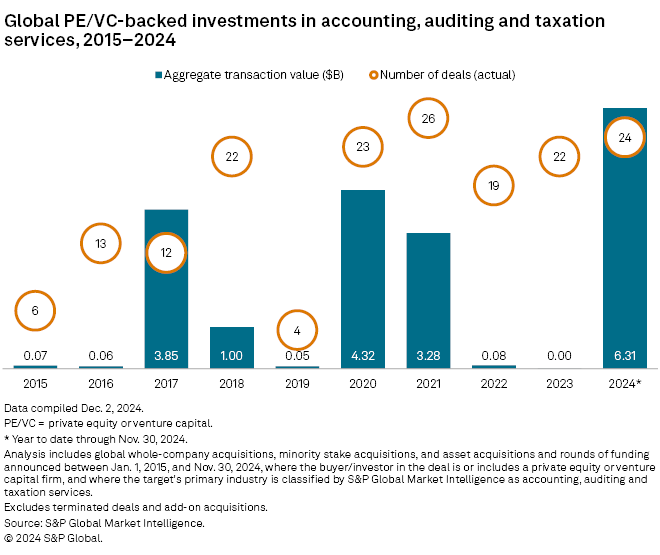

Private equity investments in accounting, auditing and taxation services firms have surged in 2024 as investors seek to consolidate a fragmented sector.

Global private equity and venture capital-backed deal value in the sector totaled $6.31 billion in the first 11 months of 2024, on track to reach its highest level since at least 2015, according to S&P Global Market Intelligence data. The number of deals stood at a three-year high of 24.

Accounting, auditing, taxation and other professional services firms have attracted private equity interest due to their stable customer base and predictable, recurring revenues, according to a report from law firm Ropes & Gray.

"Their revenues are resilient to turbulent market conditions, which is now more than ever a key consideration for private equity firms due to macroeconomic and geopolitical uncertainty. Their underlying client bases are diverse and frequently spread across sectors and geographies, mitigating macroeconomic and sectoral viability," the law firm said.

The professional services sector also operates in a large, fragmented market. With sufficient capital, private equity firms can buy and build to achieve scale, the report said.

Sovereign Capital Partners LLP, for example, is building a platform through chartered accountancy portfolio company LB Group Ltd., which recently completed its sixth acquisition and launched a new corporate brand that integrates the six accountancy practices across the East and Southeast of England into a single group.

– Download a spreadsheet with data in this story.

– Read about family offices' allocation to private equity.

– Explore more private equity coverage.

Many professional services firms are also exploring new technologies such as AI and can tap private equity to provide capital and expertise. Major accounting firms are increasing investments in generative AI. PwC has invested $1.5 billion in AI initiatives, while Deloitte has committed over $3 billion in GenAI investments globally through the 2030 financial year.

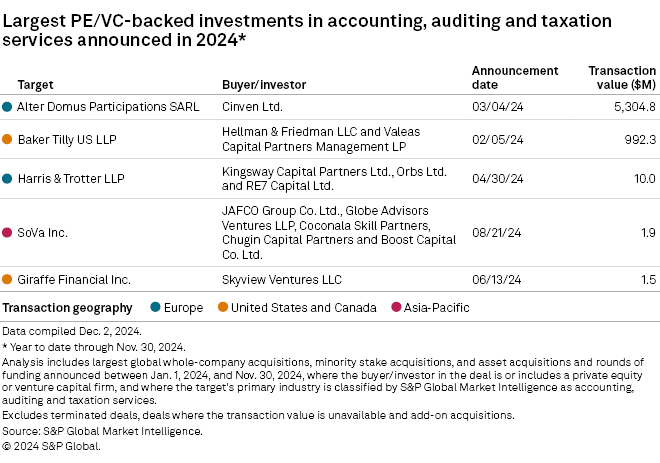

In the largest transaction in 2024 to date, Cinven Ltd. made a strategic investment in Alter Domus, valuing the fund administrator at $5.3 billion. This was also the biggest private equity transaction globally in March.

The second largest was a $992.3 million strategic investment by Hellman & Friedman LLC and Valeas Capital Partners Management LP in Baker Tilly US LLP.

Another notable 2024 deal was New Mountain Capital LLC's growth investment in Grant Thornton LLP. Terms of the investment were not disclosed.

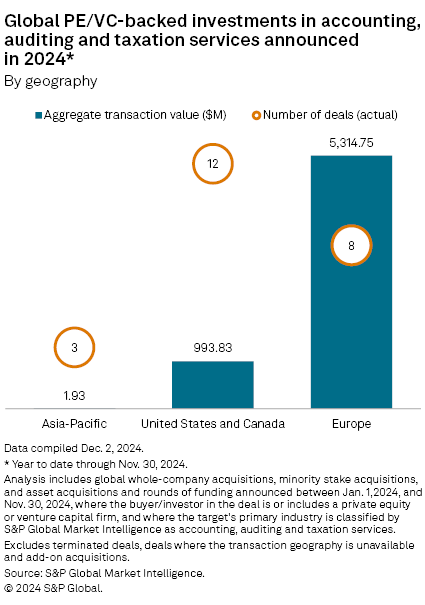

In the first 11 months of 2024, Europe secured the bulk of private equity-backed investments in the sector, receiving $5.31 billion, driven by the Alter Domus deal. The US and Canada received $993.8 million. In terms of the number of deals, the US and Canada had 12 deals, while Europe and Asia Pacific recorded eight and three deals, respectively.

November surge

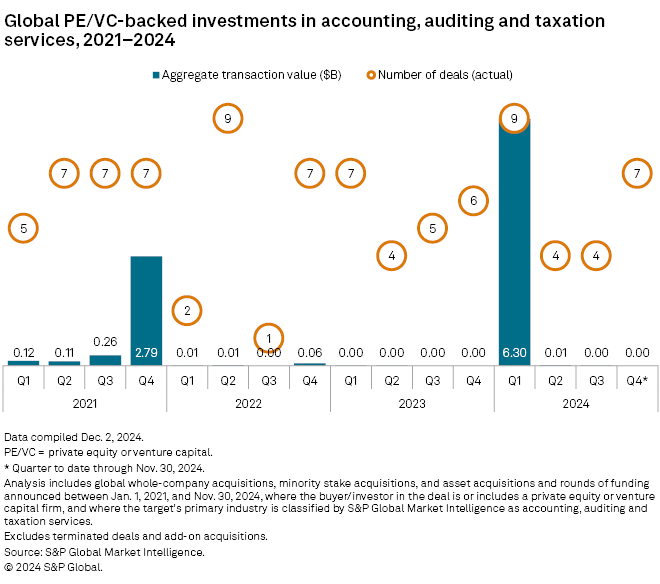

November saw a surge in private equity transactions in the sector. Centerbridge Partners LP made a strategic investment in Carr Riggs & Ingram LLC, while Investcorp Holdings BSC and pension fund Public Sector Pension Investment Board made a strategic growth investment in PKF O'connor Davies Advisory LLC.

The November surge brought the number of deals in the fourth quarter through Nov. 30 to seven, compared with six deals for the entire fourth quarter of 2023.