Despite their many similarities, French lender BNP Paribas SA is outshining its rival Société Générale SA, a trend that is likely to continue unless SocGen nails down a clear strategy, analysts say.

The fortunes of SocGen's flagship equities derivatives business — a source of profit in the good times, but a risk in the bad — are particularly hurting the bank as is uncertainty about its future direction.

Both institutions operate in similar markets, including French retail and investment banking. They nearly ended up as part of the same group in 1999 when the then-Banque Nationale de Paris attempted to take over both SocGen and investment bank Paribas, spoiling an attempt by SocGen and Paribas to merge. BNP ended up with Paribas, forming today's BNP Paribas.

BNP Paribas has built itself into Europe's second-largest banking group by assets, while SocGen holds fifth place.

Profit pressure

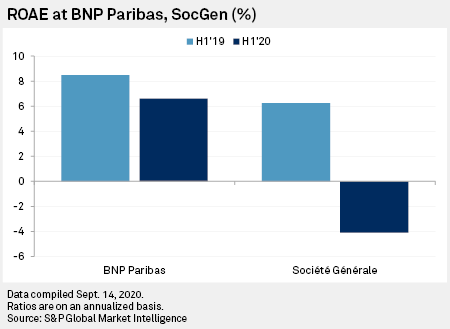

Like many European peers, both banks had been struggling before the coronavirus pandemic from low profitability, brought about by weak economic growth, increased regulation, ultra-low interest rates and tough competition. They both took a hit from the coronavirus-induced market rout in March, but BNP Paribas is outperforming SocGen on various measures.

It posted a second-quarter return on average equity of 6.6%, down from 8.48% a year before, while SocGen's ROAE was negative 4.09%, compared to a positive 6.24% a year earlier.

And the income outlook for SocGen is gloomier. The S&P Capital IQ consensus estimates a full-year loss for SocGen of €1.02 billion, compared to a profit of €3.25 billion in 2019. BNP Paribas' full-year net income is projected to total €6.16 billion, down from €8.17 billion in 2019.

"There have been a lot of discussions and questions about SocGen's strategy and the profitability of their investment banking unit for some time now," said Jérôme Legras, head of research at Axiom Alternative Investments. "There's no determination to bring the [return on equity] above 10%. There are maybe ways of doing so — M&A, cutting back the investment bank — but the feeling that prevails today is that the strategy hasn't been working for years and they are in an impasse."

In February 2019, SocGen revised its 2020 return on tangible equity target to between 9% and 10%, down from an earlier target of 11.5%, after it was hit by turbulent market conditions. But in February 2020, the bank said it was expecting an improvement in 2020 ROTE from 6.2% in 2019, without specifying any figures.

SocGen rejigged its management board in August after posting its second quarterly loss in a row and said it would restructure its flagship equity derivatives to better manage risk.

"It's not a real change of strategy. It's more a game of musical chairs," Legras said of the management change.

It comes two years after another major management reshuffle.

SocGen "seems to be in a perpetual state of restructuring," said Johann Scholtz, an analyst at research and investment management firm Morningstar.

The bank's flagship equity derivatives business is now a source of concern for investors, he said.

"It really begs the question of where does their competitive advantage lie," Scholtz said. "They have been quite adamant in the past that they view structured products and equity derivatives as their strength. ... It all boils down to pricing and how you are pricing for that risk when you are writing those contracts."

Franchise

While BNP Paribas was also hammered in the first quarter, it fared much better in the second quarter, benefiting from a rebound in the debt market like most of its peers. It is less reliant on derivatives than SocGen, and its investment banking franchise is of better quality, Scholtz said.

Both BNP Paribas and SocGen did not respond to a request for comment. SocGen's CEO told a conference on Sept. 24 that the bank is transforming its equity product range, noting that clients could accept lower yield in a zero interest rate environment while the bank takes on less risk.

BNP Paribas' fixed income, currencies and commodities' income rose to €3.41 billion in the first half from €1.83 billion the year before, while at SocGen it increased to €1.31 billion from €980 million during the same period. BNP Paribas' equities income dropped to €203 million in the first half from €1.10 billion the year before, while at SocGen it dropped to €450 million from €1.74 billion.

BNP Paribas' first-half investment banking revenues rose to €7.08 billion from €6.11 billion the year before. At SocGen, they fell to €3.51 billion from €4.51 billion during the same period.

BNP Paribas also has a stronger franchise and network presence in Europe outside of France, which adds to stability and diversification of its revenues, said Tomasz Walkowicz, vice president for European financial institutions at rating agency DBRS Morningstar.

The lender benefits from its Belgian retail operations and also retail saving products such as life insurance, which consume very little capital and provide better return on equity, Legras said.

SocGen's first-half retail revenues fell to €7.35 billion from €8.11 billion the year before. The bank announced on Sept. 23 that it was studying a plan to merge its Société Générale and Crédit du Nord retail networks as it seeks to cut costs. BNP Paribas' first-half revenues fell to €15.44 billion from €16.17 billion.