Electric vehicles charge on solar power at Google's headquarters in Mountain View, Calif. |

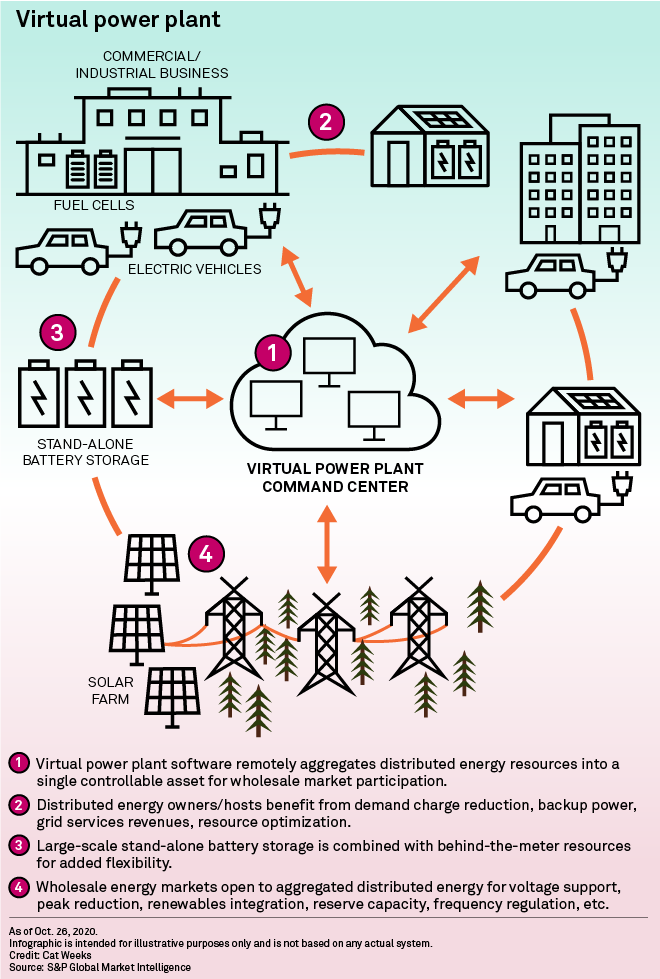

Investors have committed at least $1.2 billion in recent weeks toward the creation of software-controlled clusters of rooftop solar arrays, battery storage systems, electric vehicles, thermostats, smart plugs and other distributed energy devices — assemblies known as virtual power plants.

The fresh capital injection for virtual power plants, or VPPs, builds on Order 2222, the Federal Energy Regulatory Commission's landmark order in September 2020 to open U.S. wholesale power markets to competition from aggregated behind-the-meter resources, and it capped a pivotal year for VPP developers.

"This is going to be a massive market," John Carrington, CEO of Stem Inc., a California-based developer of artificial intelligence-driven VPPs, said in a recent interview. "There is going to be a lot of room for a lot of players."

Stem intends to lead the pack, leveraging its planned public debut on the New York Stock Exchange in the first quarter through a merger with Star Peak Energy Transition Corp., a special purpose acquisition company that completed an IPO in August 2020. Disclosed in December 2020, the proposed deal would funnel up to $608 million in gross proceeds to Stem, including $383 million in cash from Star Peak and $225 million in common stock in the new Stem, allowing the company to build on its early successes.

Along with other VPP funding initiatives, Stem's intended public listing illustrates the growing attraction of cloud-coordinated, local resources as an alternative to the dominant model for power supply, which relies on large-scale generation and long-distance transmission.

While still generating losses, Stem has developed roughly 1,000 MWh of on-demand storage capacity at hundreds of commercial and industrial projects operating or under contract in California, Hawaii, Massachusetts, New York and other U.S. markets and in Ontario. As independent system operators and regional transmission operators implement FERC Order 2222 in the next few years, Stem is eyeing "full participation and value" of its VPPs in U.S. wholesale markets, according to Carrington, by offering voltage support, frequency regulation, renewable energy integration, reserve capacity and other grid services.

From sci-fi to reality

"Even before the lights started going out in California, there was a big problem in that every night, on a weeknight in particular, a huge ramp takes place and we have to turn on a lot of dirty old fossil fuel plants to meet the state's energy needs," Cisco DeVries, CEO of Oakland, Calif.-headquartered OhmConnect Inc., said in an interview. "The best way to solve it, the cheapest, easiest way, is to get people in their homes to use less at key times."

In early 2021, OhmConnect plans to activate the first 100 MW of a planned 550-MW residential VPP at hundreds of thousands of California homes. It is heralded as the world's largest such project and relies on mixed distributed energy resources, including energy conservation. OhmConnect and its network are buoyed by a recently disclosed $100 million investment from Sidewalk Infrastructure Partners LLC, which is backed by Alphabet Inc., the parent of Google LLC.

| A rooftop solar array at the Soleil Lofts apartment complex in Herriman, Utah, is part of a |

Another distributed energy aggregator, Swell Energy Inc., in December 2020 announced up to $450 million in funding for its rollout of four VPPs combining capacity from 14,000 solar and battery systems, underpinned by contracts with Southern California Edison Co., utility subsidiaries of Hawaiian Electric Industries Inc. and others.

Also in 2020, Sonnen Inc., an affiliate of oil major Royal Dutch Shell PLC, said it planned to collaborate on completing seven solar- and battery-equipped California apartment complexes in 2021, building on a similar project in Utah.

Sunrun Inc., the leading U.S. home solar supplier, plans to leverage its $3.2 billion acquisition of rival Vivint Solar Inc., which closed in October 2020, to expand its contracted solar-plus-storage VPP fleet in California, Hawaii, New York and New England. It is working with AutoGrid Systems Inc. on the software to aggregate and dispatch the distributed resources.

"Obviously, using batteries and distributed residential solar [as VPPs] was science fiction 10 years ago," said Ed Fenster, co-founder and executive chairman of Sunrun. Now, "having solar power stored in a battery that is dispatchable ... is the most attractive capacity to have."

Bringing order to chaos

Some grid operators, including the California ISO, New York ISO and ISO New England, have already begun to roll out elements of the full-scale participation for VPPs that FERC has ordered, seeding the market with early activity.

Across North America, an estimated nearly 1,000 MW of cumulative VPP capacity was expected online at the end of 2020, mostly in the United States, according to consulting firm Guidehouse. The firm anticipates a compound annual growth rate of roughly 31% in the 2020s, with an annual VPP market in North America of 8,600 MW by 2029.

"The main driver is just the fact that we're relying on distributed energy resources more than ever," said Peter Asmus, an associate director at Guidehouse. "You're going to need to aggregate and optimize them or you're just leaving value on the table or you could have chaos on the grid."

With the regulatory and financial support VPPs received in 2020, it may not be that way much longer. "The beauty of the virtual power plant is you can have value at the sites for the owner … but you can also contribute to solving problems on the grid," Asmus said.