Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Aug, 2022

By Adrian Jimenea and Mohammad Taqi

Higher funding costs and elevated credit losses are likely to temper stronger lending revenues at European banks in 2023, according to analysts.

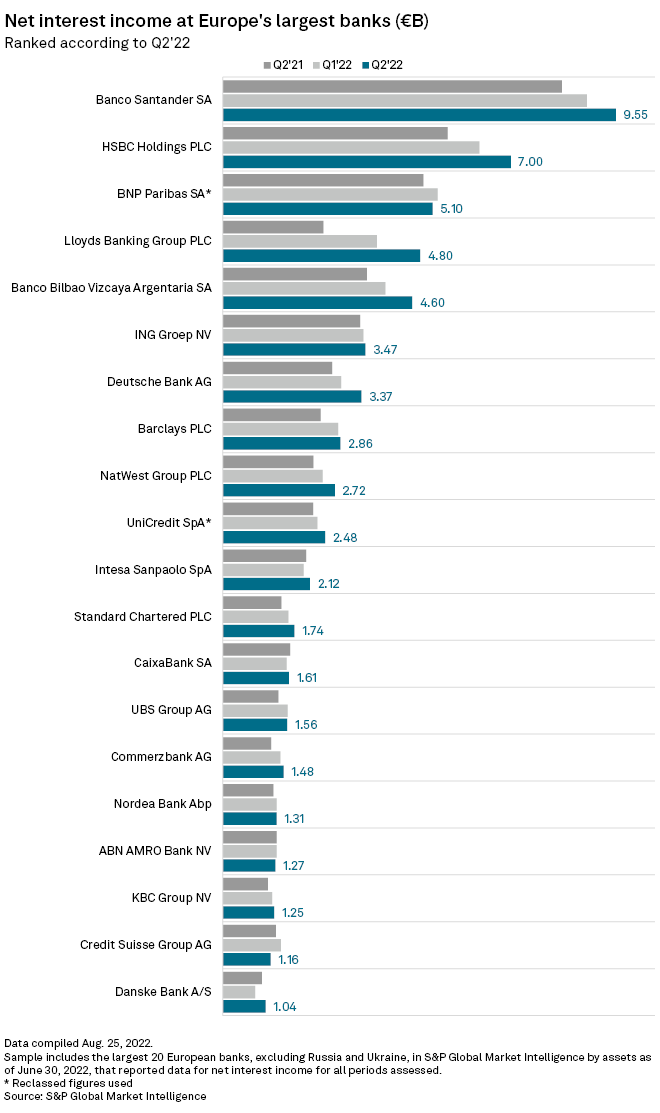

The continent's largest lenders have enjoyed stronger net interest income — revenue from loans minus the interest paid on deposits — after central banks began raising interest rates to curb inflation. In a sample of 20 banks, 17 reported year-over-year growth in the second quarter, S&P Global Market Intelligence data showed. British lender Lloyds Banking Group PLC booked the sharpest increase, with NII nearly doubling year over year.

Net interest incomes are likely to continue to rise versus prior years, with lending volumes recovering to pre-pandemic levels, Martin Rauchenwald, a partner at London-based specialist private equity investor Financial Services Capital, told S&P Global Market Intelligence.

Margins on lending are set to grow by between 20% and 35% on average over the next three years, assuming expectations around GDP growth and monetary policy are met, Emiliano Carchen, principal in the financial services practice at consultancy Oliver Wyman, told S&P Global Market Intelligence. There will be a small impact on 2022 margins and a bigger impact in 2023, he said.

Banco Santander SA recorded the most net interest income in the second quarter, with outgoing CEO José Antonio Álvarez previously saying higher rates would provide a "big, significant uplift." Spanish and Italian banks are especially well-positioned to benefit from rising rates, Berenberg analyst Michael Christodoulou said in an Aug. 15 research note. Berenberg sees a particular upside for banks geared to benefit from rising rates, such as Spain's CaixaBank SA.

Furthermore in regions where central bank rates are rising, banks have not been passing on rates to depositors as quickly as previously expected, Christodoulou wrote.

Double-edged sword

Monetary policy tightening will also lead to higher wholesale funding costs for banks, however, driven by a hike in the risk-free rate and widening credit and government spreads, Oliver Wyman partners Elie Farah, Matthew Austen and Carchen wrote in a recent discussion paper. Banks can also expect lower fee income in the next few years. Banks' different business models, and their varying exposure to the opposing dynamics of loan repricing and wholesale or deposit funding, as well as the structure of their balance sheets and geographic presence, will determine the upside on their net interest margins, Carchen said.

Higher rates also limit loan demand and could lead to higher loan losses, analysts at Deutsche Bank Research warned in a July 26 note.

