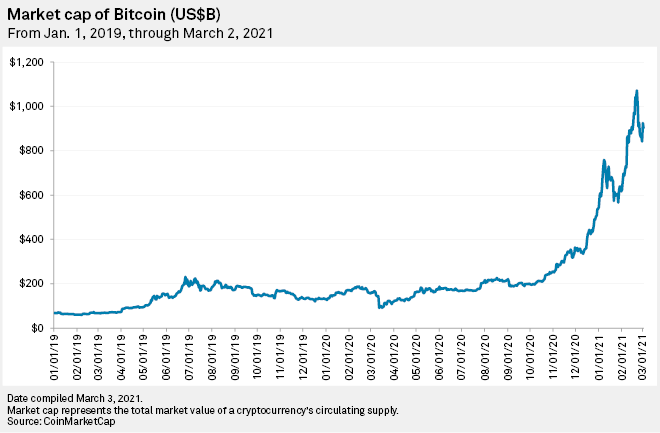

With bitcoin prices increasing more than fivefold since March 2020, institutional investors in the U.K. are keen to get a slice of the action. Not only are some investors making peace with the notorious volatility of cryptoassets, they are starting to view them as a vital ingredient for a balanced portfolio.

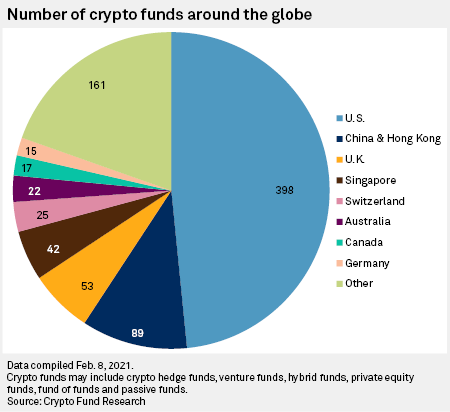

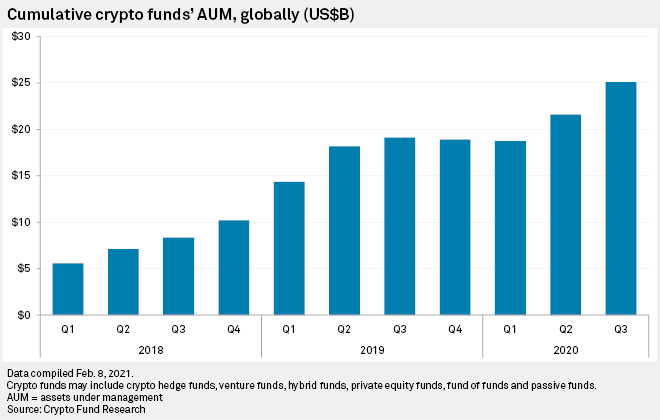

Global cryptoassets under management hit $25.1 billion at the end of the third quarter of 2020, up from $19.11 billion a year previously, according to Cryto Fund Research. The U.K. accounts for only 6% of the number of cryptocurrency funds globally, compared to the U.S.' 48% and Hong Kong and China's 11%. But industry participants say that the U.K. market is set for a growth spurt.

As central banks around the world keep interest rates low to cope with the economic fallout of the coronavirus pandemic, growing worries about inflation have prompted institutions to look at cryptoassets anew, according to industry insiders. The result is that negative messaging about the "Wild West" of cryptoassets has given way to conversations about their properties as an inflation hedge, or even "digital gold," according to Blair Halliday, head of U.K. at Gemini Trust Company LLC, a cryptocurrency exchange. New York-headquartered Gemini, which was founded by the Winklevoss twins, Tyler and Cameron, expanded into the U.K. in September 2020 and in March this year it said it was launching a cryptocurrency fund services platform for asset managers.

"We now no longer have the constant negative verbiage [about cryptocurrencies]. There is more understanding, and more awareness of what the opportunity is," Halliday said in an interview.

Cryptocurrencies such as bitcoin are decentralized digital currencies, the operations and transactions of which operate independently of central banks.

