Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Mar, 2021

An illustration of a new Apple store rolling out in select Target locations.

An illustration of a new Apple store rolling out in select Target locations.

Source: Target

Even as the pandemic has sent more shoppers online, Target Corp. is increasingly teaming up with major brands such as Apple Inc. and The Walt Disney Co. to create mini stores within its own retail locations to boost sales and drive foot traffic.

Over the past two years, the Minneapolis-based retailer has announced so-called "shop-in-shop" concepts with Disney, Apple and cosmetics giant Ulta Beauty Inc. Target runs the mini stores and generates revenue from products sold within the shops as well as sales of those products purchased on dedicated landing pages on Target's website. Analysts say the move is designed not only to increase sales online and fend off competition from Amazon.com Inc. but also to drive shoppers back to brick-and-mortar locations for everything from "Frozen 2" doll sets to the latest iPhone.

Nick Shields, a senior analyst with Third Bridge who covers the retail sector, said Target is likely to strike additional partnerships to further create a unique mix of merchandise in its stores as popular retailers reevaluate their physical store network.

"They hope this is just a foot-traffic driver," Shields said.

Target's plans to add the mini shops come as COVID-19 cases decline, potentially luring a portion of consumers back into stores.

Michael Baker, managing director with D.A. Davidson, said Target's success as an essential retailer during the pandemic has made the company a more attractive partner.

While the pandemic hurt many smaller businesses, Target's revenue soared in 2020 as consumers took advantage of the company's in-store and online offerings as well as same-day services, including curbside pickup.

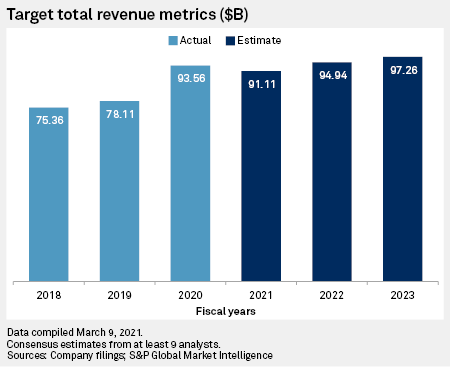

The retailer's revenue reached $93.56 billion in fiscal 2020, up from $78.11 billion in fiscal 2019. Consensus estimates call for Target's revenue to drop slightly in 2021 before continuing its upward trend in 2022 and 2023.

"A brand like Disney is not going to want to partner with a retailer that is losing sales and closing stores," Baker said.

Individually, these retail partnerships are not likely to significantly impact Target's revenue, but collectively they might contribute to a "2 or 3% bump annually" over the next few years, said Shields of Third Bridge.

Any boost would be in addition to sales generated by Target's own brands, 10 of which generated $1 billion or more in sales during fiscal 2020.

Target's stock has twice moved up on announcements of the store partnerships.

Following the Sunday, Aug. 25, 2019, Target announcement of its store partnership with Disney, Target's stock rose 1.2% to close at $104.77, up from the prior trading day's close of $103.49. Following the Nov. 10, 2020, announcement of Target and Ulta's partnership, Target's stock rose 3.6% to close at $177.56, up from a previous close of $171.37. By contrast, Target's Apple partnership announcement on Feb. 25, 2021, was followed by a 0.9% dip in the stock to $183.44, down from a previous close of $185.08.

Retailers are pursuing partnerships with Target as they look to shed real estate costs amid declining foot traffic, Shields said.

Disney and Apple did not return inquiries for this story. But Disney said in March that it would shutter at least 60 of its physical retail stores in North America before year-end as the company focuses on its e-commerce business. Disney will keep its Target stores intact, however. Target said in 2019 that it planned to open 25 Disney stores within select Target stores in October of that year and 40 additional locations by October 2020.

Meanwhile, Apple shut down more than 50 stores in California in December 2020 and announced plans in January to temporarily close more than 20 stores in Texas, Georgia and North Carolina due to surging COVID-19 cases in those states. But Target said in February that it will begin rolling out 17 Apple stores at Target locations in a move to double Apple's footprint in select stores.

"If I'm Apple, I'd rather close three stores and then open up a store within a Target store where foot traffic is three times what it is at the store I just closed," Shields said.

Brandon Fletcher, an analyst with AB Bernstein, said Target offers retailers a chance to showcase products without all the expenses of a traditional physical store. "All you get to do is essentially give them brand guidelines," he said.

That does not mean the shops within Target are exact replicas of a stand-alone Disney or Apple store. Fletcher said Target's Disney stores are adorned with interactive displays and seating areas to watch Disney clips, but they do not have specialized staff, he said.

Apple and Ulta Target stores will be pared-down versions of the traditional stores, but both retailers will provide Target employees with specialized training to man the mini shops, ensuring that customers get specific advice on Apple accessories and makeup products, he said.

Target declined to comment on terms of its vendor relationships. However, Baker said Target purchases merchandise wholesale from Disney and Apple and then keeps the profits for any goods sold within the mini stores and on the Target website. Any sales Disney or Apple makes from merchandise on their own platforms would be separate from those sales, he said.

Shields said any additional store concepts Target adds will help it fend off competition from Amazon, which is working on its rolling out its still-small physical store footprint.

"They can say 'Amazon does e-commerce does really well and good for them, but we are the holistic retailer that offers you a great online experience and a great store experience," Shields said.