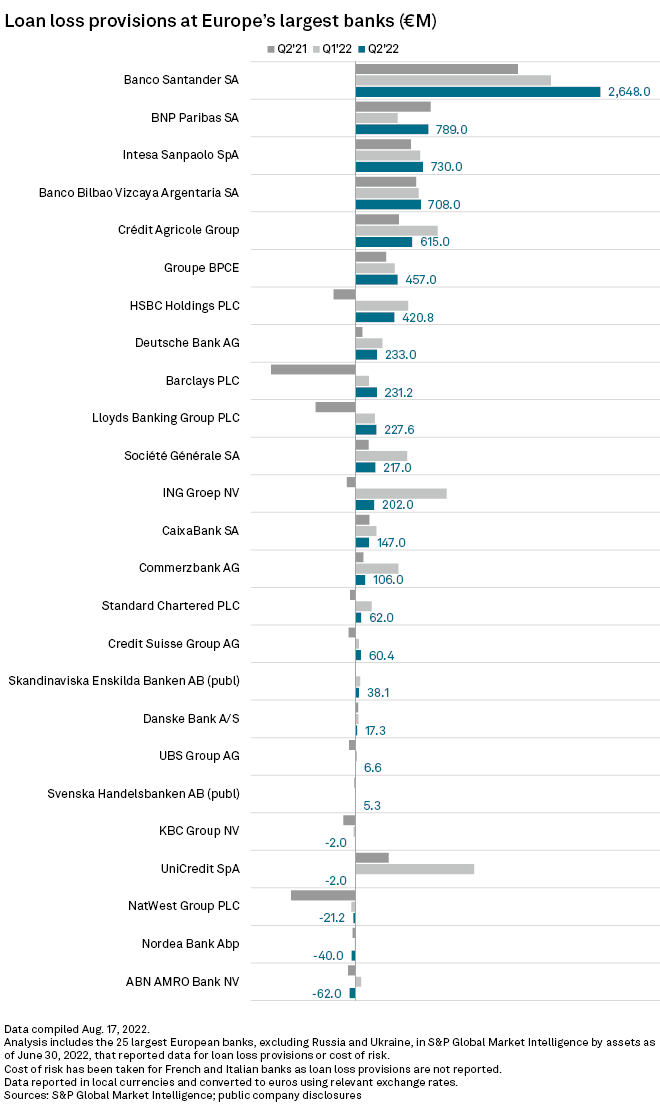

The costs of risk are already beginning to rise, and this will likely continue, with most of the impact set to be seen in 2023, according to Financial Services Capital's Rauchenwald.

"Although economic sentiment has turned negative, it will take time for the real economic impact to feed through to loan loss provisions," Rauchenwald said.

Twenty of the banks in S&P Global Market Intelligence's sample reported higher loan loss provisions in the second quarter or incurred charges versus year-ago writebacks. Santander, along with recording the highest NII, also recognized the most provisions at €2.64 billion, up from €1.78 billion.

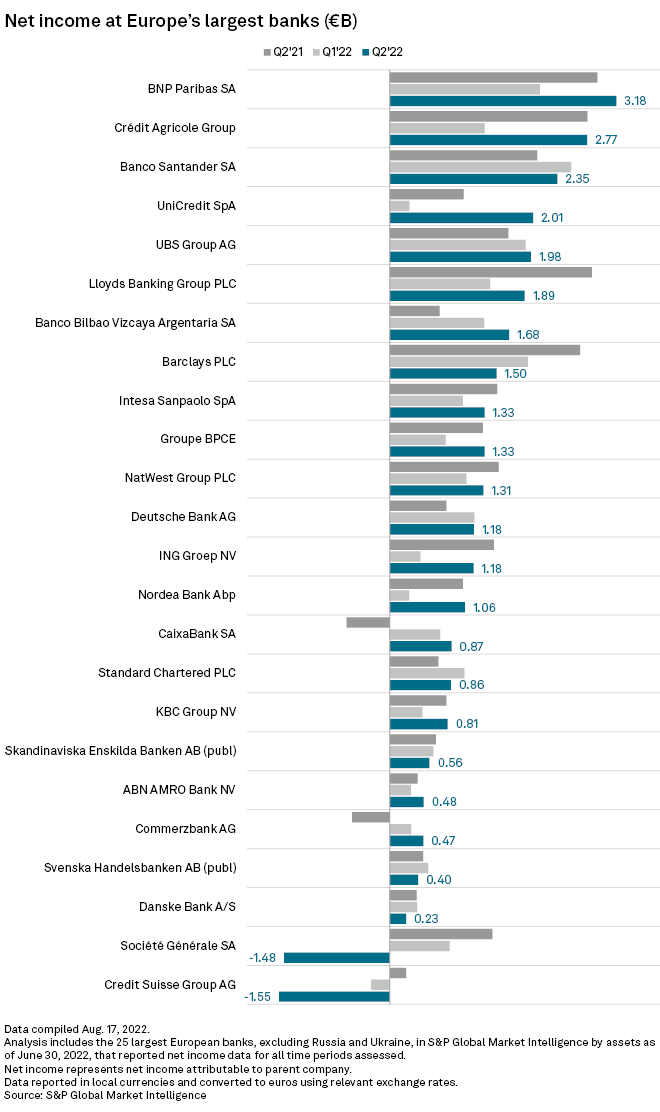

Nonetheless, banks largely gained a profit boost in the second quarter, with their NII offsetting elevated costs and loan losses, Berenberg's Christodoulou said. Thirteen of the 25 banks in Market Intelligence's sample reported either year-over-year net income growth or swung to profits from year-ago losses in the second quarter.

Only Credit Suisse and Société Générale SA posted losses in the quarter, with the former suffering from its troubled investment bank and the latter taking in charges related to its exit from Russia.

Record inflation

Inflation across Europe has risen since the beginning of 2022, and banks are particularly vulnerable. Eurozone inflation is at a record high, hitting 8.9% in July. In the U.K., inflation was 10.1% in the same month, the highest in more than 40 years.

In response, the European Central Bank in July raised rates, to zero, for the first time in over 11 years, with another hike expected in September. The Bank of England also increased its benchmark rate to 1.75% in early August.

European banks' capital levels are resilient and better prepared for a downturn, according to Rauchenwald.

"Future winners will be those that can optimize their asset strategy around the emerging economic environment, with a greater focus on underwriting and segment selection," he said.

Banks in Russia and Ukraine, where government ownership means they are subject to different market dynamics than those in Western Europe, were excluded from this analysis.