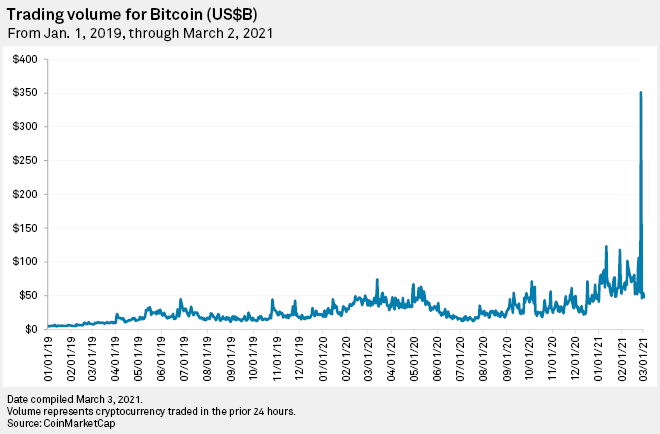

However, as the price hovers around the $50,000 mark in early March, it is still far above where it was one year earlier, at about $8,500, as the trading volumes and market cap of the digital currency soared in January this year, according to CoinMarketCap data.

Institutional investors have played a "major" role in the growth of bitcoin prices in the past year, according to Francesc Rodriguez Tous, lecturer in banking at the Business School of City, University of London.

"In a world where interest rates are so close to zero, investors will search for yield. And bitcoin, with all its ups and downs, has managed to provide an impressive return in previous years," he said in an email.

Obi Nwosu, CEO and co-founder at Coinfloor, a U.K.-based cryptocurrency exchange, also believes that increased institutional investment has fueled price growth.

"With bitcoin, it seems to be driven by institutional investors," he said in an interview, adding that bitcoin is the only "institutional grade" cryptocurrency.

Price movements in other, less established cryptocurrencies are generally more influenced by retail investors, he said.

Elon Musk's Tesla is among the U.S. companies to invest in bitcoin. The trend of corporate and institutional investments in crypto is also picking up in the U.K. |

Several major institutions in the U.S. have taken steps to invest in cryptocurrencies. BlackRock Inc. said in January that it had submitted documents to the U.S. regulator to allow two funds to start investing in bitcoin futures. Goldman Sachs Group Inc. said in March that it will resume trading in cryptocurrencies, while Elon Musk's Tesla Inc. put $1.5 billion of spare cash into the digital currency in January, and Square Inc. parked $50 million in October 2020.

U.K. investors are gradually moving into the asset class. Traditional fund manager Ruffer Investment Management invested 2.5% of its $27 billion portfolio in cryptocurrencies in late 2020. By February 2021, the company had already made a $650 million profit, according to Coindesk.

Nwosu said that he expects that more U.K.-based companies will start to hold spare cash in cryptocurrency in future.

Coinfloor already provides services for a number of U.K. corporates that hold reserves in cryptocurrency, but Nwosu said that he cannot disclose names.

The coronavirus effect

As the pandemic continues and monetary policy remains loose, institutional investors are concerned about a "significant pickup" in inflation, according to Francesca Fornasari, head of currency solutions at Insight Investment, a specialist asset manager.

"Investment in assets with a limited supply such as bitcoin have become popular as a form of digital gold," she said in an email.

As unusual monetary policy persists, insurance companies, asset managers and wealth managers are starting to take bitcoin's inflation-hedging properties seriously, according to Anatoly Crachilov, founding partner and CEO at Nickel Digital Asset Management, a U.K.-based digital asset hedge fund,

"A wall of capital is set to come into the sector. We are going into a period of structural growth of the sector, and it is increasingly driven by institutions," he said.

The volatility question

For Alex Manson, head of SC Ventures, the innovation and ventures arm of Standard Chartered PLC, volatility is a fact of life regardless of the asset class, and institutional investors have plenty of tools to manage it.

"Institutions don't see volatility as inherently good or bad," he said in an interview.

SC Ventures launched Zodia, a cryptocurrency custodian service for institutional investors, in partnership with Northern Trust Corp., in December 2020.

"Crypto is here to stay. The market will mature, and will become less volatile, but it will take time," Manson said.

Crachilov also believes that volatility in cryptocurrencies will eventually even out over time. The presence of larger institutional investors who take a long view of the market, and have less sensitivity to the daily prices changes, should mean that today's wild swings will eventually become a thing of the past, he said.