French and Spanish lenders are likely to keep hold of loan loss provisions in the third quarter through 2022 as they wait to assess the ultimate impact of the COVID-19 pandemic.

Other major European lenders such as Barclays PLC and HSBC Holdings PLC began to release some of their COVID-19-related provisions in the second quarter as lockdowns ended and economic activity rebounded. HSBC continued to write back provisions in the third quarter, recording a $659 million release.

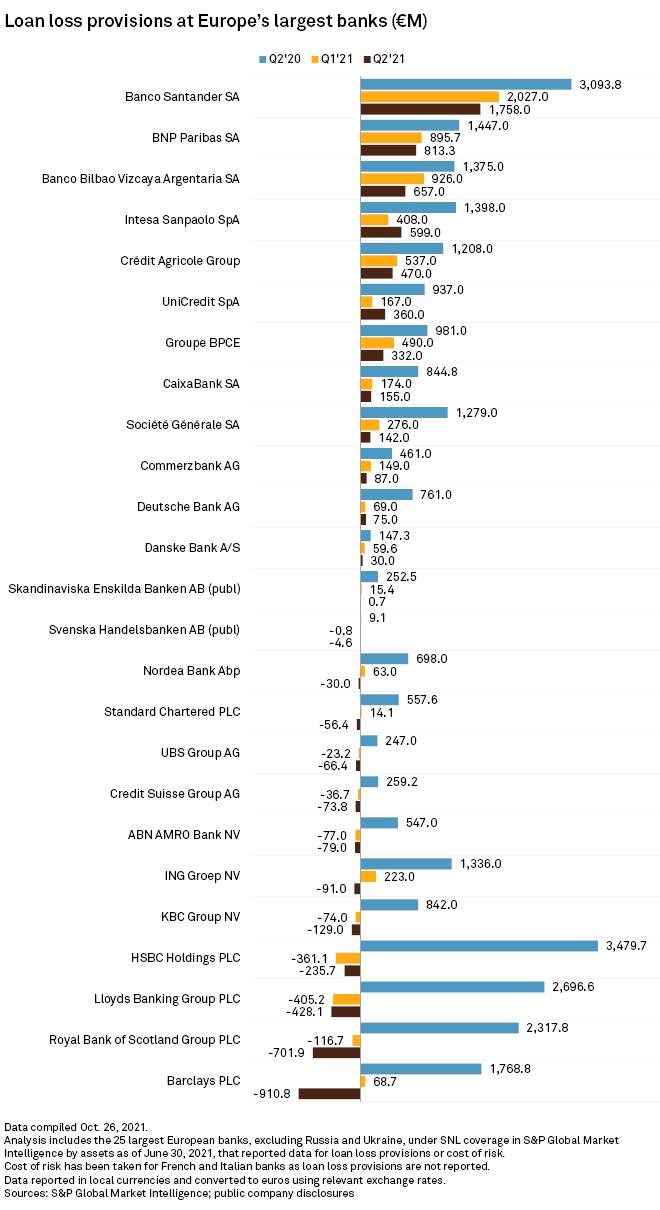

Major French and Spanish banks have been among the most cautious in Europe and occupied seven of the top 10 spots for loan loss provisions in the first half of 2021 across the continent's 25 largest lenders by total assets, according to S&P Global Market Intelligence. Just under half released provisions in the second quarter, ranging from €5 million at Sweden's Skandinaviska Enskilda Banken AB (publ) to €911 million at U.K.-based Barclays.

"It's too early now to say: 'The pandemic is over, it's history, let's go back to 2019'," Sam Theodore, senior banking consultant at Scope Insights, said in an interview. "In the same way too many analysts and the market in general were anticipating a new asset quality-driven banking crisis at the beginning of the pandemic, by the same token now, too many people are eager for banks to write back provisions to boost the bottom line and to increase dividends."

France and Spain were two of the worst-hit European economies by the pandemic. France's GDP shrunk 8.1% in 2020 and Spain's fell 10.8% as both countries endured prolonged lockdowns. France has seen 118,000 COVID-19 deaths since the start of the pandemic, while Spain has seen more than 87,000.

France's GDP is forecast to rebound by 6.3% in 2021, according to the International Monetary Fund, while Spain's is expected to rise 5.7%.

The strength of the economic recovery will be instrumental in determining the potential for provision releases, said Michael Christodoulou, banks analyst at Berenberg. Banks tend to make provisions in two ways: one based on economic modeling, and the other through management overlays, which consider risks attached to specific areas of lending.

Given the peculiar nature of the COVID-19 pandemic, the likelihood of provision releases from management overlays is low, as banks will proceed with caution until there is more clarity on its ultimate economic impact, said Christodoulou. "If we see any releases, it's going to be from the econometric models," Christodoulou said. "You could potentially see some of those in the third quarter."

Banco Santander SA, the first of the major Spanish or French banks to report third-quarter results, made a further €2.2 billion of loan loss provisions during the period, up 22.2% from the previous quarter. The bank expects to make provision releases of between €700 million and €1 billion in the fourth quarter "on the back of the new macro scenario … if nothing changes in our view of the macro scenario," CEO José Antonio Álvarez said.

The recent removal of government support measures for businesses and individuals in Spain will likely play a significant role in determining the potential for provision releases at Santander and other Spanish banks. Spain's furlough scheme, known as ERTE, ended Sept. 30. More than 270,000 workers were still on the scheme as of Aug. 31.

"Spain is one [of] the most uncertain of the major Western European economies when it comes to the furlough withdrawal," said Stefan Nedialkov, director at Citigroup Global Markets. "There is a chance that we won't really be seeing meaningful write backs until the [Spanish] banks have had more experience with how borrowers behave after the furlough ends, on the retail side and also on the [small and medium-sized enterprise] side."

Regulators will also have a bearing on the potential for provision releases. Margarita Delgado, deputy governor of the Bank of Spain, in September urged banks to hold off on releasing provisions made in response to the pandemic. In addition, the ECB and French Prudential Supervision and Resolution Authority, in particular, are being extremely cautious, said Scope Insights' Theodore. "The supervisors will encourage banks to stick to being more conservative, not to rush write backs, which is the right thing to do."

European banks' scope for writing back provisions may even encounter some resistance next year, Theodore added. The European Commission in May 2020 relaxed the implementation of International Financial Reporting Standard 9, which required banks to build provisions based on expected losses, as part of its response to the crisis. As economic conditions improve, the standard will likely come back into force.

"At some point the rules have to go back in place, which means that provisions will need to be readjusted upwards based on expected losses rather than realized losses," said Theodore. "There won't be too much room for big write backs."