Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Feb, 2021

By Sanne Wass

Commodity trade finance suffered a hit to its reputation in 2020 as it faced major losses and fraud scandals, all while banks scaled back their lending. Despite this, funds see the segment as an attractive investment opportunity, even more so now that banks want out.

John MacNamara, previously Deutsche Bank's global head of structured commodity trade finance and now an independent commodity specialist, said he has been contacted by several funds that wish to move into commodity trade finance.

"They have spotted a market opportunity and they're correct, there is one," he said, adding that the outlook for commodities, including within energy, is "pretty positive for 2021."

Many banks have a different view. A wave of bankruptcies among commodity traders last year, many of which were linked to allegations of fraud, led to significant losses for lenders. Total commodity trade finance revenues for banks globally dropped to $1.7 billion in the first half of 2020, a 29% decline from a year earlier, according to figures from Coalition, an S&P Global-owned research company.

It prompted many to reassess their strategies in financing trade within oil, metals and agricultural products. ABN Amro Bank NV, for one, announced in August 2020 that its activities in this space would be "discontinued completely," while other large commodity trade finance banks such as Société Générale SA, BNP Paribas SA and Rabobank have started to trim their operations.

The collapse of Singapore-based Hin Leong Trading (Pte.) Ltd. was particularly painful for lenders, which were reported by Bloomberg to have a combined exposure of at least $3 billion to the oil trader.

Aggressive lending

But fund managers and industry experts argue that banks' large commodity losses in 2020 were largely caused by specific bank practices that could have been avoided.

"The business case is still very strong," said Suresh Hegde, head of structured private debt at NN Investment Partners, which is currently fundraising for a new fund that will invest primarily in traditional commodity trade finance. "I think it's really important to understand and explain what actually happened in these bad cases in 2020," he said.

Many of the problems faced by banks' commodity financing departments during the pandemic were rooted in their increasingly aggressive lending practices, Hegde said.

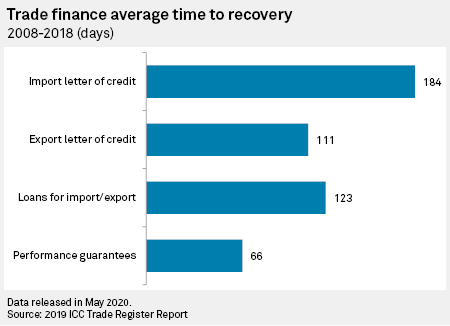

Historically, trade finance has been considered one of the safest forms of businesses for banks, as the financing has been short term and linked to specific trades secured against the commodities or goods as collateral, keeping default rates low.

But over the years, banks have, due to competitive and regulatory pressure, moved toward providing more traditional, unsecured corporate lending facilities to commodity traders, supported by the strength of their balance sheets rather than actual transactions, leaving them more exposed to corporate credit risk, Hegde said.

"That's something that we've always been clear that we didn't want to do," he said. NN Investment Partners will invest only in commodity trade finance assets linked to specific sales contracts, which creates "a very different risk profile" and better supports the "good characteristics" of trade finance, he added.

As banks moved away from transactional trade finance, they essentially lost control over the goods they fund, said Nicolas Clavel, chief investment officer at Scipion Capital, an investment manager specializing in commodity trade finance in emerging markets. This has made them vulnerable to fraudulent practices such as multiple financing of the same trade, an issue at the center of many of the recent fraud cases.

Clavel said Scipion tends to deal with small and medium-sized companies and it is "completely obsessed by control" of the transactions, which has enabled it to manage through the crisis with a 6% net return to investors in 2020. Scipion was able to suspend credits to high-risk commodities and geographies during the pandemic, he said. While logistical challenges did cause delays, its fund did not record any defaults.

That is not to say that 2020 was not a tough year for other commodity trade finance funds, and some of them did get caught in the collapses in Singapore, said MacNamara. "A number of them have had quite significant withdrawals," he said.

Yet even they continue to see opportunities in commodity trade finance, with many of them now "sorting themselves out" and planning to return to the market with revised business models and price expectations, he said. Particularly funds that previously chased investor returns between 10% and 12% are now lowering their targets to 6% to 8% in order to deal with better borrowers, he said.

MacNamara said banks' changing lending practices have largely been driven by capital requirements under Basel III and so-called Basel IV, which "more or less ignore transactional collateral." Because funds do not fall under the same regulatory requirements, they are better positioned to take on transactions that may not be profitable for banks, he said.

Closing the gap

Institutional investors can provide liquidity to the commodity trade finance market through funds such as Scipion, which originate their own assets and typically finance trades, or parts of trades, for which banks do not have capacity or risk appetite.

Another way into the market is through funds such as NN Investment Partners, which buy commodity trade finance assets from banks. This is an attractive proposition, particularly for a growing number of major European insurance companies that are interested in the yield of commodity trade finance but wish to invest in low risk assets, Hegde said. NN Investment Partners' trade finance fund is targeting returns between 3% to 4% above Libor.

This category of investors will provide important liquidity to banks that remain in commodity trade finance and want to pick up business left behind by competitors, but face capital limitations in doing so, said Hegde.

For example, ING Groep NV expects to sell more assets to investors to meet the rising demand for commodity trade finance without significantly growing its portfolio.

Funds will, however, face challenges in closing the financing gap left by banks, as many of them are "relatively small," said MacNamara.