| French president Emmanuel Macron campaigns for re-election in Marseille on April 16. Source: Louise Delmotte/Getty Images |

France's largest lenders will turn their attention to tackling a deteriorating outlook for revenues and asset quality after the country re-elected Emmanuel Macron as president April 24.

Macron beat far-right candidate Marine Le Pen by a margin of 17 percentage points, avoiding a Le Pen victory that would have cast uncertainty over the future direction of the country. Le Pen is a longstanding euroskeptic, and it was feared that her election would see a loosening of political and economic ties between France and the European Union.

The share prices of France's three largest banks by total assets — BNP Paribas SA, Crédit Agricole SA and Société Générale SA — had already struggled in 2022 before rising concerns about a potential Le Pen presidency pushed them even lower in early April, before recovering in the lead-up to the final round vote. Surging inflation and economic upheavals following Russia's invasion of Ukraine have dashed hopes for a profit-boosting writeback of COVID-19 bad-loan provisions, while French banks are also particularly dependent on fixed-rate lending, denting the benefit of any euro-zone rate hike, and further suggesting a slowdown this year after a record-breaking 2021.

"French banks are not going to experience a continued strong growth in revenues," Arnaud Journois, vice president, financial institutions at credit rating agency DBRS Morningstar, said in an interview. "The political environment in Europe and inflation are big challenges."

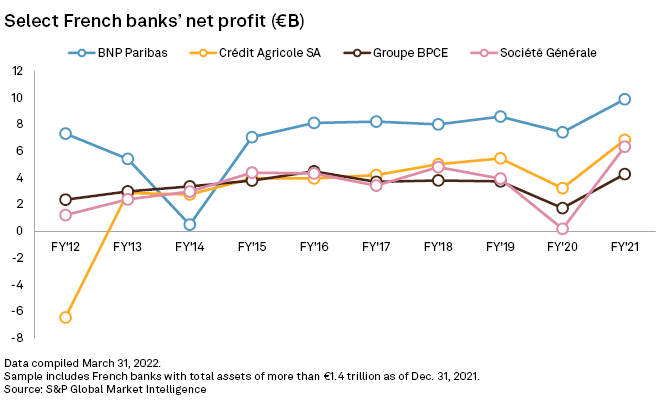

BNP, CreditAg and SocGen all posted record profits in 2021, according to S&P Global Market Intelligence data. Unlisted Groupe BPCE had its second-best year. All four banks also enjoyed record or near-record revenues aided by the global economic bounce-back that followed pandemic lockdowns.

Bad loan growth

The lenders' attempts to maintain that momentum will be countered by eurozone inflation that surged to 7.5% in March from 5.9% in February. France's central bank estimated in March that French GDP growth would slow to 2.8% in 2022, from 7.0% in 2021, in an adverse scenario.

As well as depressing revenues for French banks, a slowdown in economic growth would threaten the ability of many borrowers to pay back loans, increasing the cost of losses on loans for lenders.

"A further material deterioration in geopolitical issues in Europe with more ripple effects on the macroeconomic climate would mean that the cost of risk would materially increase," said Olivier Panis, senior vice president of the financial institutions group for France and Benelux at credit rating agency Moody's.

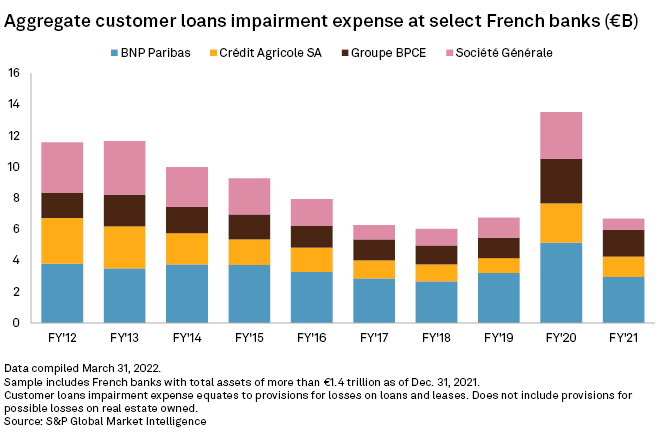

Lower cost of risk was one of the main drivers of French banks' profits in 2021 following the huge provisions for bad loans they made in 2020 in response to the COVID-19 pandemic. The aggregate cost of impairment on customer loans at France's four largest banks more than halved in 2021 to €6.7 billion from €13.5 billion in 2020, Market Intelligence data shows.

Analysts had expected French banks to begin releasing in 2022 some of the bad loan provisions they had made in response to the COVID-19 pandemic, which would have boosted profits. Such releases are less likely as the global economic outlook deteriorates.

"Heightened volatility for raw materials and the broader weakening economic prospects could require banks to book higher provisions, although we also expect banks to utilize some of the provisions booked in relation to COVID-19 that were not released in 2021," DBRS Morningstar said in a March 16 report.

Groupe BPCE declined to comment for this article. BNP Paribas, SocGen and Crédit Agricole did not respond to requests for comment.

Russia exposure, interest rates

The French banks will derive fewer revenues from the Russia market in future. SocGen, which had exposure of €18.6 billion at the end of 2021, is pulling out, selling its Rosbank subsidiary and insurance business amid global sanctions. BNP Paribas and Crédit Agricole are also exiting, and Groupe BPCE is reducing its Russia operations.

Even the European Central Bank's widely expected raising of interest rates is unlikely to offset downward pressure on French lenders' revenues in 2022. While a hike in rates by the ECB in response to spiraling inflation will boost eurozone banks' lending margins and net interest income, French banks will be among the last to feel the benefit.

"Most of the loans in France are fixed rate," said Journois. "So you would have to wait, in theory, several years for the total impact on the new generation of loans to completely materialize."

Revenue prospects for the largest French banks' sizeable corporate and investment banking divisions are also mixed. Increased demand for foreign exchange and commodities hedging in response to the turbulence in markets caused by Russia's invasion of Ukraine will likely result in solid first-quarter results, Panis said. But a prolonged economic slowdown will offset this with a drop in fees from reduced merger and acquisition activity and shrinking debt issuances due to the increased uncertainty, while more extreme market volatility is also a downside risk, Panis said.

"You can win on some businesses, but lose on others," said Panis. "Our central assumption anyway at the beginning of this year was that it would be less positive than last year in terms of CIB business [for French banks]."

Pressure on French banks' revenues could be compounded by rising costs as the surge in inflation begins to feed through to operating expenses, said Johann Scholtz, bank analyst at financial services company Morningstar, which owns rating agency DBRS.

"The trend that you've seen across Europe of a bit of inflationary pressure is starting to form on the cost side and you could see that filtering through in most of the results," Scholtz said.