new India to the world's electricity demand," Ember said.

Wind and solar met about a third of this increased demand, with the rest fulfilled by fossil fuels. This resulted in a 9% increase in more polluting coal generation, which rose to an all-time high of 10,042 TWh globally as high gas prices made coal more economical. Gas generation only rose by 1%.

Power should really be the low-hanging fruit of the global decarbonization game, but the past year highlighted some of the challenges, Jones said on a March 30 webinar accompanying the report's publication.

A global gas glut, due in part to the demand resurgence, resulted in more gas-to-coal switching in power stations, something that will continue in light of the war in Ukraine as governments pivot away from Russian gas imports. As high gas prices continue into 2022, Europe's coal exit may be interrupted and new renewables will displace gas instead of coal, Ember said.

Reshaping EU energy

The European Union wants to stop importing Russian gas by 2027. Imports from other regions via pipeline networks and LNG import terminals will make up much of this shortfall, but the EU also seeks to further accelerate renewables deployments.

"It's clear that the biggest winners will be wind and solar; you can already see that by the raft of announcements," Jones said on the webinar. As coal and gas prices surge and become expensive and politically toxic, more governments are now trying to turn their backs. "They now want out of two fossil fuels," Jones said.

Molecules may also be displaced by a burgeoning green hydrogen and ammonia market. Countries like Australia are also ramping up to meet this projected demand in Europe with export partnerships, such as the recent agreement by Fortescue Future Industries Pty. Ltd. with E.ON SE to ship 5 million tonnes of hydrogen into Germany each year by 2030.

But in the immediate term, there will still be more coal consumption in many parts of the world, including in Europe. Germany, for instance, is open to ramping up coal-fired generation to curb Russian gas usage, its energy ministry said.

The EU's new requirement to fill gas storage across the bloc to 80% for the next winter and in the coming years will also spur coal burn, some experts said. As already-scarce gas is diverted into storage, more power plant operators could opt for coal in the coming months.

"Climate change is a long-term challenge, and many countries are facing immediate challenges," Muyi Yang, an electricity policy analyst at Ember, said on the webinar.

"Clearly it's something that worries us a lot, that we have this momentum to phase out coal, and now it's been slightly distracted," Jones added.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.