Europe's largest banks provided $55 billion in financing in 2021 to companies expanding oil and gas production, which the shareholder group behind the research says is a clear contravention of climate science and banks' own net-zero commitments.

ShareAction, which coordinates shareholder campaigns, examined loans and issuance underwriting services by 25 of the biggest European banks to 50 companies with large oil and gas expansion plans, excluding any sustainable, transition or non-fossil fuel-related financing. It found that some $33.2 billion was supplied to fossil fuel expanders after the banks committed to ambitious climate goals through the Net-Zero Banking Alliance throughout last year.

HSBC Holdings PLC, BNP Paribas SA, Deutsche Bank AG, Crédit Agricole SA and Barclays PLC granted the largest levels of such financing in 2021. Meanwhile, policies to restrict financing to oil and gas expansion are still rare among European banks, the study said.

This is despite the International Energy Agency, or IEA, a global energy watchdog, in May last year guiding that there is no room for investment in new oil and gas fields in order to meet the Paris Agreement goal of limiting temperature rises to 1.5 degrees C by 2050. Scenarios from the IEA are named as credible sources in target-setting guidelines the banks have committed to using.

Banks argue they need to help their clients transition to a low-carbon future.

In the IEA's net-zero scenario, oil demand will fall by more than 4% per year between 2020 and 2050, which will translate into higher credit risk and loss of revenue for banks that fail to reduce their exposure to the industry, said Xavier Lerin, a senior banking analyst at ShareAction.

Banks' oil and gas activities are of increasing concern to shareholders, who are "willing to go further than ever before on challenging banks on this," said Kelly Shields, a campaigner at ShareAction. In a July letter to 63 banks, 115 investors representing $4.2 trillion in AUM specifically asked lenders to align their climate plans with the IEA's net-zero scenario.

"Although banks really flaunt their green credentials of being part of the Net-Zero Banking Alliance, they're really nowhere near where the IEA says they need to be," Shields said in an interview.

All but one of the 25 European banks are now members of the Net-Zero Banking Alliance, and have thereby committed to bring greenhouse gas emissions linked to their lending and investment portfolios to net-zero by 2050.

Financing the transition

Banks, meanwhile, are resisting adopting a "no expansion" policy as suggested by the IEA road map and say they are introducing targets and policies in line with their net-zero commitments.

A BNP Paribas spokesperson said the IEA's anticipated scenario of a fall in oil demand "is not materializing," but rather that demand is "trending upwards."

"A unilateral drop in oil and gas supply, with no equivalent drop in demand, would have negative social and environmental consequences," the spokesperson said, adding that BNP Paribas' alignment strategy has "a view to a just and inclusive transition."

The spokesperson further noted that there was a "significant decrease" in support granted by BNP Paribas to oil and gas players in 2021 compared with 2019 and that this reduction will continue as the bank implements its net-zero plan.

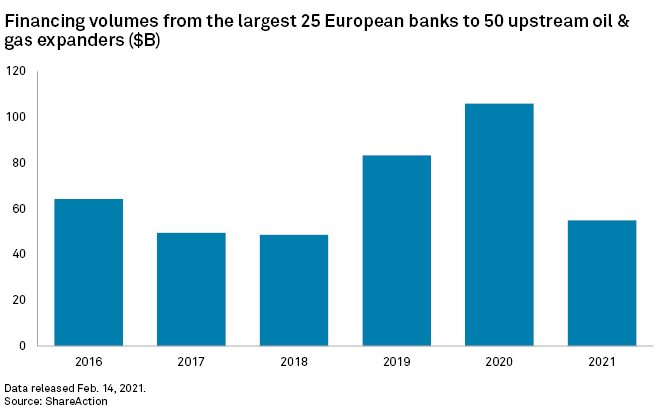

While total financing activity to oil and gas expanders did drop compared with 2019 and 2020, the 2021 level is consistent with pre-pandemic levels, according to the research.

A Crédit Agricole spokesperson said they "strongly refute the statements in this report" and the methodology is not clear enough. The bank has tightened its exclusion criteria for unconventional fossil fuels and is currently examining trajectories for the alignment of portfolios with the Paris Agreement, the spokesperson said.

Deutsche Bank said carbon-intensive sectors account for only a small share of its loan book and that it is having "an intense dialogue with clients to move from high-carbon business models towards low- and no-carbon ones."

Barclays reiterated its ambition to become a net-zero bank, saying it has implemented restrictions around the financing of new oil and gas exploration projects in the Arctic as well as 2025 targets for reductions in financed oil and gas emissions. HSBC said it will release "science-based targets" for its oil and gas and power and utilities portfolios this month.

While the Net-Zero Banking Alliance does not require its members to restrict fossil fuel expansion, signatories commit to using decarbonization scenarios from "credible and well-recognized sources," such as the Intergovernmental Panel on Climate Change and the IEA, to set long-term and intermediate targets that are aligned with the temperature goals of the Paris Agreement.

The IEA net-zero by 2050 road map is the only scenario that explicitly rules out investment in new oil and gas fields, but ShareAction argues in its research that other widely recognized 1.5 degrees C scenarios would necessarily lead to a similar conclusion.

New business opportunities

La Banque Postale SA is the only bank included in the research with a policy that aligns with the IEA net-zero road map by ceasing financing to all new oil and gas projects, according to ShareAction.

While this policy "naturally led [the bank] to make choices and forego certain opportunities," the clear stance on fossil fuels "positions us favorably in terms of new business wins, for environmentally conscious clients," according to Adrienne Horel-Pagès, La Banque Postale's chief sustainability officer.

The French lender, which has pledged to a complete exit of coal, oil and gas by 2030, is increasingly seeing local authorities and businesses question lenders on their fossil fuel policy as part of "request for proposal" processes, Horel-Pagès said in an email.

For other financial institutions, directly adopting a policy statement on oil and gas expansion in accordance with the IEA finding is "not feasible," said Samu Slotte, head of sustainable finance at Danske Bank A/S, in an email. Danske generally finances its customers' activities rather than specific projects, and supporting the energy transition involves supporting customers that produce oil and gas with "the least harm to the environment," Slotte said.

Instead, the Danish lender has implemented a target to reduce carbon in its oil and gas production loan portfolio by 50% by 2030, which Slotte said is "well in line with expected oil demand in the IEA net-zero scenarios and therefore achieves the alignment in a way that we can better manage as a bank."

ShareAction highlighted Danske, together with Crédit Mutuel Group, NatWest Group PLC and Commerzbank AG, as front-runners in that they have started restricting financing for new oil and gas projects, either for exploration or for development of new infrastructure.

Rabobank, Crédit Mutuel and La Banque Postale were the only three of the largest European banks to have provided no financing in 2021 to the fossil fuels expanders covered by the research.